Among the various landed housing types in District 20, detached homes occupy a category of their own. They are not the most frequently transacted, nor the most discussed in everyday market conversations. Yet, when viewed through the lens of long-term ownership, multi-generational planning, and capital preservation, detached homes represent the district’s most exclusive and structurally resilient segment.

District 20’s landed market is often characterised by its balance — stable family demand, central connectivity, and mature neighbourhoods that evolve steadily rather than abruptly. Detached homes sit at the very top of this ecosystem. Their rarity, holding power, and consistently low transaction volumes are not signs of weak demand, but rather indicators of strong owner conviction and limited replacement supply.

Drawing from the latest D20 Landed Research findings and URA REALIS data up to November 2025, this article takes a focused look at how detached homes behave within D20, who they are most suited for, and why they continue to function as one of the most defensible landed asset classes in Singapore’s city-fringe landscape.

Why Detached Homes Matter in D20

Detached homes represent the purest form of landed living: full land ownership, maximum privacy, and design autonomy unconstrained by party walls. In District 20, this asset class takes on added significance because of the district’s structural characteristics.

Unlike fringe OCR districts where detached homes may appear in newer, master-planned enclaves, D20’s detached houses are almost entirely located within long-established landed estates such as Windsor Park, Thomson Ridge, and select pockets near MacRitchie Reservoir. These neighbourhoods were shaped decades ago, when land plots were larger and density controls less restrictive.

As a result, detached homes in D20 are not easily replicated. There are no future land releases for new bungalows within the district, nor are there large sites available for subdivision at scale. This makes every existing detached plot a genuinely irreplaceable asset within a highly mature, central-fringe setting.

Inventory Profile: True Scarcity in a Mature Market

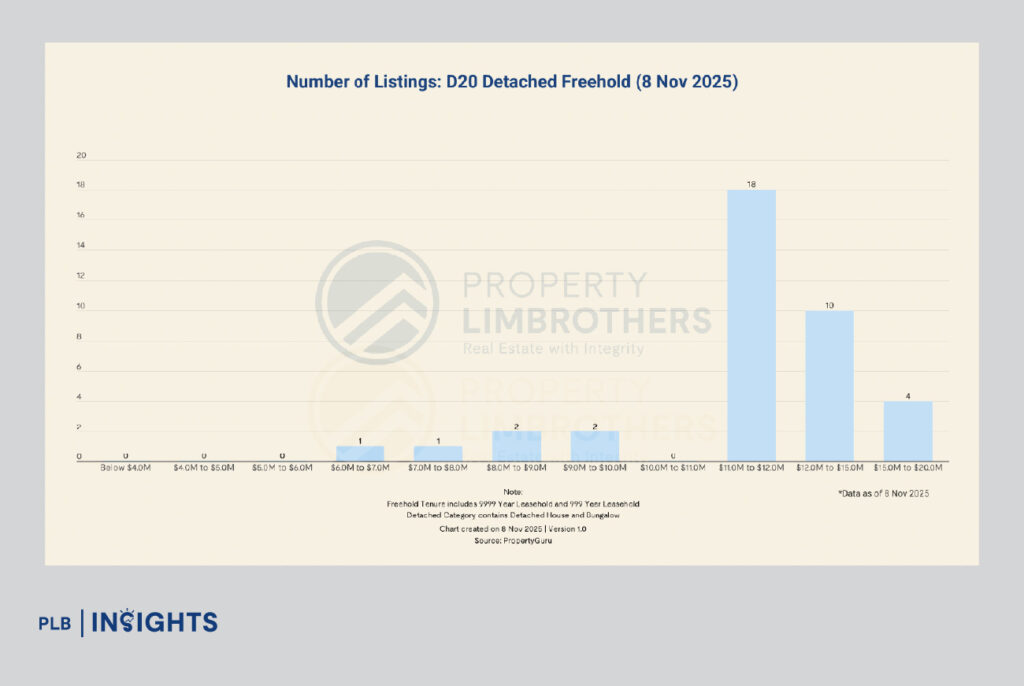

According to the D20 Landed Research Report, detached homes are the rarest landed type in the district, with fewer than 50 active freehold listings as of November 2025. This already small number becomes even more meaningful when viewed alongside D20’s other landed segments, where inter-terrace and semi-detached homes number well into the hundreds.

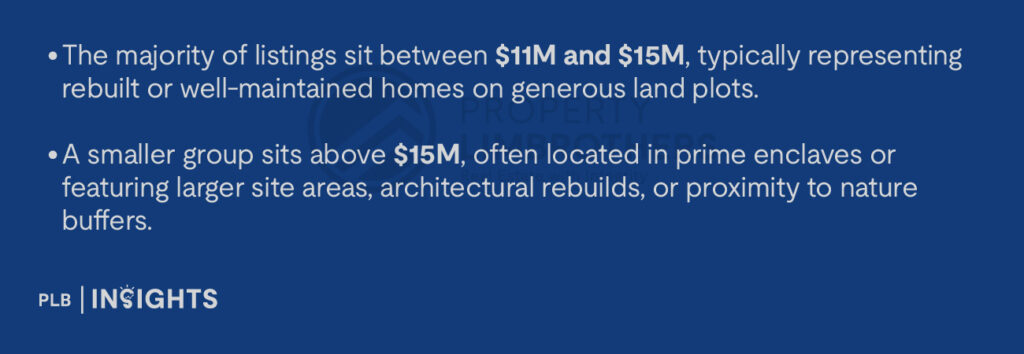

The pricing distribution of detached homes reflects both their scarcity and the profile of their owner base:

Notably absent is any meaningful “entry-level” detached market. Unlike semi-detached or terrace homes, there is no broad quantum band that facilitates frequent upgrading activity. Once homeowners move into detached houses in D20, many remain for decades — sometimes across generations.

This structural holding behaviour is a defining feature of the segment.

Absorption Ratio: Low Turnover, Not Weak Demand

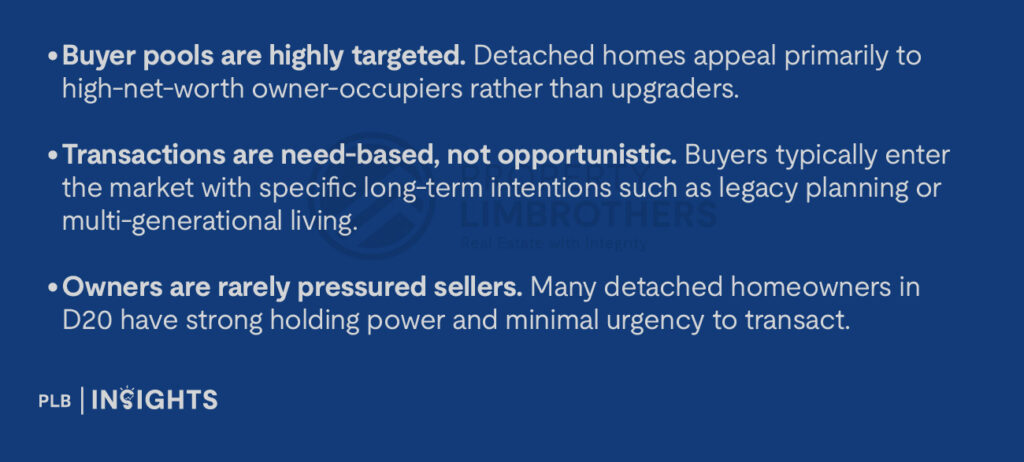

Detached homes in D20 show an estimated ~8-month absorption ratio, placing them between corner terraces and semi-detached homes in terms of liquidity.

At face value, this may appear slower than entry-tier landed segments. In reality, it reflects three important truths:

When deals do occur, they are often decisive — with buyers prioritising land size, micro-location, orientation, and rebuild potential over short-term price movements.

Detached Homes as Multi-Generational Assets

One of the most consistent demand drivers for detached homes in D20 is multi-generational planning.

District 20’s appeal to families is already well established through its school network, green spaces, and connectivity. Detached homes amplify this appeal by offering flexibility that other landed types cannot match:

In an environment where freehold landed supply is structurally constrained, detached homes function less as lifestyle upgrades and more as long-term family anchors.

Long-Term Price Performance: Stability Over Velocity

From 2015 to 2025, detached homes in D20 recorded an estimated 4.1% compound annual growth rate (CAGR) — lower than terrace homes, but firmly aligned with their role as defensive, long-duration assets.

This performance profile highlights a key distinction:

Detached houses are less influenced by renovation trends, short-term interest rate cycles, or buyer sentiment swings. Instead, their value is anchored by land scarcity, plot size, and micro-location quality — factors that change little over time.

Premium Enclaves: Where Detached Homes Demonstrate Strong Staying Power

Detached homes in District 20 are not evenly distributed, nor do they perform uniformly across all locations. Based on observed listing concentration and holding behaviour, stronger demand and price resilience tend to cluster in well-established micro-pockets rather than across the district as a whole.

Windsor Park

Windsor Park stands out as one of D20’s more established landed enclaves with a notable concentration of detached homes. Characterised by quiet residential streets, larger average land plots, and high owner-occupier presence, detached houses here tend to be tightly held and benchmarked at the upper end of the district’s pricing spectrum.

Upper Thomson and Thomson Ridge pockets

Select landed pockets around Upper Thomson and Thomson Ridge also feature detached homes, benefiting from proximity to the Thomson–East Coast Line, mature amenities along Upper Thomson Road, and access to reputable schools. While these areas comprise a mix of landed types, detached homes within these pockets continue to attract long-term owner-occupiers seeking centrality without sacrificing low-density living.

Nature-adjacent streets near MacRitchie and Lower Peirce

Detached homes located close to MacRitchie Reservoir and Lower Peirce greenery enjoy an additional layer of appeal stemming from their low-development surroundings and limited future supply risk. Such nature-adjacent attributes typically enhance long-term price resilience rather than short-term transaction velocity.

In the detached segment, these micro-locational factors often play a more significant role in buyer decision-making than district-wide pricing averages, reinforcing the segment’s long-term, fundamentals-driven character.

Buyer Profile: Who Buys Detached Homes in D20?

Detached home buyers in D20 typically fall into three categories:

Established High-Net-Worth Families

Often upgrading from large semi-detached homes or premium condominiums, this group prioritises privacy, space, and legacy planning.

Multi-Generational Households

Families looking to consolidate living arrangements under one roof while maintaining functional separation.

Long-Term Wealth Preservers

Buyers who view detached homes less as trading assets and more as capital stores insulated from volatility.

Across all profiles, short-term returns are rarely the primary consideration.

Why Detached Homes Remain D20’s “Hardest” Asset Class

When evaluated holistically, detached homes in District 20 stand out for three enduring reasons:

These factors explain why detached homes continue to behave differently from other landed types — with fewer transactions, steadier pricing, and strong confidence across cycles.

Conclusion: Detached Homes as the Foundation of D20’s Long-Term Resilience

Detached homes represent the pinnacle of District 20’s landed market — not because they are frequently traded, but precisely because they are not. Their scarcity, strong owner conviction, and alignment with long-term family use make them one of the most stable landed assets in Singapore’s central-fringe landscape.

As the district continues to mature, with no new landed supply on the horizon and sustained appeal across generations, detached homes will likely remain the quiet backbone of D20’s landed identity. They are assets designed not for market timing, but for permanence — anchoring both lifestyle and wealth across decades.

If you are considering a detached home in District 20, informed positioning and micro-location insight are essential. Our sales consultants can help you navigate this rare segment with clarity and confidence. Click here to get in touch.

Thank you for reading, and stay tuned! For more detailed insights regarding the landed property market, join our Landed VIP Club and stay updated with the latest market trends and expert advice.