Singapore’s resale condominium market in 2024–2025 has demonstrated distinct performance trends, with certain bedroom types leading the charge in growth across various segments. While some areas and developments have seen consistent upward momentum across all unit sizes, the factors driving this success are multifaceted, shaped by a combination of unit size preferences and evolving buyer demographics.

In this article, we’ll take a closer look at the top 10 projects showcasing significant year-on-year growth across 1-, 2-, 3-, 4-, and 5-bedroom units.

We’ll explore the underlying reasons behind the exceptional performance of specific bedroom types and highlight the key planning areas and developments that are propelling this growth.

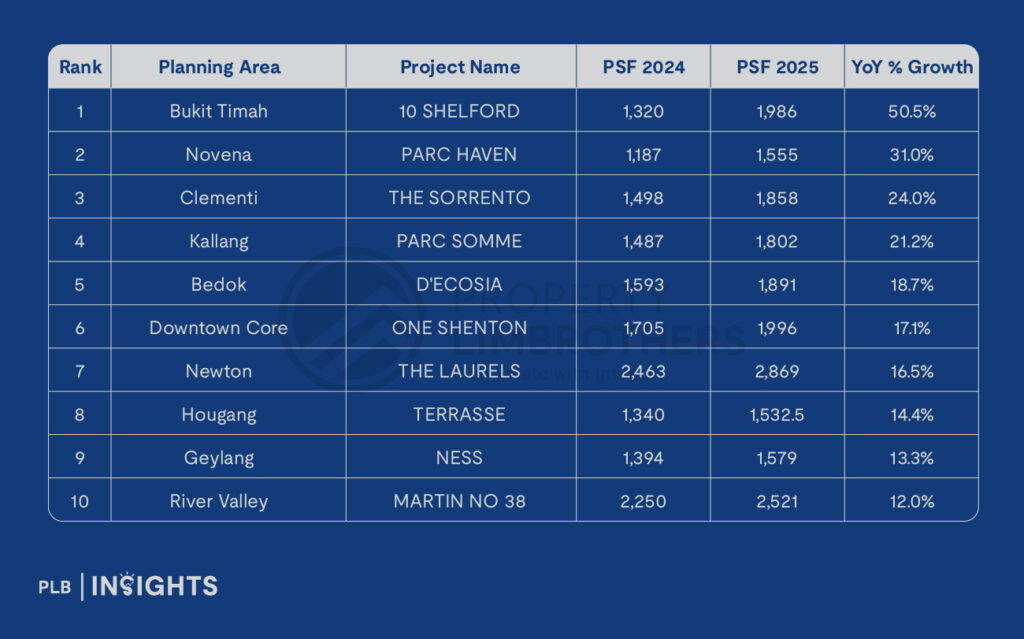

1-Bedroom Condominiums: Prime Entry-Level Homes with Catch-Up Growth

Key Insights:

1-bedroom units have seen some of the sharpest price increases in Singapore’s resale market. In areas like Bukit Timah, Novena, and the Downtown Core, prime locations with strong connectivity are pushing resale prices higher. These neighborhoods offer easy access to MRT stations, business hubs, and lifestyle amenities, making them highly sought after by both investors and first-time buyers.

What’s Driving This Growth?

Central Location Appeal:

Developments such as 10 Shelford (Bukit Timah) and Parc Haven (Novena) have seen year-on-year increases of up to 50%, driven by their prime positioning in established, high-demand districts. The easy access to transportation and top amenities makes these areas ideal for those seeking convenience.

Investment Demand:

The 1-bedroom segment remains attractive to investors, offering affordable entry points and strong rental yields. As new launches in these areas raise price per square foot (psf) benchmarks, older resale properties are catching up. For instance, 10 Shelford’s price growth reflects this increasing investor confidence in prime areas.

Catch-Up Growth:

Older resale units, such as those in Bukit Timah, are benefitting from the rising pricing of newer launches nearby. As buyers seek relatively affordable options in prime locations, the catch-up effect boosts demand and prices for well-located older condos.

Top Performers:

10 Shelford leads the 1-bedroom segment with a 50.5% increase in psf, followed by Parc Haven (Novena), which saw a 31% increase. These top projects reflect how location and proximity to key infrastructure drive price growth.

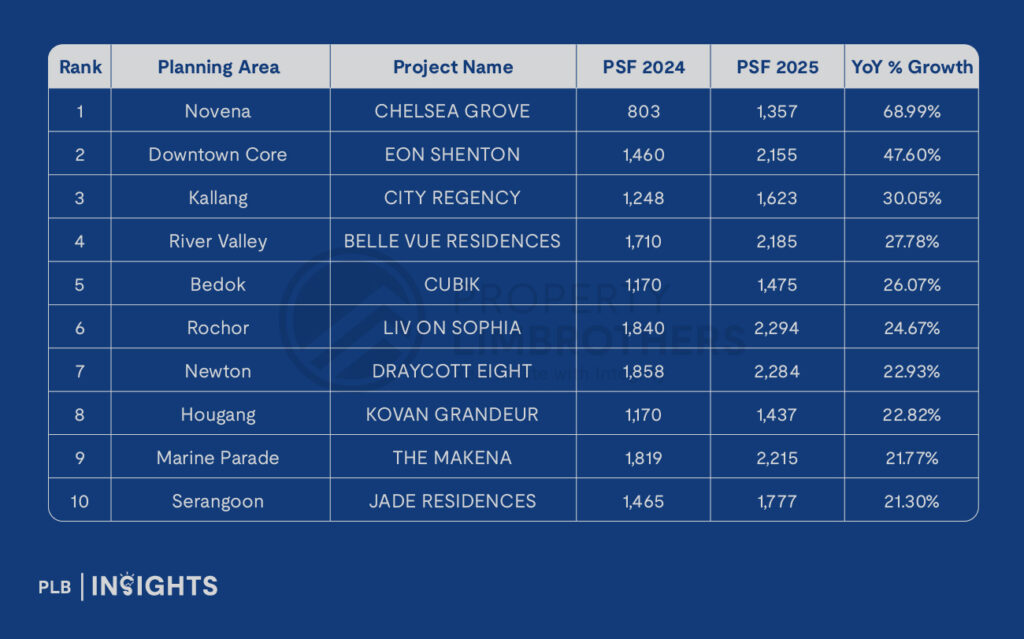

2-Bedroom Condominiums: The Sweet Spot for Young Families and Upgraders

Key Insights:

The 2-bedroom market has been one of the standout performers, particularly in city-fringe areas like Novena, Kallang, and Marine Parade. These locations offer a balance of accessibility to the city center without the premium prices of Core Central Region (CCR) districts, making them increasingly attractive to young families and upgraders.

What’s Driving This Growth?

Demand from Families and Upgraders:

The demand for 2-bedroom units has surged as young families and first-time homebuyers look to transition from HDB flats to private housing. These units provide larger living spaces at more affordable prices than newly launched properties in central areas.

Urban Renewal and Repricing:

As districts like Novena and Kallang undergo urban redevelopment, older resale units are seeing significant price appreciation. Chelsea Grove (Novena), for example, saw a stunning 69% increase in psf as the area transforms into a vibrant urban hub.

City-Fringe Appeal:

Areas close to the CBD, like Kallang and Marine Parade, continue to attract families and investors alike, offering the perfect balance of connectivity, amenities, and value for money.

Top Performers:

Leading the 2-bedroom segment is Chelsea Grove (Novena), with a stunning 69% increase in median psf from 2024 to 2025. Other top performers include Eon Shenton (Downtown Core) and City Regency (Kallang), showing how strategic location and urban development can drive strong returns.

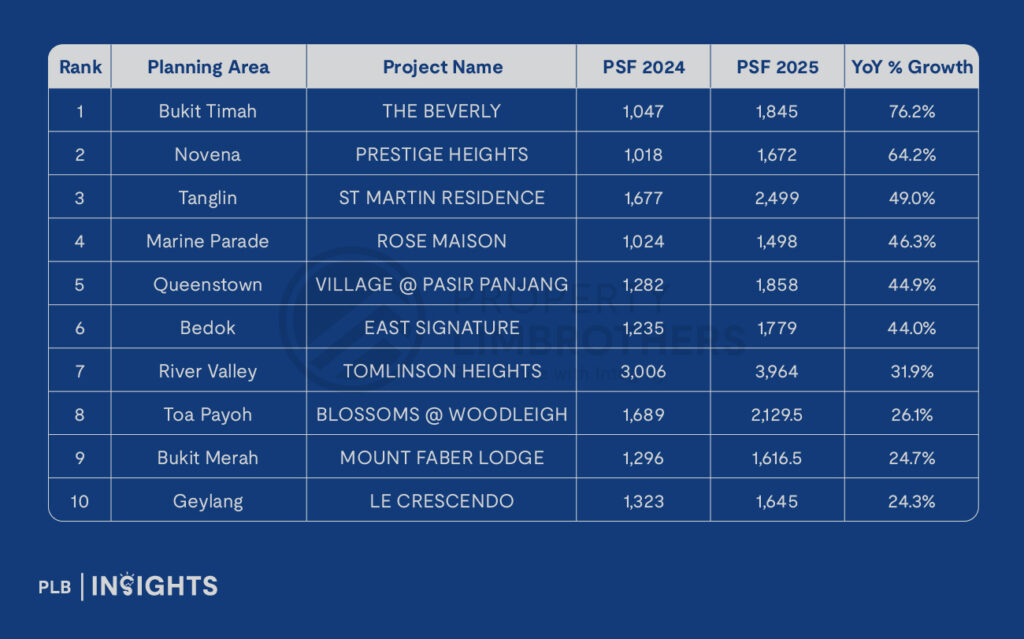

3-Bedroom Condominiums: Family-Oriented Units in Prime Locations

Key Insights:

The 3-bedroom segment has shown robust growth, particularly in prime and near-prime districts like Bukit Timah, Novena, Tanglin, and Marine Parade. These areas are increasingly popular with families seeking larger homes that are well-connected and close to top schools and amenities.

What’s Driving This Growth?

Limited Supply of Larger Units:

Larger 3-bedroom units are becoming rare in prime areas, especially as land becomes scarcer. Buyers looking for family homes in prestigious districts like Bukit Timah and Tanglin are finding limited options, creating a competitive market for these larger units.

Family Appeal:

Locations like Bukit Timah and Tanglin are highly desirable for families due to their proximity to prestigious schools and parks. This demand for family-oriented units is driving prices up as buyers prioritize space and convenience.

Repricing of Older Stock:

Older properties in these prime areas, such as The Beverly (Bukit Timah) and St Martin Residence (Tanglin), have been experiencing price growth as the market reprices them in line with new, high-priced launches in the area.

Top Performers:

The Beverly (Bukit Timah) leads the charge with a massive 76.2% y-o-y median price increase. Other notable performers include Prestige Heights (Novena) and St Martin Residence (Tanglin), showing how demand for family-sized units continues to grow in these sought-after neighborhoods.

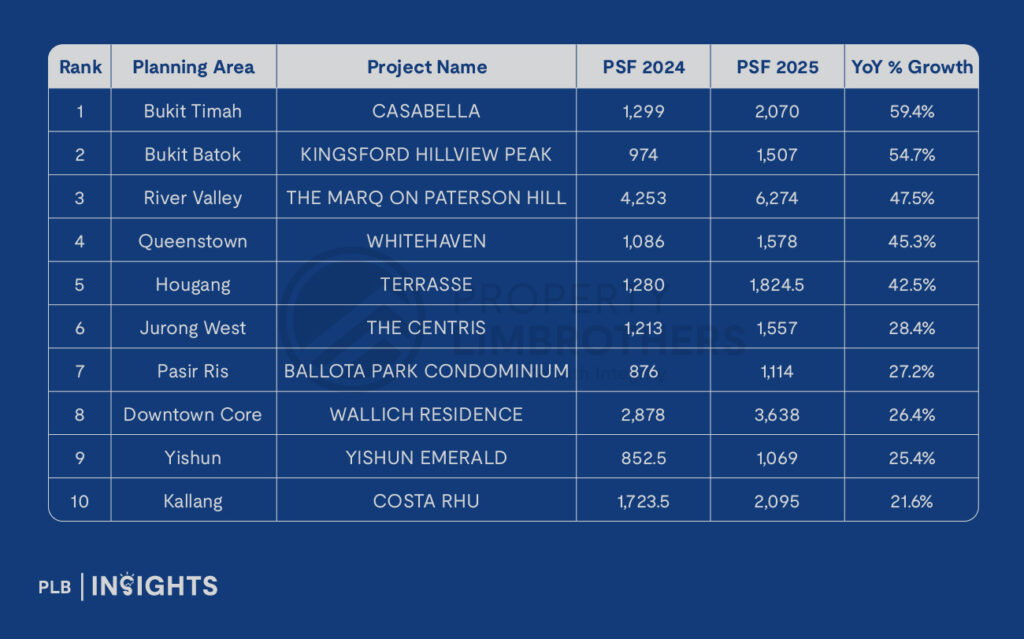

4-Bedroom Condominiums: Luxury Homes in Prime Locations

Key Insights:

The 4-bedroom market has seen some of the highest percentage price increases, especially in prime districts like Bukit Timah and River Valley. As large family homes become scarce in these high-demand areas, 4-bedroom units are becoming increasingly valuable.

What’s Driving This Growth?

Scarcity of Large Family Units:

There’s a shortage of larger units in established locations. Families looking for space in prime areas are finding few options, making the existing 4-bedroom condos a rare commodity.

Repricing of Older Units:

Many older 4-bedroom units have been re-rated as the demand for family homes in prime locations grows. Properties like Casabella (Bukit Timah) and Whitehaven (Queenstown) have seen strong price increases as buyers turn to these spacious, well-located homes.

Limited New Supply:

With developers focusing more on smaller units, the availability of large family condos is shrinking, pushing up prices for existing units in desirable locations.

Top Performers:

Casabella (Bukit Timah) saw a 59.4% price increase, leading the 4-bedroom segment. Other top performers include Kingsford Hillview Peak (Bukit Batok) and The Marq on Paterson Hill (River Valley), highlighting how scarcity and location drive price growth.

5-Bedroom Condominiums: Larger Homes for Aspirational Upgraders

Key Insights:

The 5-bedroom segment, while smaller in volume, has seen impressive growth, especially in executive condominiums (ECs) and larger private condos in suburban and mature areas like Sengkang, Punggol, Pasir Ris, and Bukit Timah. These homes are ideal for families looking for more space and luxury without paying the premium of central areas.

What’s Driving This Growth?

Demand from Upgraders:

As families move from HDB flats to larger, more luxurious homes, ECs like The Topiary (Sengkang) offer the perfect balance of space, luxury, and affordability in suburban locations.

Prime-Freehold Homes:

Freehold properties like Pandan Valley (Bukit Timah) are increasingly popular as “forever homes,” offering long-term stability and value in well-established neighborhoods.

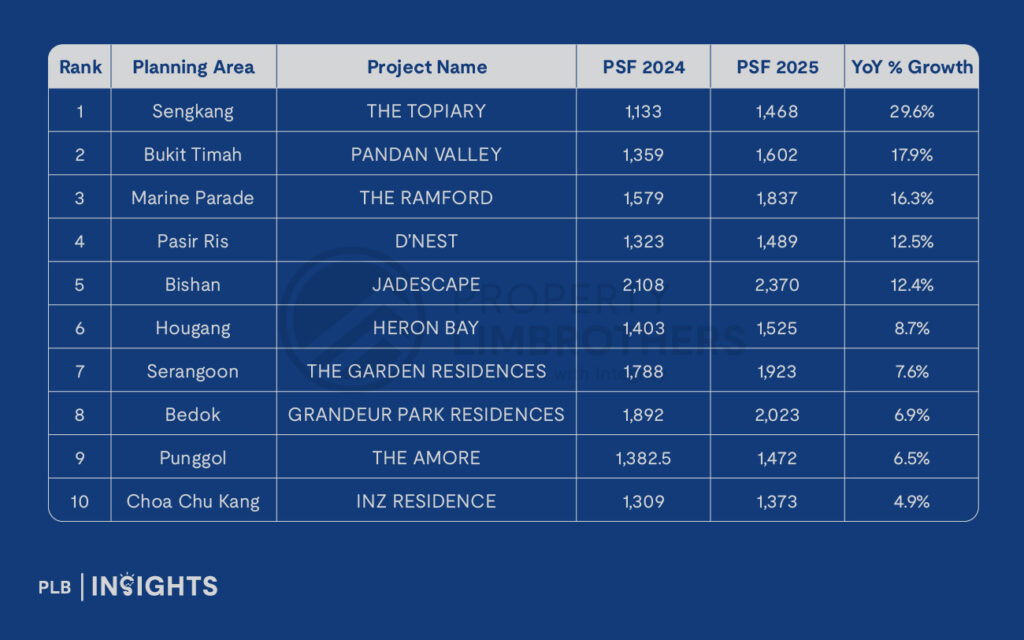

Top Performers:

The Topiary (Sengkang) leads the segment with a 29.6% price increase, followed by Pandan Valley (Bukit Timah) at 17.9%. These projects highlight the growing demand for large homes with space and long-term investment potential.

Conclusion: Prime Areas and High-Return Segments

For 1-bedroom and 2-bedroom units, Bukit Timah, Novena, and the Downtown Core are the standout performers. These prime areas offer unbeatable connectivity and proximity to business hubs, making them a magnet for investors and first-time buyers. The market in these regions is booming, with sharp price increases driven by the high demand for central, well-located properties. Bukit Timah and Novena in particular are seeing explosive growth, as buyers continue to flock to established, transport-rich neighborhoods.

Meanwhile, larger flats in Sengkang, part of the OCR, are experiencing strong price appreciation. Executive condominiums (ECs) like The Topiary offer a rare combination of space and affordability, making them highly attractive to HDB upgraders. As the CCR becomes increasingly unaffordable, OCR locations like Sengkang are emerging as prime destinations for families seeking larger homes without the premium price tag.

In short, central locations for smaller units and OCR areas for larger flats represent the sweet spots for investors and homebuyers in Singapore’s dynamic resale market.

Stay Updated and Let’s Get In Touch

Should you have any questions, do not hesitate to reach out to us!