District 16 has long been known for its steady landed market—but if there’s one segment that truly captures the pulse of active buyer demand today, it’s the inter-terrace home. Nestled within mature enclaves like Bedok and the Upper East Coast, these homes continue to move with a rhythm that reflects both affordability and confidence.

In this article, we take a closer look at how D16’s inter-terrace segment is performing—from absorption rates to price resilience—to help homeowners and buyers alike better understand the current momentum and future potential of this highly sought-after tier of landed living.

A Snapshot of Demand: Why Inter-Terrace Homes Remain a Hot Ticket

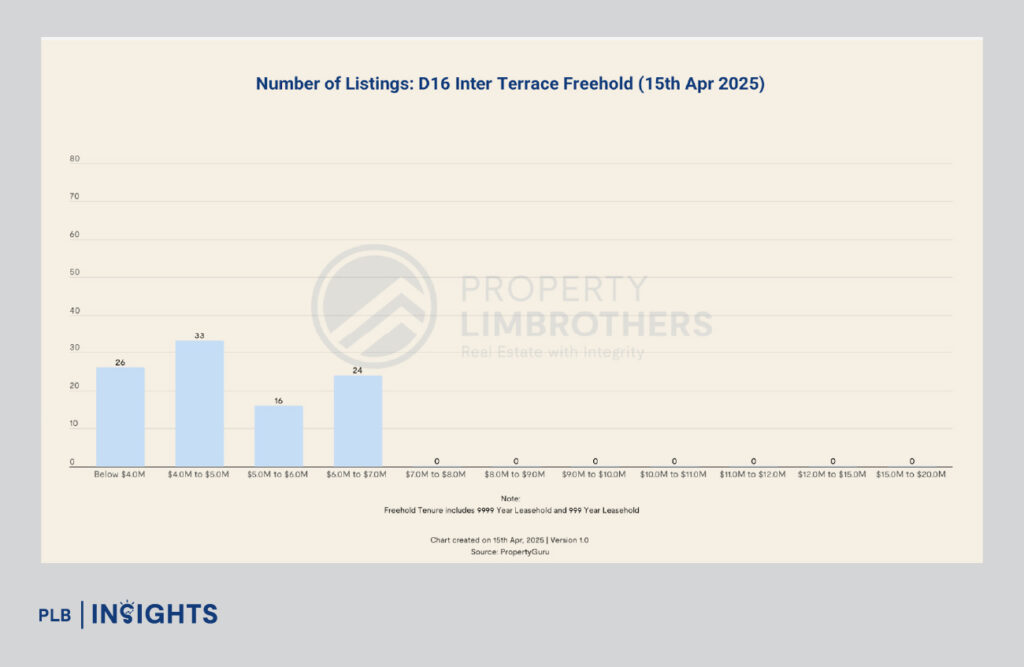

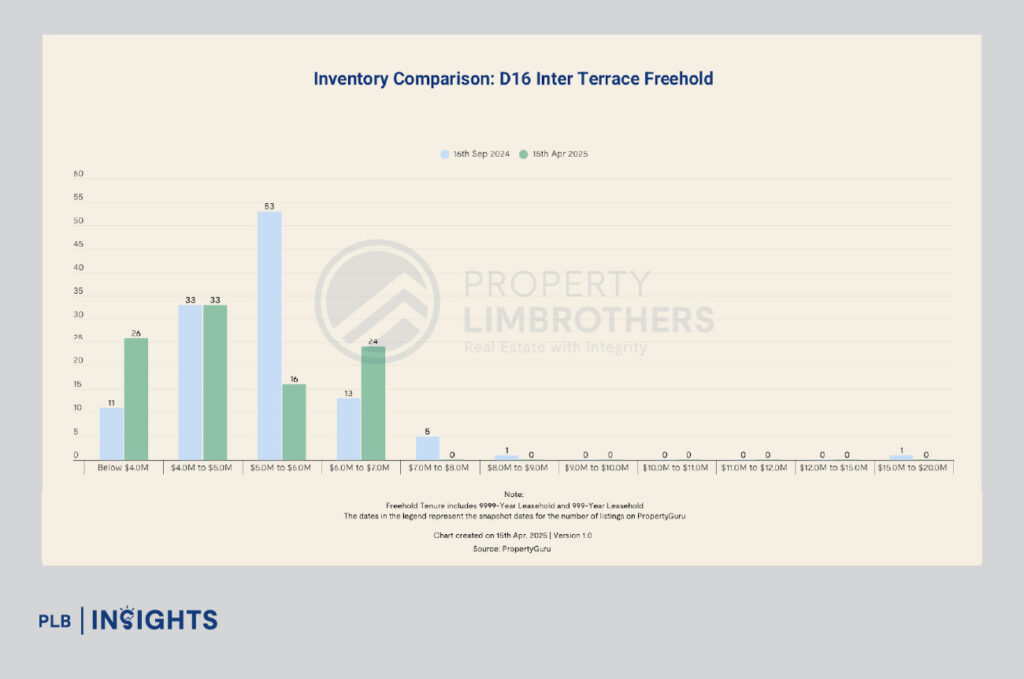

Among the four primary landed categories in D16, inter-terrace homes have remained the most accessible option for homebuyers, both in terms of price quantum and transaction volume. As of April 2025, 99 freehold inter-terrace listings were available in the district, forming a key segment of the landed landscape.

The concentration of listings under $5 million is especially notable. In fact, nearly two-thirds of inter-terrace listings fall into the $4 million to $5 million range or below, with 33 and 26 listings respectively. The lack of listings above $7 million reflects the organic price ceiling in this segment and underscores the strong holding power among owners of upgraded or redeveloped inter-terraces.

But the real test of demand isn’t just in pricing—it’s in how quickly units are sold.

Market Velocity: A 4.3-Month Absorption Ratio Signals Healthy Liquidity

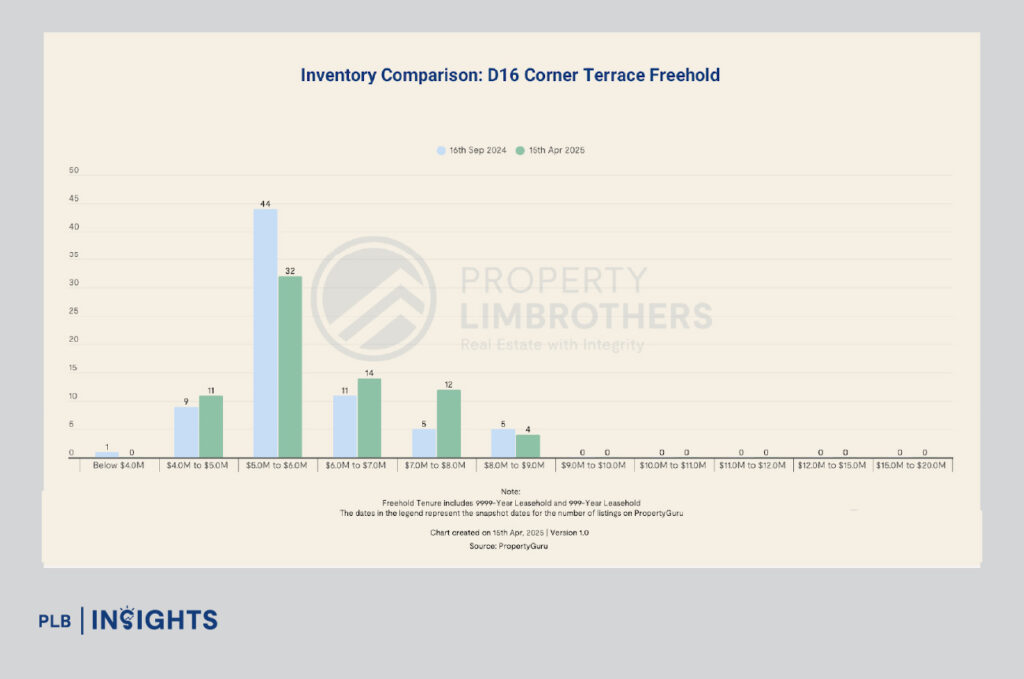

Between September 2024 and April 2025, 38 terrace homes were transacted in D16, of which a large proportion were inter-terraces. With a combined 164 listings (99 inter-terrace and 65 corner terrace homes) over that period, the absorption ratio sits at 4.3 months.

This means that at the current pace of sales, it would take just over four months to clear the entire terrace inventory—indicative of a well-balanced and liquid market. In fact, terrace homes are currently the most absorbable landed asset class in D16, outpacing semi-detached (12.8 months) and detached homes (12.9 months) by a significant margin.

This level of turnover reflects two things:

1. A strong and steady pool of buyers, especially those upgrading from condominiums and resale HDBs.

2. A price point that hits the “sweet spot” for freehold landed ownership—without breaching upper-tier budgets.

Price Stability and Consistent Appreciation

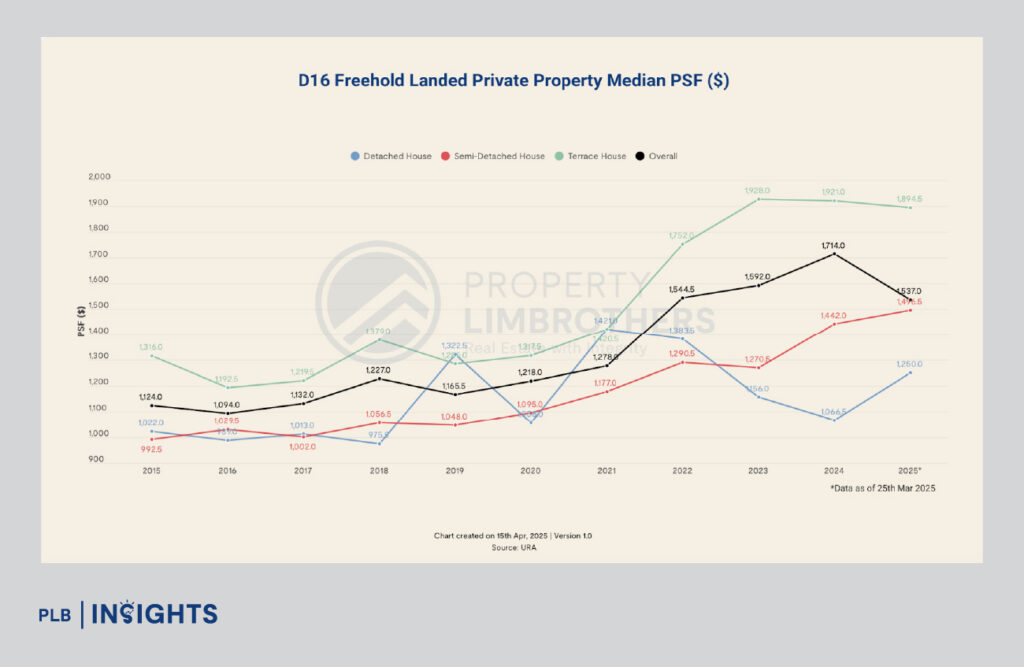

Long-term growth in the inter-terrace segment has also been encouraging. From 2015 to 2025 YTD, terrace homes in D16 posted the highest compound annual growth rate (CAGR) among all landed types, at 3.7%. That’s ahead of both semi-detached homes (3.6%) and detached homes (2.1%).

Part of this performance can be attributed to the scarcity of new landed supply. Over the past 15 years, pure landed stock across Singapore has grown by less than 6%, with inter-terrace homes seeing some of the least additions due to land constraints and zoning regulations.

For buyers looking at capital preservation and consistent upside potential, this trend makes inter-terrace homes an increasingly compelling proposition—especially in a district as mature and lifestyle-rich as D16.

Accessibility Without Compromise

What truly sets D16’s inter-terrace market apart is its ability to deliver the essentials of landed living—privacy, control over your home, land ownership—without requiring an eight-figure investment.

From Kew Drive to Bedok Park and Sennett Estate, inter-terrace homes are often nestled within tranquil neighbourhoods that still enjoy close proximity to daily conveniences, MRT stations like Tanah Merah and Bedok, and even East Coast Park. The upcoming Thomson-East Coast Line will further enhance east-west connectivity and value preservation for these enclaves.

This combination of accessibility and amenity-rich living allows D16 inter-terrace homes to serve a wide demographic: upgraders, young families, retirees looking to downshift while retaining land ownership, and investors who value tangible scarcity.

What This Means for Buyers and Sellers

For buyers, the 4.3-month absorption rate is a clear signal: inter-terrace homes in D16 are moving—consistently and competitively. If you’re looking to enter the landed segment, there’s an opportunity here to do so at a quantum that still reflects real value, in a district that continues to mature gracefully.

For sellers, healthy turnover and a well-defined price ceiling provide confidence. Well-maintained or upgraded inter-terrace homes can command firm offers, especially in the $4 million to $5 million band where buyer demand is most concentrated. Liquidity is on your side—provided your pricing reflects the current transactional momentum.

Final Thoughts

D16’s inter-terrace segment is proof that landed living in Singapore doesn’t always require headline-grabbing budgets. With a manageable price quantum, consistent turnover, and long-term capital growth potential, inter-terrace homes in D16 offer a strategic and attainable step into the landed class.

Whether you’re looking to buy your first landed property or planning a strategic exit as a seller, understanding the segment’s absorption rate is key—and right now, all indicators point to strength, stability, and demand.

Want to stay ahead of the curve on D16’s landed market? Join our Landed VIP Club to receive exclusive insights, research breakdowns, and invites to upcoming clinics where we unpack the trends behind Singapore’s most resilient property class.

Navigating Singapore’s landed property market doesn’t have to be daunting. Our experienced consultants are here to provide personalised guidance and expert insights, ensuring a smooth journey to finding your ideal home. Whether you’re seeking a legacy investment or a dream property for your family, we’re ready to help you make the right choice. Contact us today to turn your aspirations of owning a landed home into a seamless and rewarding reality.