As Singapore’s property market continues to evolve in 2025, one trend that has garnered attention is the widening price disparity between properties in the Core Central Region (CCR) and the Rest of Central Region (RCR).

While this shift is partly due to the increasing demand for properties in both areas, several factors contribute to the variation in pricing across these regions. In this article, we explore these trends, the drivers behind them, and what they mean for buyers and investors looking to make informed decisions in the rest of the year.

Understanding the Price Landscape: CCR vs. RCR

To understand the difference in pricing between the CCR and RCR, it’s essential to break down the key factors at play. Historically, CCR, which includes prime areas like Marina Bay, Orchard Road, and Tanjong Pagar, has commanded higher prices due to its centrality and proximity to the business and financial districts. On the other hand, RCR, which includes areas such as Tiong Bahru, Bugis, and Queenstown, has generally been priced lower, offering greater affordability while still maintaining reasonable access to the city center.

However, price trends have shown interesting shifts. Let’s break down some of the current pricing differences and future expectations.

Price Trends: Comparing Properties in 2025

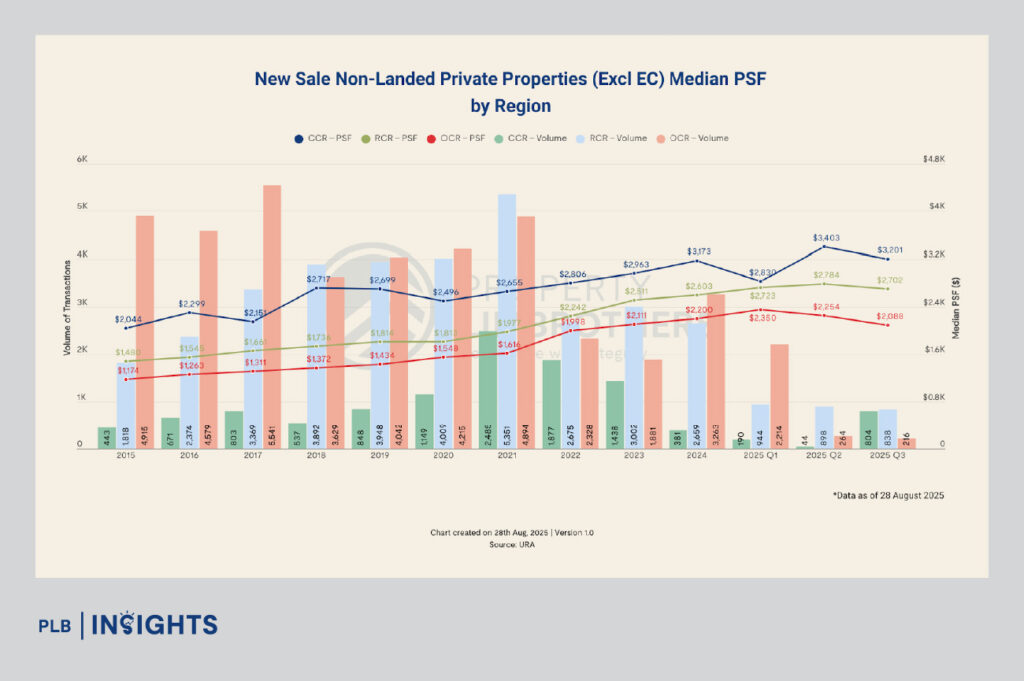

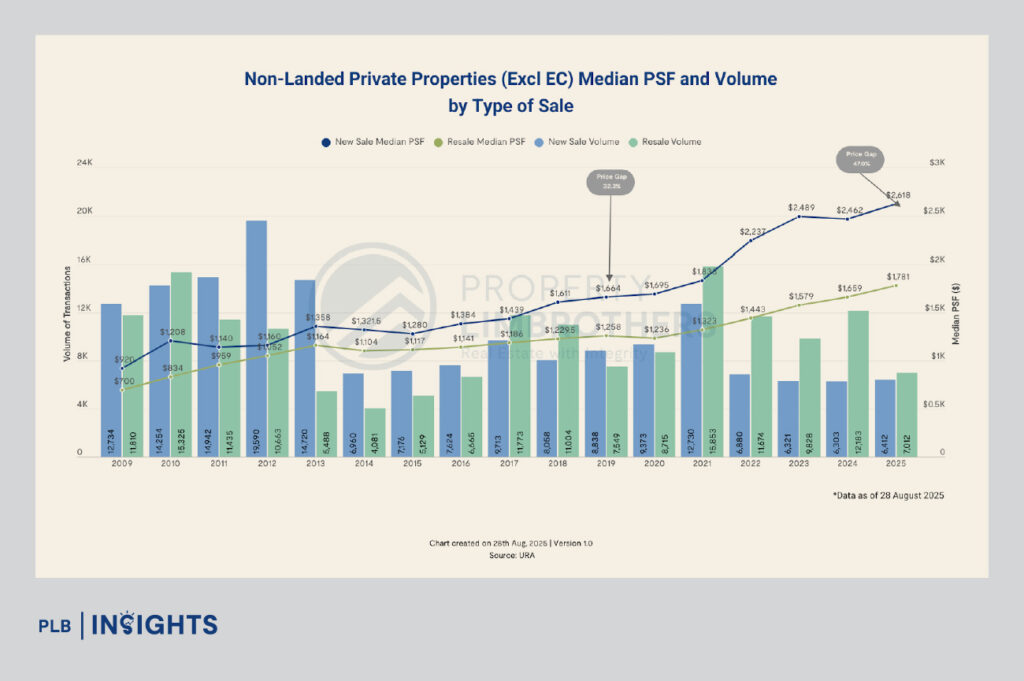

As we look at the prices for new launches in both regions, there is a clear contrast between the luxury-oriented CCR and the more affordable RCR.

RCR (Bloomsbury Residences): Prices here are starting at an average of $2,487 PSF for a 3-bedroom unit, with 4-bedroom units priced around $2,517 PSF and 5-bedroom units at $2,720 PSF. These are relatively attractive prices for buyers looking for proximity to the city at a slightly lower price point than those found in CCR.

City-Fringe (Aurea): Located in Beach Road (D7), a vibrant city-fringe area, Aurea offers a premium over RCR pricing, with 3-bedroom units at $2,828 PSF and 5-bedroom units at $3,560 PSF. While these prices are higher than those in the RCR, they are still more accessible compared to prime CCR areas like Marina Bay.

Prime CCR (W Residences): Positioned in one of Singapore’s most coveted locations, W Residences at Marina View (D1) boasts premium prices. Here, 3-bedroom units start at $3,273 PSF, while 5-bedroom units can go as high as $4,130 PSF. The significant price premium in CCR reflects its proximity to key business and leisure hubs, as well as its luxury amenities and exclusivity.

The key takeaway here is that the price gap between CCR and RCR is not just about location; it’s also about the luxury positioning of these developments. W Residences, located in one of Singapore’s most sought-after areas with panoramic views of Marina Bay Sands and easy access to premium shopping malls, restaurants, and business hubs, is understandably much more expensive. On the other hand, properties like Aurea and Bloomsbury Residences, while still offering central locations, cater to a different target market, often with less focus on prime luxury.

Why the Growing Interest in City-Fringe Properties?

The price gap is narrowing, and here’s why.

The price gap between properties in RCR and CCR has become more pronounced, particularly in the 4-bedroom segment.

RCR (Bloomsbury Residences) vs RCR City-Fringe (Aurea): The difference here is about ~17%, with Aurea commanding a slightly higher price per square foot, driven by its location in a rapidly-developing area close to key infrastructure. While RCR remains attractive due to its affordability and accessibility, Aurea offers a middle ground for those looking for a more premium location without paying the full price of a CCR property.

RCR (Bloomsbury Residences) vs Prime CCR (W Residences): The price difference here is much more pronounced, with a ~42% gap between the two properties. This reflects the luxury positioning of W Residences, which offers high-end living in one of Singapore’s most iconic areas, with views of Marina Bay Sands and the CBD. The price premium in CCR can be attributed to location prestige, accessibility, and the development’s alignment with the highest standards of luxury living.

These price differences highlight the growing price segmentation in the market. While RCR continues to appeal to those seeking affordable access to the city, prime CCR properties are catering to luxury buyers who are willing to pay for exclusivity, location, and high-end amenities.

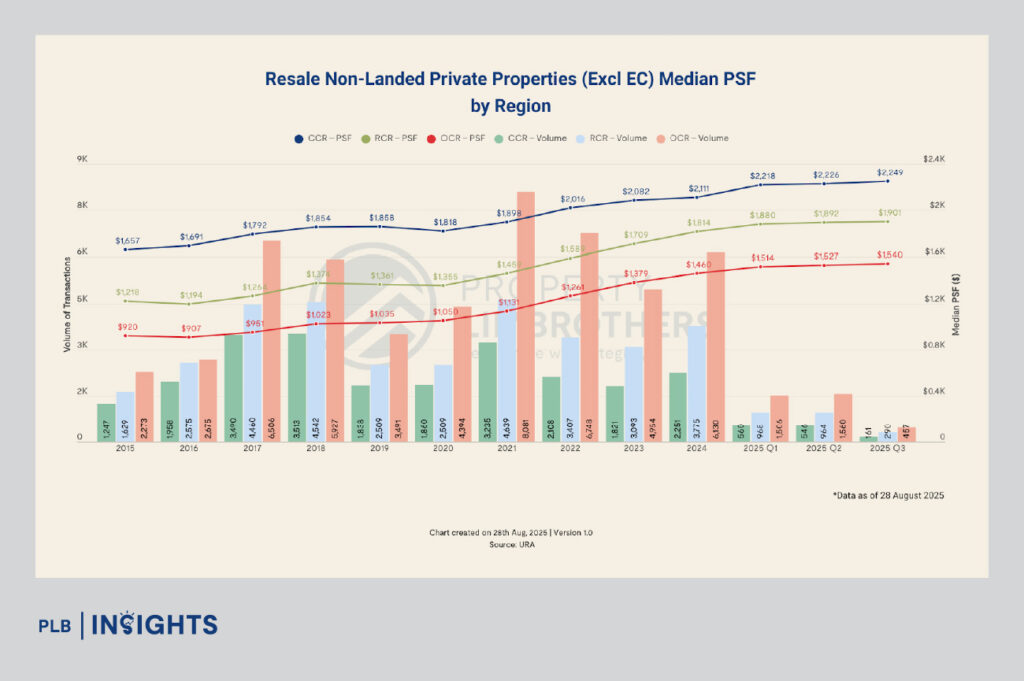

Resale Market Dynamics: The Impact of Price Gaps

In addition to new sales, the resale market is another area where price differences between CCR and RCR are noteworthy. The attached charts show that resale prices in CCR have historically been higher than those in RCR due to the availability of established properties in prime locations. However, the resale volume in the RCR has been increasing, reflecting a strong demand for well-located but more affordable properties.

The price gap between new sale PSF and resale PSF has been growing, with resale properties in CCR continuing to command higher prices due to the location and exclusivity factor. On the other hand, resale prices in RCR remain more competitive, offering value for money, especially as buyers look for properties with good potential for capital appreciation as the urban regeneration progresses.

Implications

Affordability vs. Prestige: Buyers in RCR areas continue to enjoy a significant price advantage, with properties like Bloomsbury Residences offering value for money while still providing easy access to the city center. However, those looking for luxury or investment-grade properties may find prime CCR developments such as W Residences more appealing, despite the higher price tag.

Investment Opportunities: For investors, the RCR remains a strong contender, offering a good balance of price and future growth potential due to ongoing urban regeneration. In contrast, prime CCR properties offer long-term stability and the potential for significant capital appreciation, especially as Singapore’s business districts continue to expand.

Emerging Demand in City-Fringe Areas: As city-fringe areas like Beach Road (where Aurea is located) undergo transformation, these regions are becoming increasingly attractive to buyers who want to capitalise on growth potential while remaining close to the central business areas. Properties in these areas are likely to see a steady increase in demand as connectivity improves and the area becomes more vibrant.

Conclusion

2025 presents a unique opportunity in the Singapore property market, especially in the RCR. As demand for properties in areas like Bugis, Tiong Bahru, and Beach Road rises, the gap in prices between CCR and RCR will likely continue to widen. However, for those seeking long-term returns, investing in city-fringe properties such as Aurea offers both affordability and strong growth prospects due to urban regeneration initiatives.

Simultaneously, prime CCR properties like W Residences continue to stand as the gold standard of luxury, offering prestige, exceptional amenities, and excellent future capital appreciation.

Investors and buyers looking to make informed decisions in 2025 should focus on RCR opportunities for greater yield potential, while luxury buyers might prefer CCR for long-term investment in iconic properties.

Stay Updated and Let’s Get In Touch

Our Goal is to Provide you with Meaningful Insights! Should you have any questions, do not hesitate to reach out to us!