On Dec 8, the Urban Redevelopment Authority (URA) released three private residential sites for sale under the second-half 2025 Government Land Sales (GLS) programme. The sites are located in Lentor Central, Kallang Close and along Dunearn Road, on the former Bukit Timah Turf City land.

All three parcels are on the Confirmed List, meaning they are launched according to schedule regardless of prevailing market sentiment. Together, they can yield close to 1,360 private residential units and come with a mix of residential, childcare and limited commercial components.

While GLS launches are a regular feature of Singapore’s housing landscape, this particular release is notable for the contrast in location profiles and market positioning across the three sites. Rather than catering to a single buyer segment or price band, the parcels span prime-adjacent Bukit Timah, a city-fringe Kallang location, and a supply-rich OCR neighbourhood in Lentor.

Three GLS sites—Dunearn, Kallang, and Lentor—highlight how Singapore’s land values, buyer demand, and development strategies differ across regions. Viewed collectively, they offer a snapshot of how supply planning and demand assessment have become increasingly location-specific in today’s private residential market.

Confirmed List Sites: Supply Without Shock

All three parcels sit on the Confirmed List of the second-half 2025 Government Land Sales programme. This detail matters.

Confirmed List sites are launched according to schedule regardless of prevailing market sentiment. In other words, URA is not reacting to short-term demand spikes or market exuberance. Instead, it is maintaining supply visibility, ensuring that developers and buyers alike can plan ahead without facing sudden land shortages or abrupt supply surges.

This approach reflects a broader theme that has defined Singapore’s housing market over the past decade: control without suppression. Supply is introduced steadily, but never aggressively enough to destabilise pricing or confidence.

What makes this release notable is not the number of units involved, but the diversity of micro-markets the sites represent — from prime-adjacent Bukit Timah, to a city-fringe riverside parcel, to a supply-rich OCR growth node.

Dunearn Road: Bukit Timah Turf City’s Second Chapter

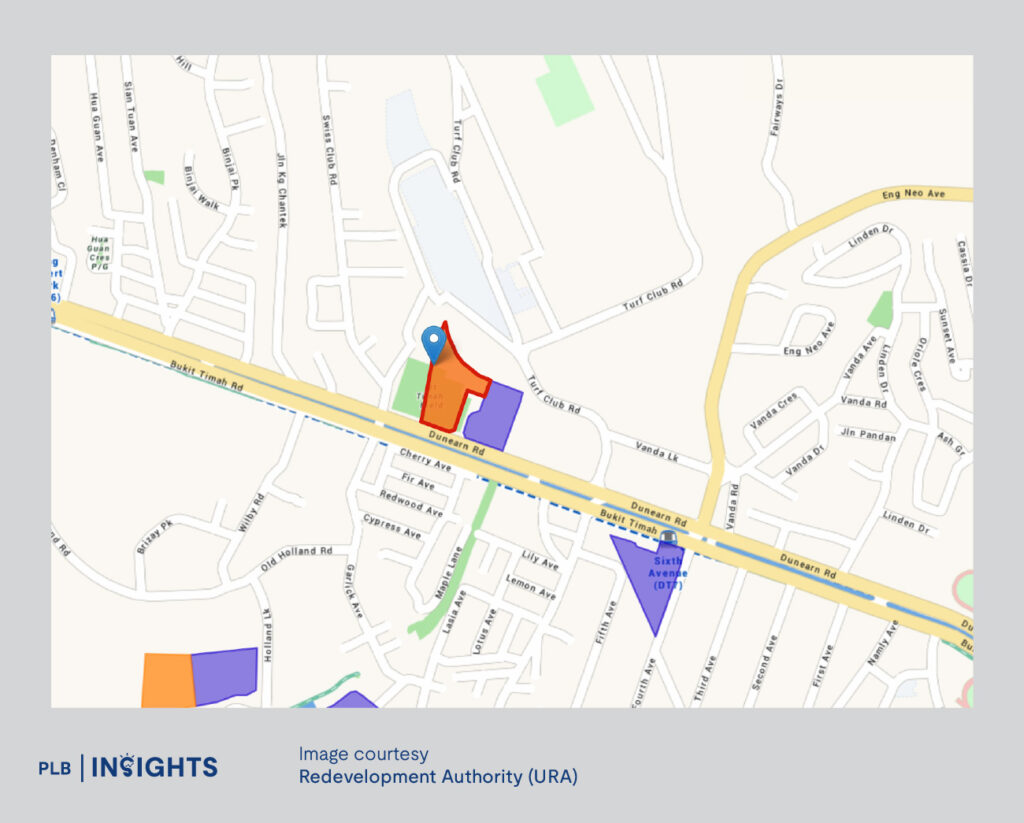

The Dunearn Road site is perhaps the most strategically significant of the three. At 19,041.6 square metres, it is the second private residential parcel released as part of the upcoming Bukit Timah Turf City housing estate.

With an expected yield of about 330 units and a maximum GFA of 30,467 square metres, the site is neither oversized nor niche. Instead, it sits squarely in the “right-sized” category for prime-adjacent developments — large enough to justify institutional interest, yet restrained enough to preserve exclusivity.

Its location just off Sixth Avenue MRT station immediately places it in a scarcity-defined micro-market. Bukit Timah has long suffered from a structural shortage of private residential land outside of collective sales, and recent years have offered little fresh supply to absorb ongoing demand from families seeking proximity to prestige schools and established amenities.

Developer Appetite: Strong, but No Longer Unrestrained

Market observers expect competitive bidding, with estimates ranging from three to ten bidders and top land offers between $1,350 and $1,450 psf per plot ratio.

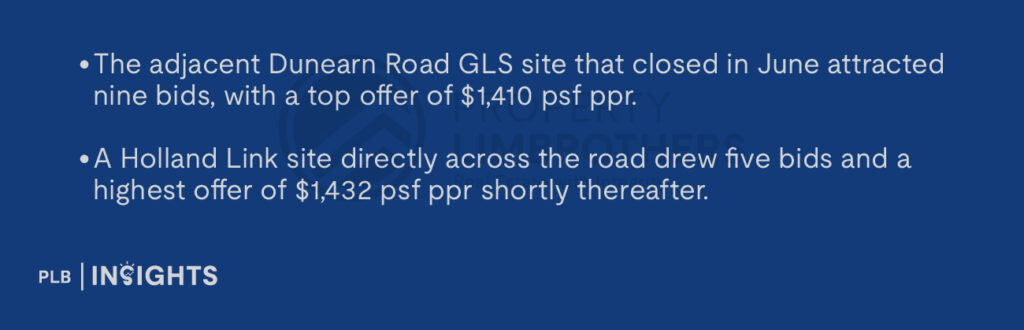

These numbers are not speculative. They are anchored by recent benchmarks:

In both cases, developers demonstrated clear confidence in the area’s underlying demand — but also a willingness to cluster bids within a narrow pricing band. That behaviour is telling.

Rather than chasing headline land prices, developers appear focused on pricing discipline, recognising that buyers in these locations are sophisticated and selective. Premium locations command premium prices, but only when backed by sound layouts, liveability and realistic exit valuations.

Supply Awareness Is Growing

At the same time, not all analysts expect runaway competition. Some point to the number of residential plots already earmarked within the wider Turf City transformation, suggesting that future supply awareness may temper bidding enthusiasm.

This divergence in views highlights an important shift in the market: developers are no longer moving in lockstep. Instead, bidding strategies are becoming more differentiated, reflecting individual balance sheets, inventory exposure and risk tolerance.

Kallang Close: A Rare City-Fringe Residential Play

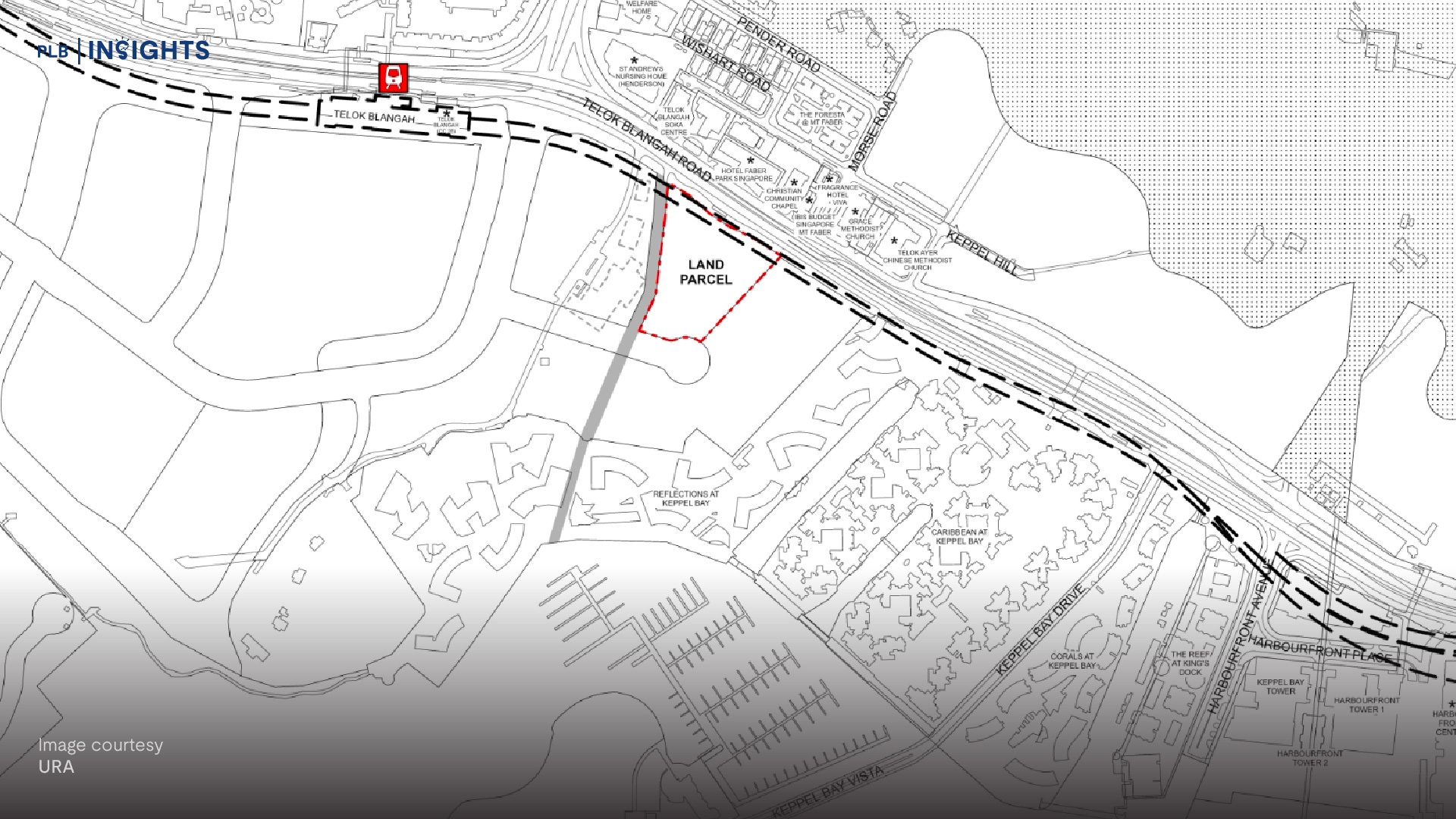

If Dunearn Road represents restrained prime-adjacent appeal, the Kallang Close site offers something quite different — a rare city-fringe residential opportunity directly beside the Kallang River and near Kallang MRT station.

Spanning 11,456.8 square metres with a generous maximum GFA of 40,099 square metres, the site is expected to yield around 470 residential units, including space set aside for a childcare centre.

What sets this parcel apart is not just its location, but its urban character. It sits at the boundary between the city core and mature heartlands, offering direct access to transport, waterways and employment nodes without commanding traditional CCR land prices.

Who This Site Appeals To

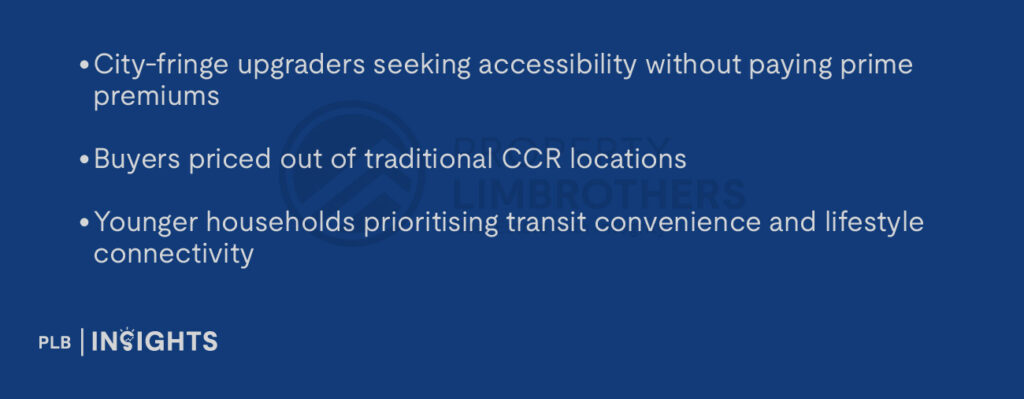

From a buyer-demand perspective, developments here are likely to attract:

This broader demand base explains why analysts expect strong interest, with estimates of up to seven bidders and land rates approaching $1,450 psf ppr.

For developers, the arithmetic is equally compelling. A larger unit count allows risk to be spread across a wider buyer base, while the location supports mid- to upper-OCR pricing without compromising absorption.

Lentor Central: Supply-Rich, Yet Still Supported

The Lentor Central site, at first glance, appears the least exciting. It is the eighth GLS parcel released in the Lentor Hills neighbourhood, an area that has seen a steady stream of launches over recent years.

Covering 15,926.2 square metres with a maximum GFA of 47,779 square metres, the site can yield up to 560 units, making it the largest of the three by unit count.

Naturally, analysts expect more measured bidding here — with two to four bidders and land prices estimated between $900 and $1,000 psf ppr.

Perception vs Reality in Lentor

Yet supply alone does not tell the full story.

Despite the growing pipeline, fewer than 50 units remain unsold across existing Lentor launches. This suggests that demand, while price-sensitive, remains firm when entry prices align with buyer expectations.

Lentor’s appeal has never been about prestige. It is about attainability, density planning and connectivity. For buyers who are value-conscious but unwilling to compromise on new-launch quality, Lentor continues to tick the right boxes.

For developers, however, margins are tighter. Pricing missteps are punished quickly in OCR markets, and this reality is reflected in more conservative land bids.

What This GLS Release Reveals About Today’s Developers

Taken together, the three sites illustrate a market operating with clear segmentation.

Developers today are not simply asking whether demand exists — they are asking where, at what price, and for which buyer profile. Prime-adjacent sites still draw strong interest. City-fringe parcels with differentiated positioning are keenly contested. Supply-rich OCR plots are evaluated pragmatically.

This is not a market driven by speculation or momentum. It is one characterised by selectivity and internal risk pricing.

What Buyers Should Take Away

For buyers, the implications are just as important:

Buyers who understand these differences — and assess projects based on positioning rather than headline terms like OCR or CCR — will be better placed to make informed decisions.

A Market Stabilised by Differentiation, Not Intervention

Ultimately, URA’s release of these three GLS parcels reinforces a key truth about Singapore’s private residential market: stability today is achieved through differentiation, not intervention.

Supply is released steadily, demand is segmented naturally, and pricing discipline is increasingly enforced by the market itself. The result is a housing landscape that continues to function — not overheated, not deflated, but carefully balanced.

As tenders close over the coming months, land bid behaviour will offer further insight into how developers are reading the next phase of the cycle. And for buyers, these sites will shape the next wave of options — each catering to very different priorities, budgets and expectations.

If you’re assessing how upcoming GLS developments may shape pricing and opportunities across different locations, our consultants are on hand to discuss what these site dynamics could mean for your personal housing decisions.