Branded residences occupy one of the most glamorous segments of the global property market — yet in Singapore, the segment has had a chequered history. Often associated with prestige hotel operators, concierge-style services, and international appeal, these developments have long been viewed as trophy assets. But the question today is less about status and more about sustainability: can branded residences make a comeback in Singapore’s evolving property landscape?

Understanding the Branded Residence Model

A branded residence typically bears the name of a luxury hospitality brand, such as St Regis, Ritz-Carlton, or W Hotels. Buyers are drawn by the promise of consistent service standards, design pedigree, and access to facilities managed by the hotel operator or an appointed brand team. In exchange, owners pay higher service fees and purchase at a price premium — often 20 to 30% higher than comparable non-branded developments in the same area.

In Singapore, the best-known examples include St Regis Residences, Ritz-Carlton Residences, Pullman Residences Newton, and The Residences at W Singapore – Sentosa Cove. Each sits within the Core Central Region (CCR), where scarcity and global visibility support their positioning. Beyond these, only a handful of upcoming projects — such as W Residences Marina View and Aman Singapore at Skywaters Residences — are on the horizon, underscoring how niche the segment remains.

Performance Check: Prestige Doesn’t Always Guarantee Premium Returns

According to recent transaction data (2022 – 2025 YTD), branded residences have displayed mixed results.

By contrast, several non-branded luxury counterparts — such as The Marq on Paterson Hill and Le Nouvel Ardmore— either held steady or posted similar gains without the brand premium. This reinforces a recurring lesson: branding can strengthen perceived value, but it does not override fundamentals such as tenure, site orientation, layout efficiency, and resale liquidity.

Case in Point: The Residences at W Singapore – Sentosa Cove

When CDL’s associate Cityview Place Holdings relaunched sales in April 2024, 58 units were launched at prices from $1,648 psf, almost 40% below the project’s original peak pricing of 2010. The market responded instantly. Within four days of preview, more than 65 units were sold at an average of $1,780 psf, eventually crossing 80 units by year-end.

The relaunch also triggered a wider market effect. Sentosa’s median condo prices dipped around 15% y-o-y to $1,792 psf, while transaction volumes surged — 89 deals in just three months compared to only 7 earlier in the year.

This episode underscores a truth often obscured by glamour: pricing discipline still dictates demand. Buyers will respond to value when quantum and perceived lifestyle match. The “brand halo” helps attract attention, but sustained sales come from pragmatic pricing and timing.

The Global Context: Momentum Is Building Elsewhere

Globally, branded residences are expanding at a record pace. According to Knight Frank’s Branded Residences Report 2024, there were over 640 schemes worldwide as of 2024, up from just 400 five years ago. Asia-Pacific accounts for roughly one-third of upcoming projects, led by Thailand, Vietnam, and the UAE.

Singapore, however, remains conservative. Land scarcity, high construction costs, and the absence of freehold trophy sites limit opportunities. Developers often prefer traditional luxury products, which provide more flexibility and fewer contractual obligations to brand operators.

Yet, macro conditions suggest a potential shift. The number of ultra-high-net-worth individuals (UHNWIs) in Singapore grew 4.2% in 2023, with Knight Frank projecting a 28% increase by 2028. Family offices continue to expand their Assets Under Management (AUM) base, and many wealthy residents are exploring diversification into lifestyle-driven real estate that offers tangible brand equity and long-term legacy value.

Why a Selective Resurgence Could Happen

Three underlying forces could drive a renewed appetite for branded residences:

But Headwinds Are Real

Any notion of a broad-based “boom” must be tempered by structural challenges.

Policy and ABSD Frictions

Since April 2023, the Additional Buyer’s Stamp Duty (ABSD) on foreign buyers stands at 60%, effectively limiting overseas inflows — a key demand base for branded luxury products. Local investors face higher tiers on second or third homes, narrowing domestic liquidity.

Yield Compression

High maintenance, concierge, and brand licensing fees can push monthly outgoings well above those of regular luxury condos, reducing net rental yields. The allure of brand prestige must be weighed against ongoing costs and achievable rent.

Limited Exit Liquidity

The resale market for branded residences is notoriously thin. Buyers tend to hold for lifestyle reasons rather than quick appreciation, meaning sellers may wait longer for the right match.

Perception Lag

Some older branded projects, launched before today’s minimalist preferences, face design fatigue. Without active brand rejuvenation or refurbishment, the “brand promise” can fade faster than expected.

Upcoming Pipeline: Testing the Waters Again

Two upcoming launches could define the next phase.

Both projects will test whether Singaporean buyers — who made up the overwhelming majority at The Residence at W Sentosa Cove— see long-term merit in branded products beyond novelty and name.

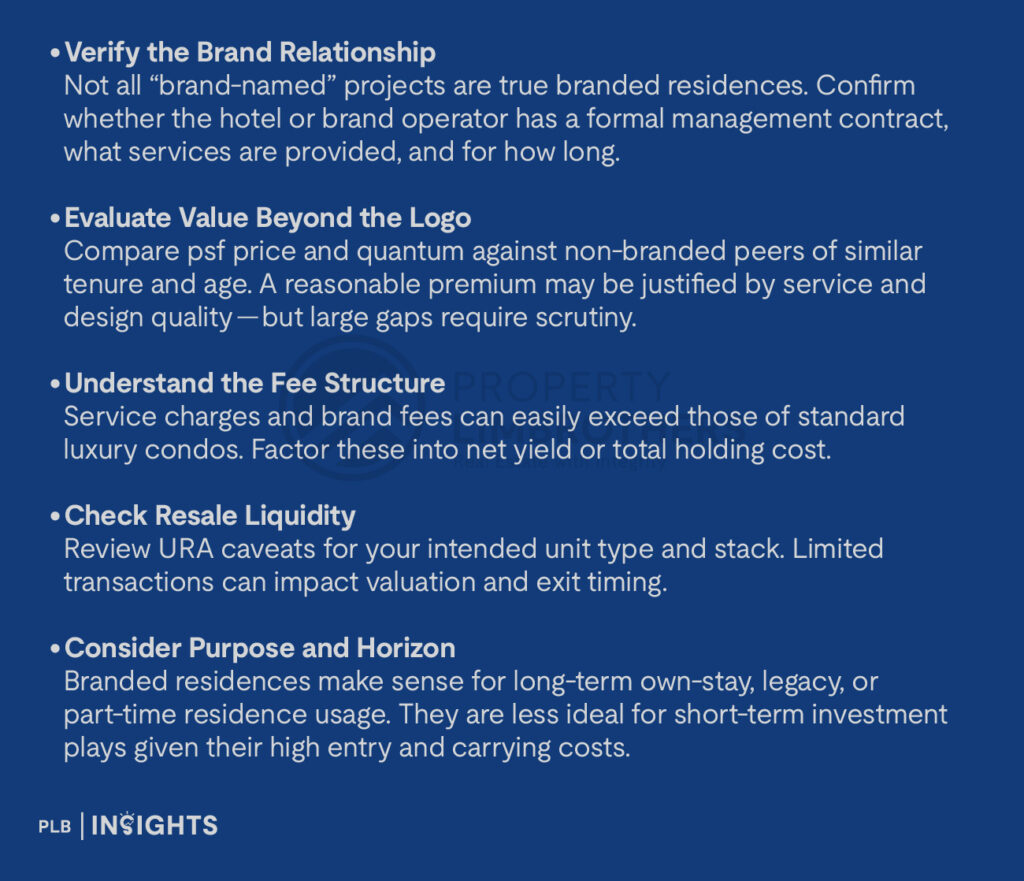

Educational Takeaways for Buyers

The Bottom Line: Cautious Optimism, Not Exuberance

Singapore’s branded residence segment is unlikely to see an explosive revival — but a selective resurgence is plausible. Developers and buyers alike are approaching with renewed pragmatism: pricing to the market, not to the brand.

If W Marina View calibrates sensibly and Aman Singapore secures deep-pocketed end-users rather than speculative demand, these projects could re-establish confidence in the segment. Conversely, if premiums again outpace perceived value, history may repeat itself.

Ultimately, branded residences in Singapore will remain a niche asset class, driven less by foreign appetite and more by discerning local buyers seeking lifestyle, service assurance, and legacy prestige. As the W Sentosa case shows, when the product-market equation aligns, luxury buyers still answer — but only when the price of prestige makes sense.

Our consultants can provide deeper insights into Singapore’s evolving luxury and branded residence market — contact us here to begin the conversation.