HDB Resale Market: Price Growth Hits a Floor

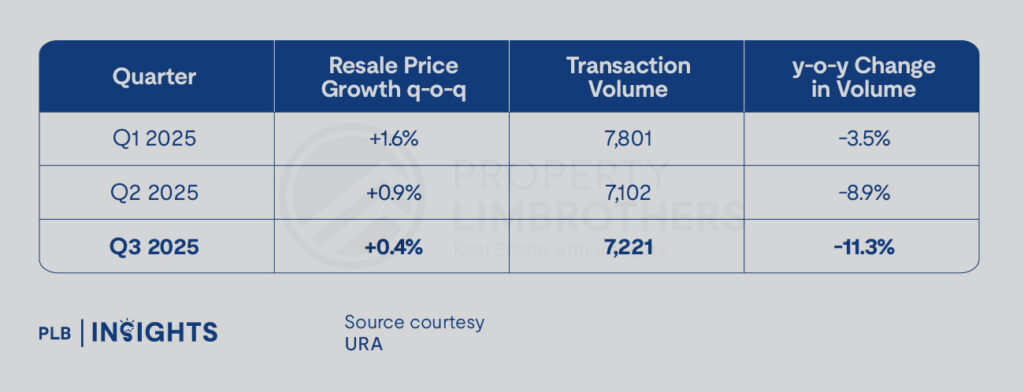

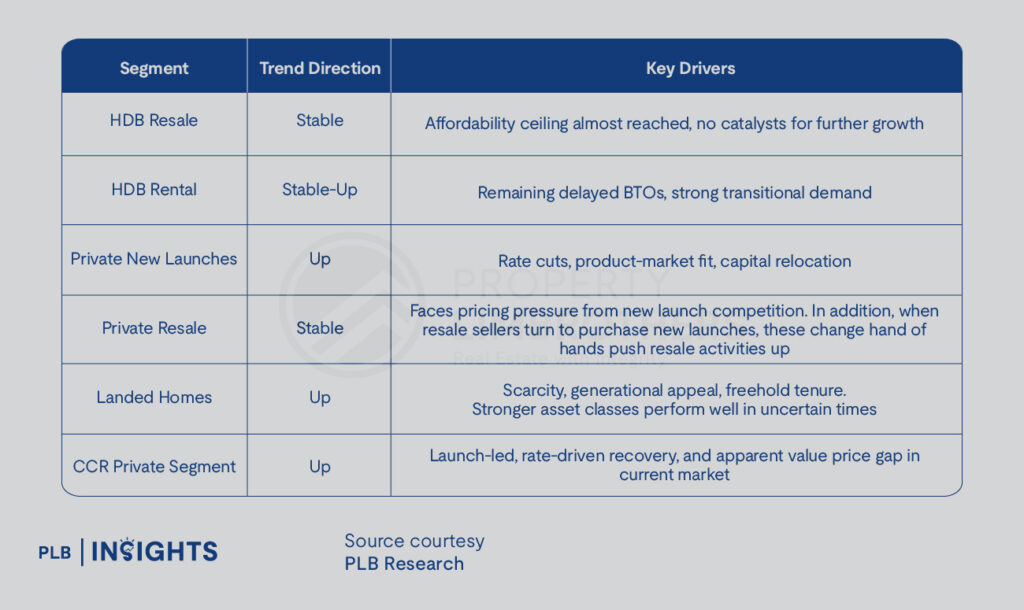

The HDB resale market recorded its slowest quarterly price growth in nearly five years in Q3 2025, signalling a maturing cycle in the public housing segment.

This is the fourth consecutive quarter of slowing price growth, and the lowest uptick since Q2 2020.

The pace of increase is attributed to a broad-based softening in demand at current price levels, driven by cumulative cooling measures, tighter financing conditions, and an increase in BTO supply in 2025.

Resale transaction volume increased by 1.7% quarter-on-quarter to 7,221 units, from 7,102 units in Q2, but remains 11.3% lower year-on-year , indicating a structural downtrend in activity despite quarterly fluctuations.

HDB Rental Market: Demand Holds Steady

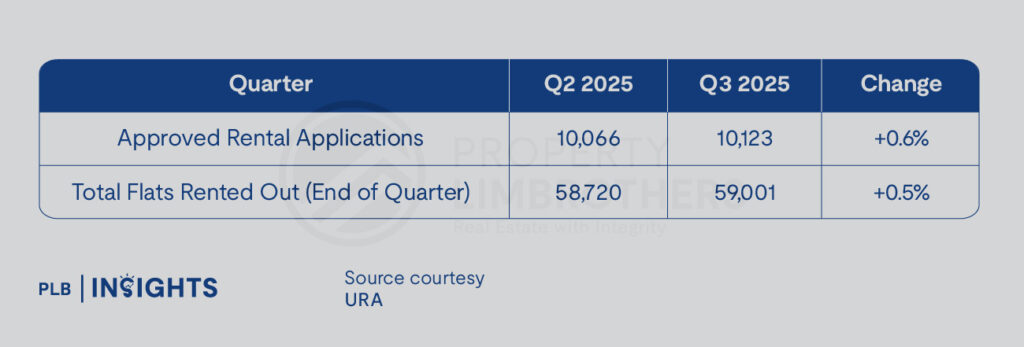

The HDB rental segment remained broadly stable with slight growth, continuing its role as a transitional housing solution amid private rental price pressures.

Rental activity remained firm, supported by the remainder of delayed BTO completion projects and demand from inbound expatriates and foreigners.

Private Residential Market: Interest Rate Cuts Unlock Momentum

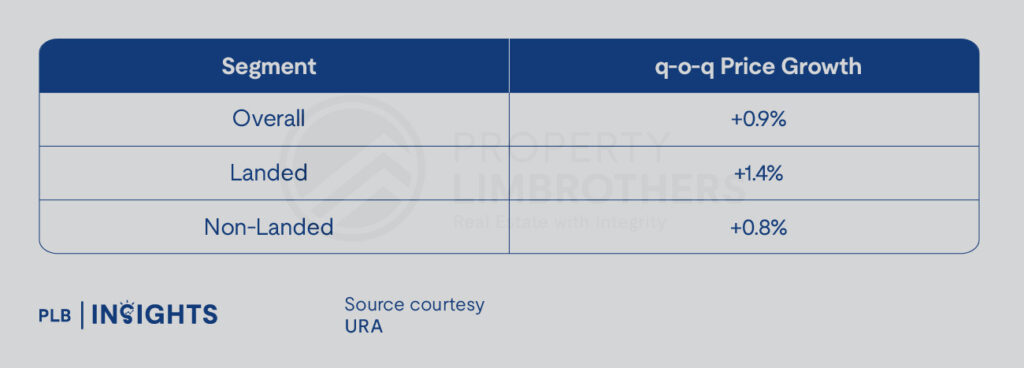

Singapore’s private residential market maintained a strong footing in Q3 2025, underpinned by a supportive financing environment following the first few waves of regional and global interest rate cuts.

The decline in SORA and mortgage rates has improved buyer affordability and supported a rebound in sentiment, especially among upgraders and relatively affluent owner-occupiers.

CCR Price Growth Driven by Launch-Led Activity

The Core Central Region (CCR) led non-landed price growth with a 1.7% q-o-q increase, significantly above the national average. This was primarily driven by a cluster of new launches, and sale of other CCR projects not yet completed that transacted at elevated price points.

These launches exerted upward pressure on the CCR price index, not only due to higher psf benchmarks but also strong absorption rates, confirming market appetite for well-designed, freehold homes in prime locations.

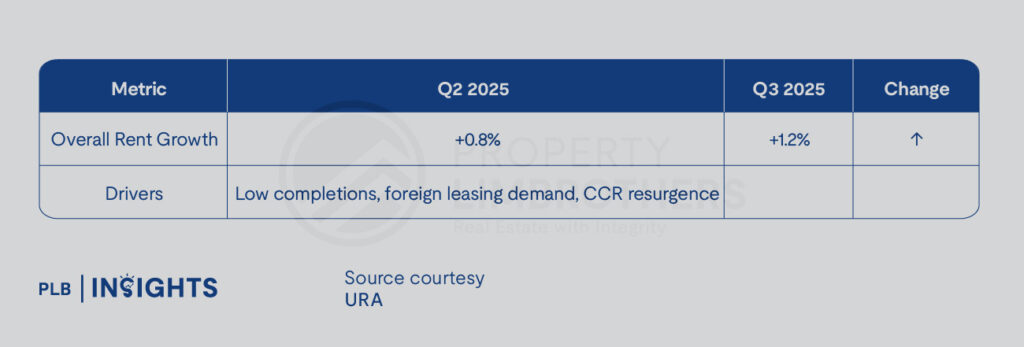

Private Rental Market: Tightness Persists

Rent increases were most notable in the CCR and RCR due to limited completions and a rebound in expatriate housing demand.

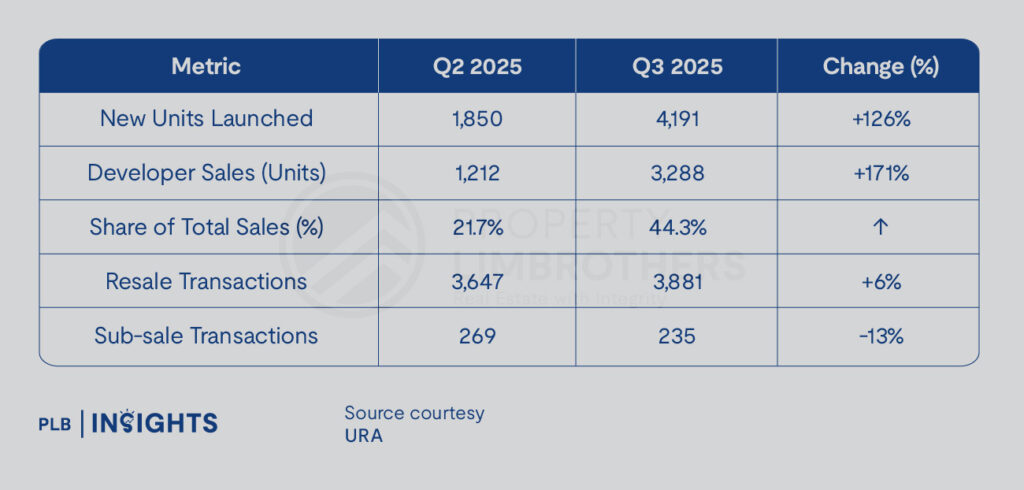

Private Sales: Launches Reassert Market Control

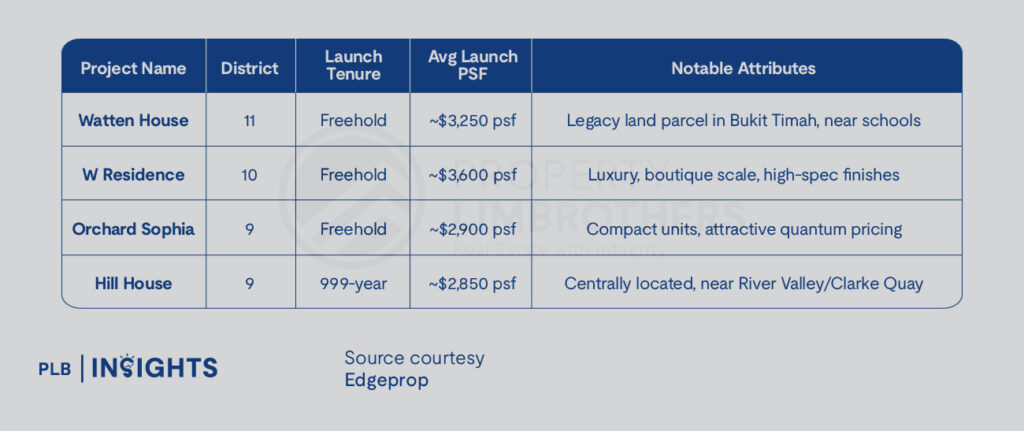

Developer launches surged in Q3, pushing up both sales volume and buyer engagement. New launch volume more than doubled, with strong project-specific momentum.

The resale segment’s dominance fell to 52.4% (from 71.1%), confirming the shift back to the primary market, driven by project-specific appeal and improving loan serviceability.

PLB’s Commentary: Landed and CCR Segment Reclaim Dominance

Q3 2025 affirms an uptick in demand, as buyers re-engage with the private residential market in response to lower interest rates, attractive launches at palatable price points, and resilient high-value segments.

Landed Market

CCR Segment

The 1.7% price surge is not speculative—it is launch-led and value-gap driven.

Projects like Watten House and W Residence showed that buyers will commit to high psf values when the project has strong locational fundamentals, offers freehold tenure, and delivers product differentiation (layout efficiency, exclusivity, design quality).

In addition, foreign buyer activity, particularly from China, has risen slightly despite higher ABSD rates, suggesting that Singapore’s political stability, currency strength, and asset security remain key draws.

Outlook: Strength Consolidates Around Core Segments

The Q3 performance sets the stage for continued strength in core and landed segments, underpinned by supportive financing conditions, strategic developer launches, and resilient end-user demand.

Stay Updated and Let’s Get In Touch

Reach out to us for a chat!