Sentiment in Singapore’s real estate sector strengthened further in 3Q 2025, supported by improving macroeconomic conditions, easing financial pressures, and resilient domestic growth.

According to the latest Real Estate Sentiment Index (RESI) published by the National University of Singapore (NUS) on Nov 17, overall confidence among market participants continued its upward trajectory.

Sentiment Indicators Trend Higher

The composite RESI climbed to 6.1 in 3Q, up from 5.7 previously. Both underlying components recorded similar increases:

NUS’ Institute of Real Estate and Urban Studies (IREUS) Director, Professor Qian Wenlan, attributed the optimism to the anticipated US Federal Reserve rate cut on Oct 29, which had been priced in by markets and helped anchor expectations of a more benign credit environment.

With the Future Sentiment Index holding at a healthy level, respondents appear confident about near-term financing costs and capital availability.

Financing Concerns Fall Sharply

The share of respondents flagging inflation and interest rate risks dropped to 10% (from 23.1% in 2Q). Concerns over tightening credit conditions also eased significantly to 5% (from 15.4%).

Perceived risks from a global economic slowdown receded from 80.8% to 70%, reflecting increased confidence in external demand stabilisation.

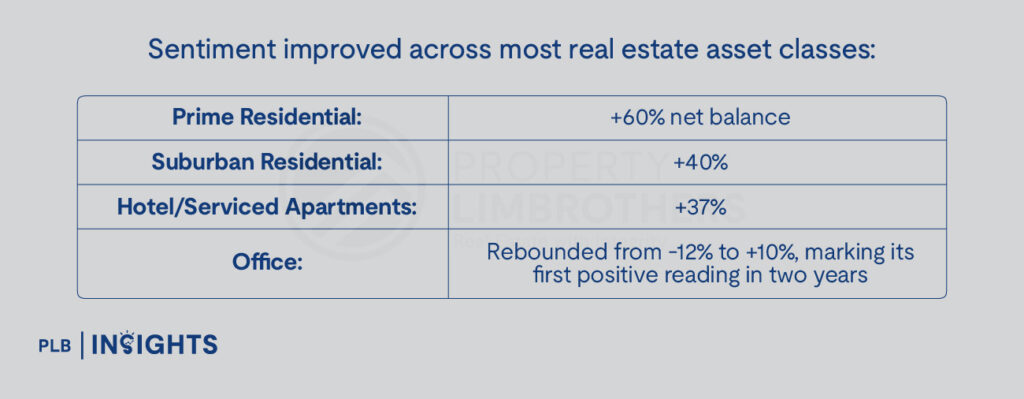

Sectoral Performance: Prime Residential Leads

Sentiment improved across most real estate asset classes:

These gains were underpinned by favourable domestic fundamentals. Singapore’s real wages rose 3.2% in 2024, the strongest growth since 2019, while unemployment remained low at 2% in 3Q, reinforcing household purchasing power.

Macroeconomic Backdrop: Growth Holds Up, But Risks Linger

Singapore’s economy expanded 2.9% YoY in 3Q (advanced estimates), outperforming expectations. Despite this, 75% of respondents continued to cite potential job losses and a domestic slowdown as key risks—slightly higher than the 73.1% recorded in Q2.

Concerns about government intervention rose sharply, with 60% of respondents expecting potential cooling measures (2Q: 42.3%). Rising construction costs also remained elevated at 55% (2Q: 50%).

By contrast, worries about oversupply, excess launches, and price bubbles diminished, each cited by only 15% of respondents.

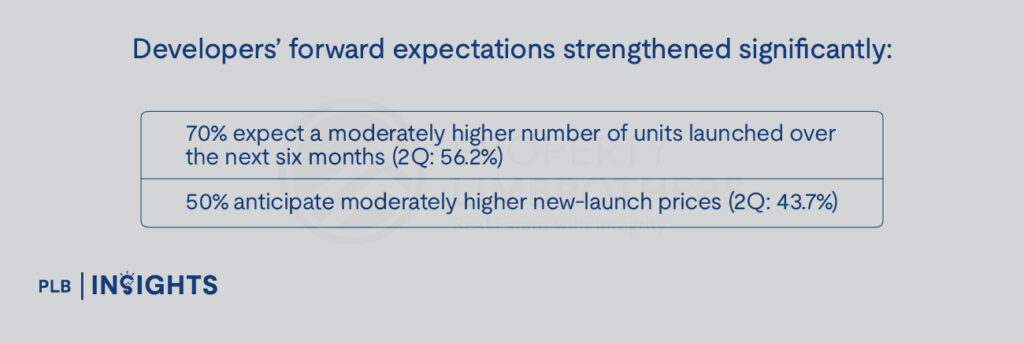

Pipeline Expectations: More Launches, Higher Prices

Developers’ forward expectations strengthened significantly:

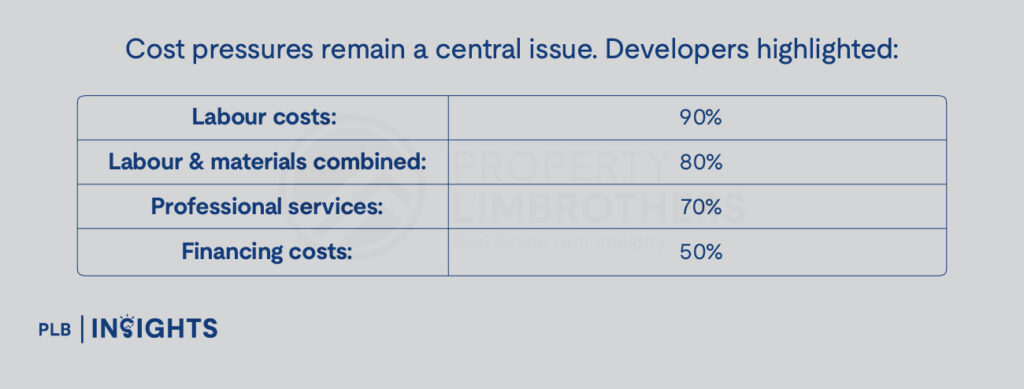

Cost pressures remain a central issue. Developers highlighted:

These illustrate broad-based cost inflation across the development value chain.

Strategic Outlook: Optimism Tempered by Geopolitical Uncertainty

While current fundamentals support higher transaction volumes and firmer pricing, Prof Qian cautioned against complacency. Despite a temporary US–China truce brokered at the APEC Summit, geopolitical risks remain elevated—particularly for Singapore’s export-driven economy. She noted that households should maintain financial prudence amid lingering uncertainties.

Stay Updated and Let’s Get In Touch

Should you have any questions, do not hesitate to reach out to us!