Overall Shophouse Market Trends (2010-2025 YTD September)

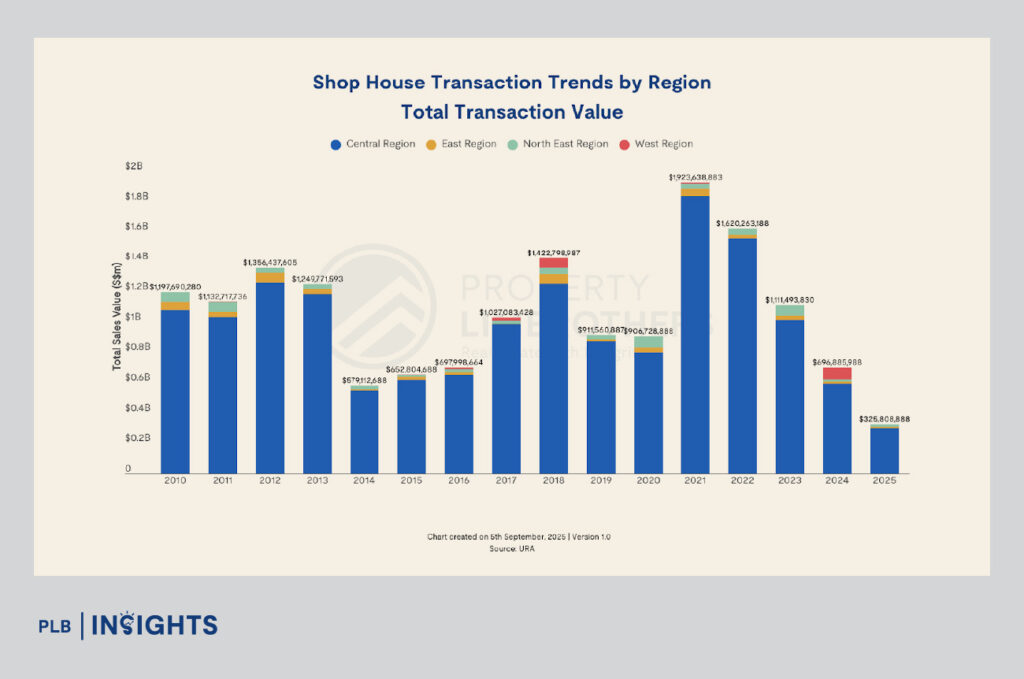

The Singapore shophouse market has experienced significant fluctuations from 2010 to 2025, shaped by a variety of economic, geopolitical, and regulatory factors. In the early years, from 2010 to 2017, the market saw steady growth, with transaction values consistently rising, reaching a peak of $1.92 billion in 2021.

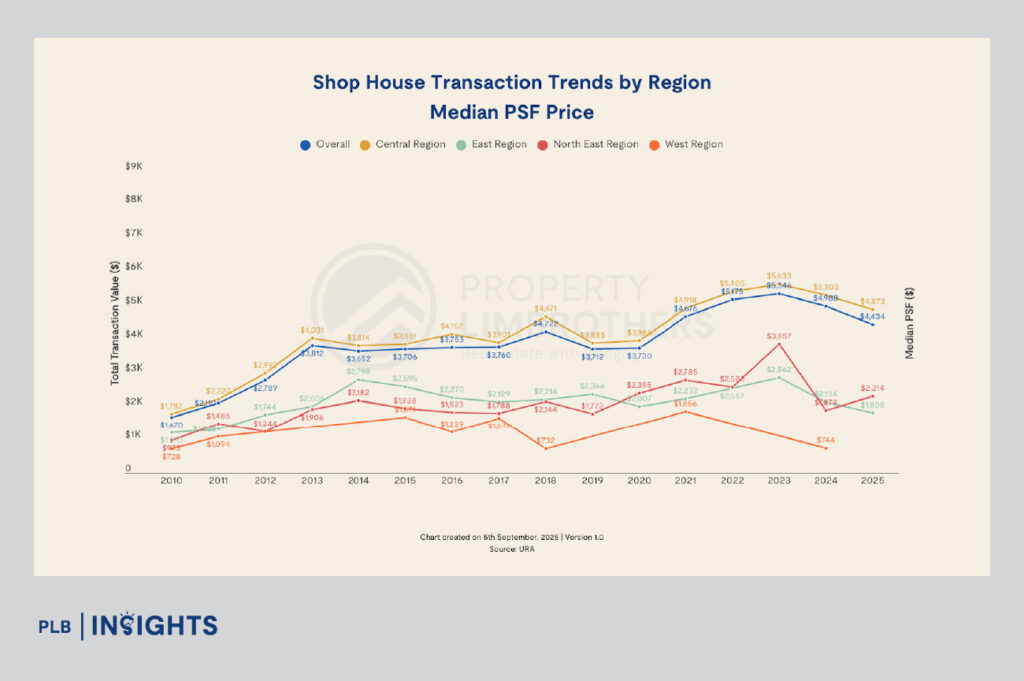

In terms of median PSF (price per square foot), prices climbed steadily from $1,670 per sq ft in 2010 to a high of $5,346 per sq ft in 2023. However, the market began to show signs of volatility post-2023. There was a noticeable slowdown in both transaction volume and prices, with 2025 projections indicating a decline, primarily due to global uncertainties, such as trade tariffs and the Middle East conflict. Despite these challenges, shophouses remain an attractive asset class for investors, particularly in areas with strong demand for both residential and commercial use.

Prominent District-Level Analysis

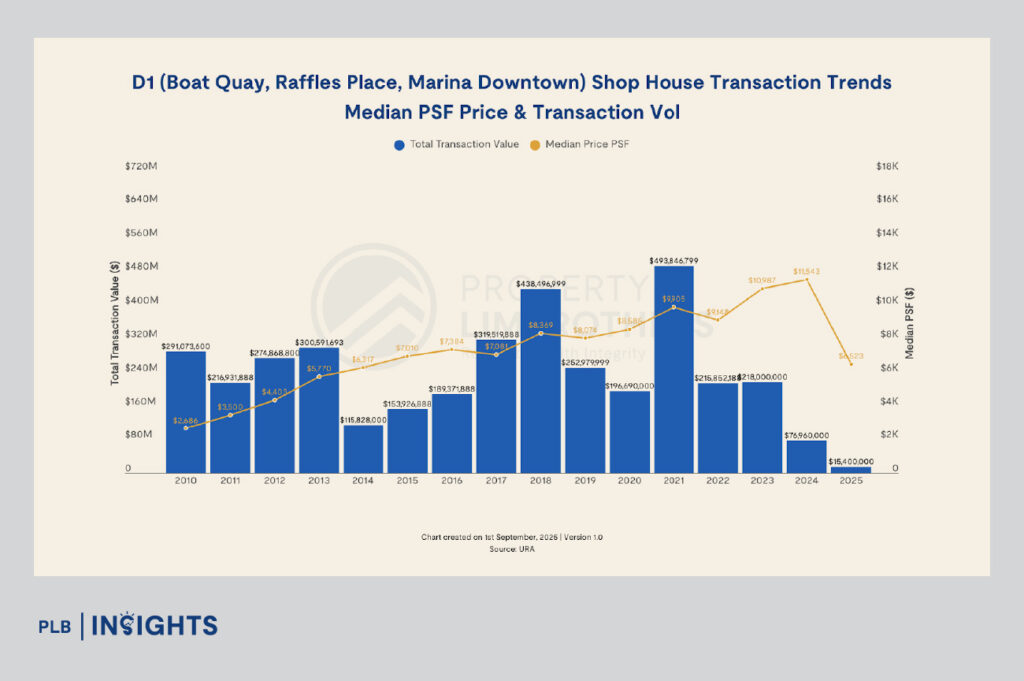

District 1: Boat Quay, Raffles Place, Marina Downtown

- Transaction Value Trends: District 1, Singapore’s central business district (CBD), has seen steady increases in shophouse transaction values over the past decade. From $291.1 million in 2010, transactions surged to $493.8 million in 2021, with some peaks in 2018 and 2021, driven by demand for prime commercial spaces.

- Median PSF: The median PSF price saw substantial growth, rising from $2,686 in 2010 to $11,543 in 2024. However, 2025 has shown a sharp decline, with prices falling to $6,523 per sq ft, reflecting a cooling market and the impact of global uncertainties.

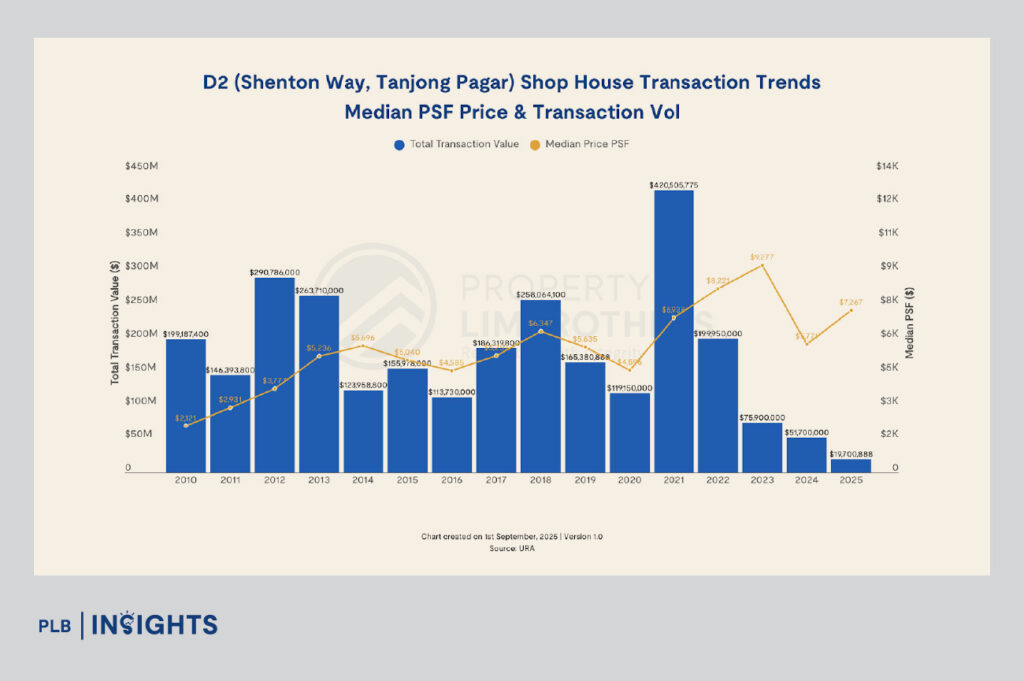

District 2: Shenton Way, Tanjong Pagar

- Transaction Value Trends: Similar to District 1, District 2 has seen rising transaction values, peaking at $420.5 million in 2021, a sharp increase from $119.2 million in 2020. The district has consistently attracted high-value transactions, driven by its role as a commercial hub.

- Median PSF: The median PSF saw consistent growth, rising from $2,121 in 2010 to $9,277 in 2023.

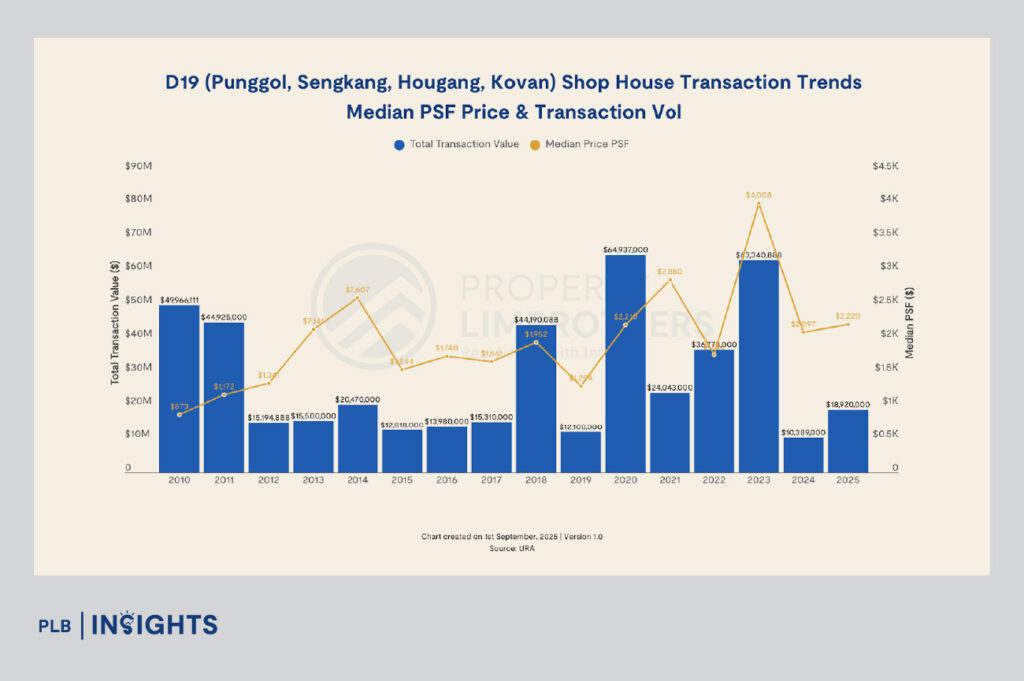

District 19: Punggol, Sengkang, Hougang, Kovan

- Transaction Value Trends: District 19 has experienced significant growth in recent years. From $49.7 million in 2010, transaction values soared to $64.9 million in 2020, reflecting a growing interest in suburban commercial properties. However, 2025 is likely to see a slower pace due to broader market corrections.

- Median PSF: The median PSF rose steadily from $873 per sq ft in 2010 to $4,008 per sq ft in 2023, with a 7% CAGR, making it one of the most dynamic districts in terms of price growth. Suburban regions seem to hold better as compared to central region and sustained a growing psf price, as opposed to what is happening in the central region such as district 1 and 2.

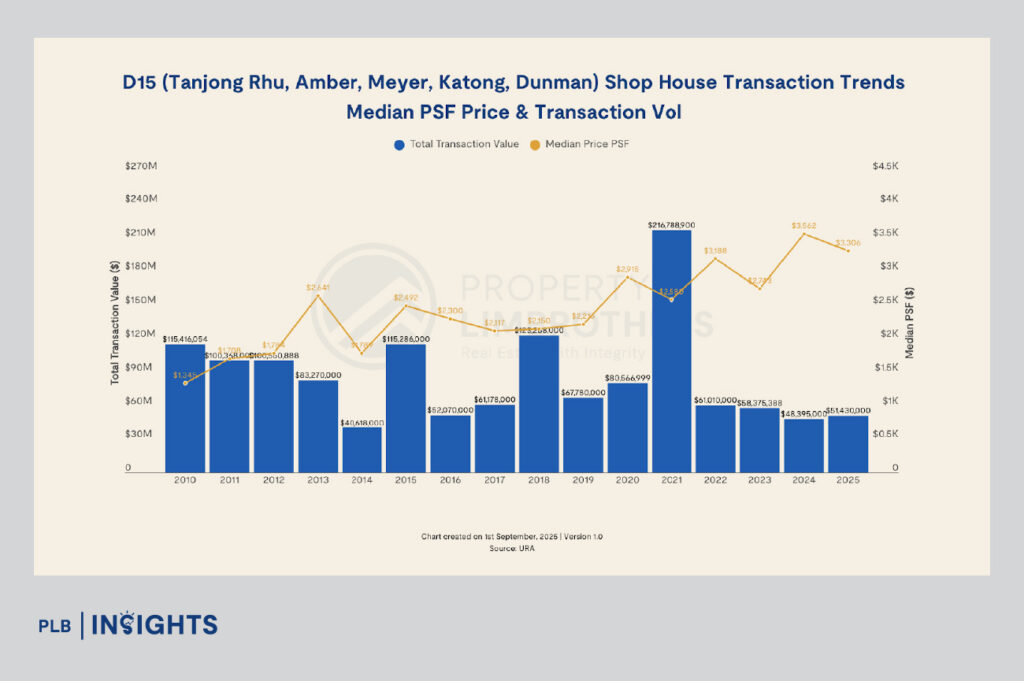

District 15: Tanjong Rhu, Amber, Meyer, Katong, Dunman

- Transaction Value Trends: District 15 experienced a significant surge in transaction values, reaching $216.8 million in 2021. This increase was fueled by strong demand for shophouses in this residential and commercial mix.

- Median PSF: The median PSF grew from $1,345 in 2010 to $3,562 in 2024, but the trend reversed in 2025, with a decline to $3,306 per sq ft. This drop suggests that the district’s shophouse market is being affected by softer demand in this district.

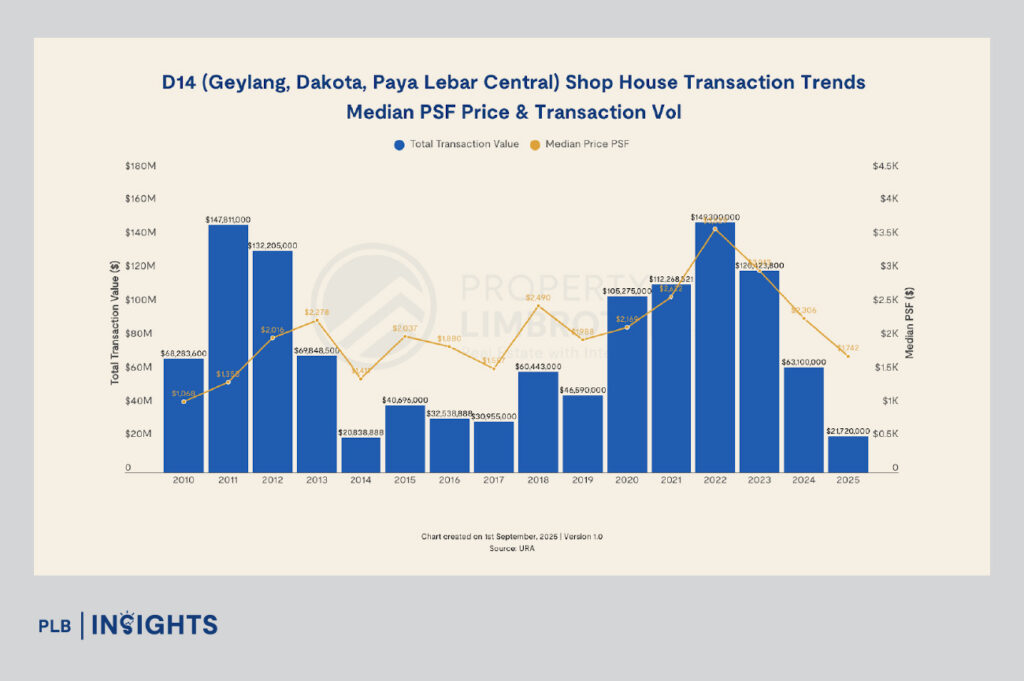

District 14: Geylang, Dakota, Paya Lebar Central

- Transaction Value Trends: District 14 saw transaction values peaking at $149.3 million in 2022, but 2025 projections indicate a slowdown in both sales volume and value due to broader market cooling.

- Median PSF: The median PSF increased from $1,068 in 2010 to $3,629 in 2022, but 2022-2025 projections show lower transaction values.

Market Insights: The Subdued State of the Shophouse Market in 2025

Despite the strong performance of key districts, the overall shophouse market in 2025 (YTD September) has remained relatively subdued. According to sources, only 18 transactions were recorded in 2Q2025, a 10% decline q-o-q from 1Q2025 and a 14.3% drop y-o-q from 2Q2024.

This slowdown can be attributed to a mismatch in price expectations between buyers and sellers, compounded by global uncertainties. Major events, such as the US trade tariffs and Middle Eastern conflicts, have created a cautious investor environment.

However, large deals still continue to emerge. In 2Q2025, 14 shophouses sold for $5 million or more, surpassing the nine deals in this price range in the previous quarter. Notable transactions included the sale of a $12 million shophouse in Bukit Pasoh Conservation Area.

In the leasing market, 800 rental contracts were signed in 2Q2025, representing a 4.9% decrease in q-oq. Despite this, rental rates per square foot rose by 3.1% q-o-q, indicating steady demand for shophouses in certain sectors.

Additionally, total transaction value in 2025 (YTD September) amounted to $325 million. The median PSF also stayed flat, increasing by just 0.5% in 1H2025. Despite challenges in the F&B sector, the living sector in shophouses has seen increased interest due to stronger returns for investors.

Outlook for 2025 and Beyond

Looking ahead, PLB Research expects a further slowdown in transaction volumes throughout 2025 is expected, with total sales expected to fall between $500 million to $700 million. The extension of the Seller’s Stamp Duty (SSD) holding period for residential properties could shift some investment interest to commercial assets, including shophouses.

Despite the current slowdown, shophouses continue to be viewed as resilient investment options, especially for long-term investors. As the market stabilises, the suburban areas and mixed-use shophouses are likely to continue drawing interest, while central districts remain prime locations for high-value deals.

Conclusion

The shophouse market has evolved from 2010 to 2025, experiencing growth in prime areas and slowing down today, while suburban districts seem to be holding the fort.

While the market has cooled in recent years, there are still opportunities for long-term investors and those seeking alternative assets amid broader market volatility. As we move into 2025, the market will likely continue to face uncertainty, but shophouses remain a vital part of Singapore’s property landscape, prized for their location, resilience, and growth potential.

For the full Shophouse District 1 – 28 charts, please visit www.disparityeffect.com.

Stay Updated and Let’s Get In Touch

Should you have any questions, do not hesitate to reach out to us!