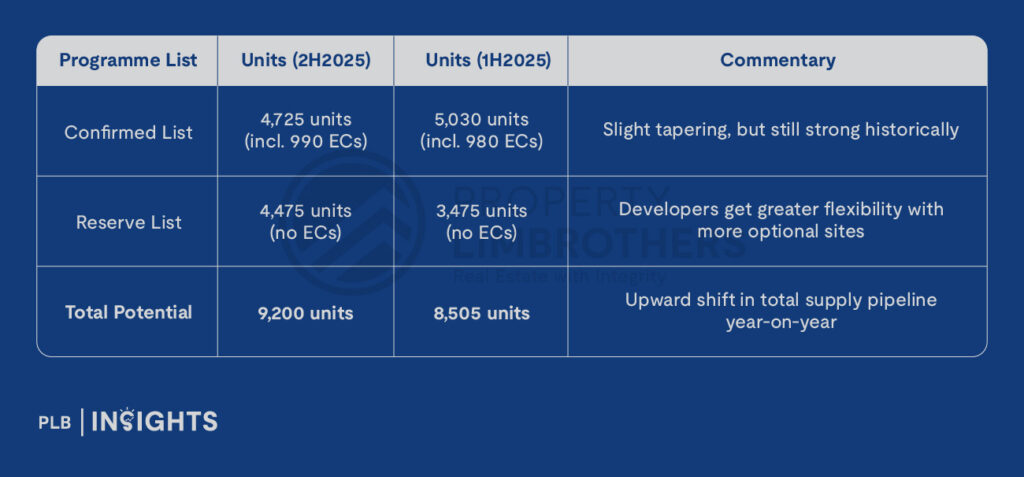

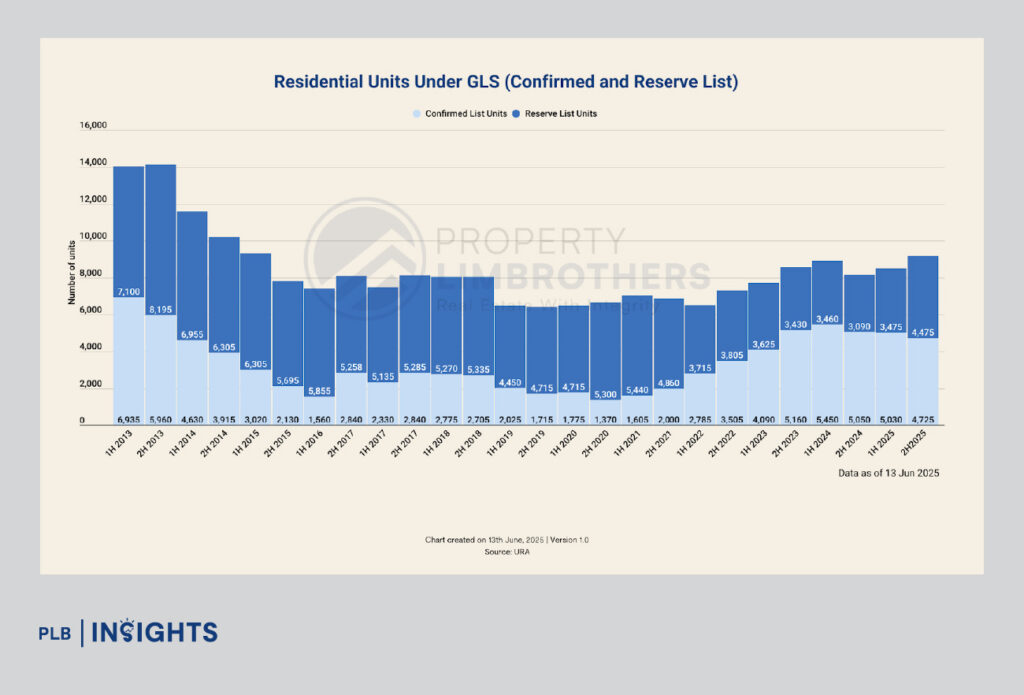

The Ministry of National Development (MND) has announced the release of 10 sites under the Confirmed List for the second half of 2025 (2H2025), yielding 4,725 private residential units, including 990 Executive Condominium (EC) units. This marks a slight dip from 5,030 units in 1H2025, although EC supply has risen marginally from 980 units earlier this year.

This brings the total Confirmed List supply in 2025 to close to 10,000 units, maintaining a historically high level of release to moderate property prices and ensure a sufficient housing pipeline.

Breakdown of GLS Supply

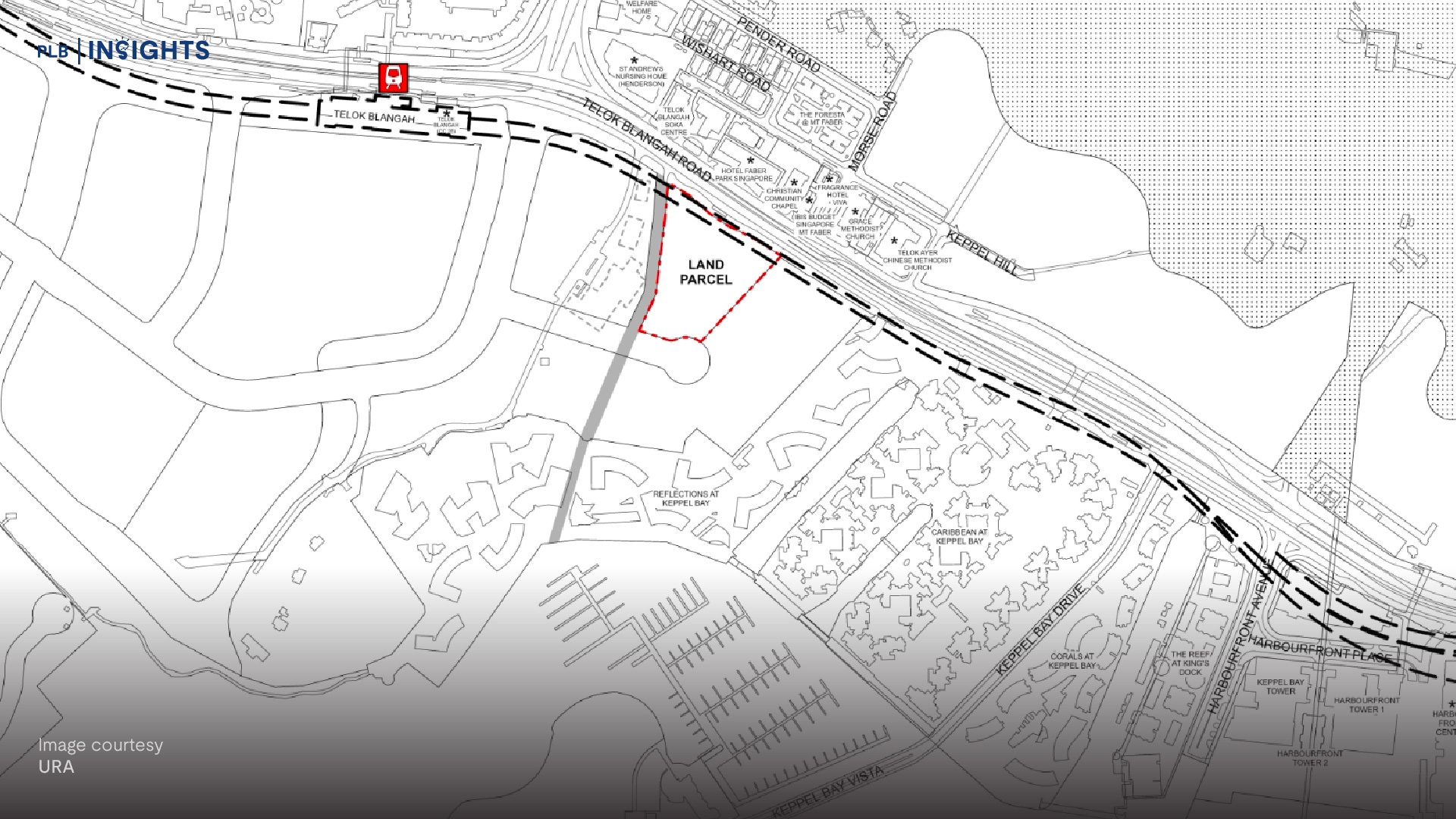

In addition to residential stock, the 2H2025 GLS slate includes 178,315 sqm of commercial GFA and 880 hotel rooms — a multi-sectoral approach aligned with urban rejuvenation goals and rising tourism interest.

PLB Commentary: Key Takeaways

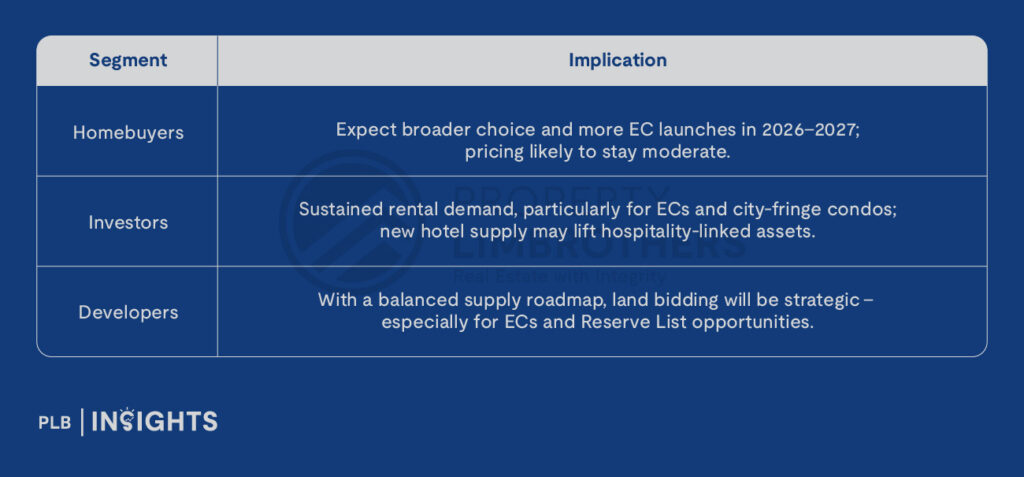

High EC Allocation Reflects Strong Demand

The jump in annual EC supply (≈1,980 units in 2025) is the highest since 2014, signalling ongoing demand among sandwiched Singaporean buyers seeking a step-up from public housing. ECs continue to appeal due to their hybrid affordability, capital appreciation prospects, and eventual full privatization after 10 years.

Insight: Expect EC sites to attract strong developer interest, especially in non-mature estates where demand from upgraders remains resilient.

Confirmed List Slightly Lower, but Supply Still Robust

The dip from 5,030 to 4,725 units between halves suggests targeted moderation, potentially in response to Q1 2025’s cooling price momentum (+0.8% vs +2.3% in Q4 2024). Authorities appear to be fine-tuning supply pacing rather than pulling back significantly.

Insight: This signals continued prudence – not contraction – ensuring a sustained pipeline without reigniting speculative fervor.

Reserve List Expansion Enhances Market Responsiveness

With 12 Reserve List sites capable of yielding 4,475 units, the government is empowering developers to respond to demand without flooding the market. This builds in flexibility while safeguarding against over- or under-supply amid macroeconomic uncertainties.

Insight: Watch for developer interest in central or city-fringe Reserve sites, especially those with mixed-use potential.

Strategic Implications for Buyers & Investors

In Summary

While the Confirmed List supply in 2H2025 is slightly lower, the total GLS programme remains robust, especially with a record EC supply and expanded Reserve List. This reaffirms the government’s commitment to a stable, sustainable housing market, with targeted support for genuine demand segments and ample optionality for private sector participation.

As always, PLB will continue monitoring site launches, tender responses, and project pipelines to keep our clients and readers ahead of the curve.

Stay Updated and Let’s Get In Touch

Interested in finding out the impact? Do not hesitate to reach out to us!