Semi-detached homes in District 20 occupy a particularly meaningful space in the district’s landed landscape — not just because of their size or configuration, but because of the way they reflect how families choose to live in one of Singapore’s most established central-fringe neighbourhoods. D20’s long-formed landed enclaves, shaped by decades of owner-occupier stability and thoughtful urban planning, have created an environment where semi-detached homes naturally thrive as the preferred option for households seeking space, comfort, and long-term practicality without stepping into the ultra-premium bungalow tier.

While Inter- and Corner-Terrace homes typically form the “liquidity core” of D20’s market, Semi-Detached homes occupy a unique and influential position. They represent the aspirational step up from terraces — a tier where homeowners seek significantly more space, privacy, and frontage without crossing the price threshold into fully detached territory. In D20, these semi-detached homes form not only one of the largest landed segments but also one of the most structurally important.

Drawing from the PLB Research D20 Landed Report (November 2025) and URA REALIS data, this article examines the performance, demand drivers, inventory movements, and long-term outlook of Semi-Detached homes across the district. As part of the weekly Landed VIP Club series, this analysis aims to provide homeowners and buyers with a grounded, comprehensive understanding of how semis anchor the district’s stability and future growth trajectory.

Why Semi-Detached Homes Matter in D20

Semi-Detached homes offer one of the most balanced combinations of attributes in Singapore’s landed landscape. For many families, they present the ideal middle ground — offering the land, frontage, and privacy that define landed living, while maintaining a quantum that remains more accessible than detached homes.

In D20, these homes are particularly meaningful because they suit the lifestyle patterns of families who have outgrown terrace homes and now seek additional comfort, flexibility, or multi-generational living room. The district’s estates, including Upper Thomson, Shunfu, Thomson Ridge, Windsor Park, and Jalan Pemimpin, offer layouts and plots that appeal to households planning for long-term occupancy.

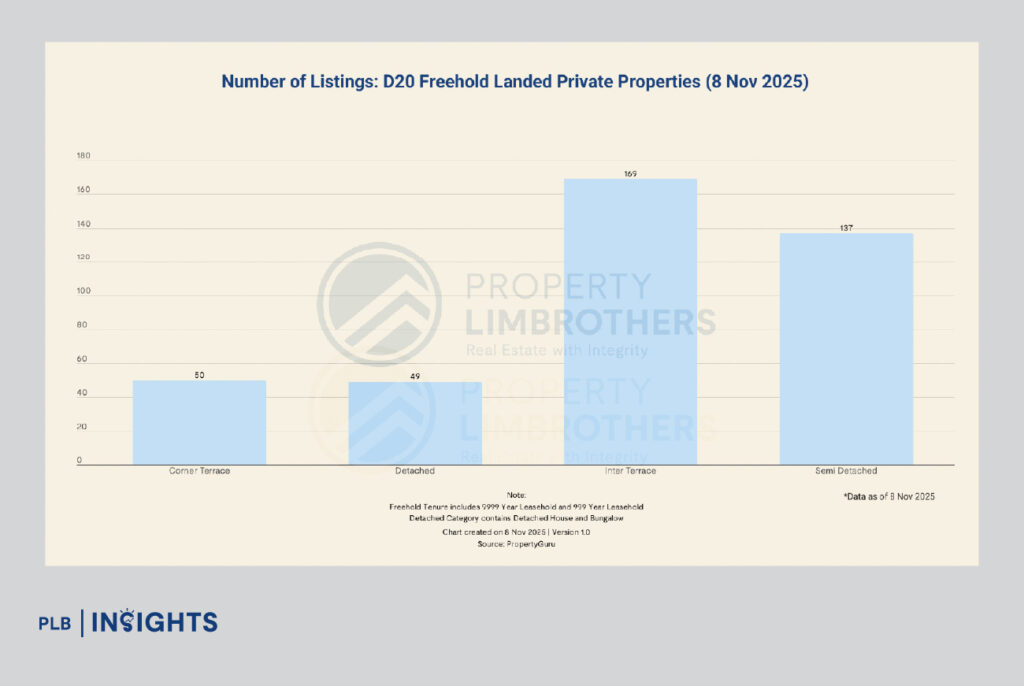

According to the D20 Landed Research Report, Semi-Detached homes form the second-largest freehold landed supply segment, totalling 137 active listings as of November 2025 . This sizeable inventory signals not oversupply, but a vibrant mid- to upper-tier segment shaped by both long-term owner-occupiers and active resale participation. It also reflects the district’s maturity, where homes built across different decades now coexist — adding diversity in price points, conditions, and redevelopment potential.

Inventory Profile: A Diverse and Mature Segment

Semi-Detached homes in D20 span a wide range of price brackets, reflecting estate age, land size, home condition, and location. This breadth is characteristic of a matured landed district and is largely shaped by homes built across multiple eras.

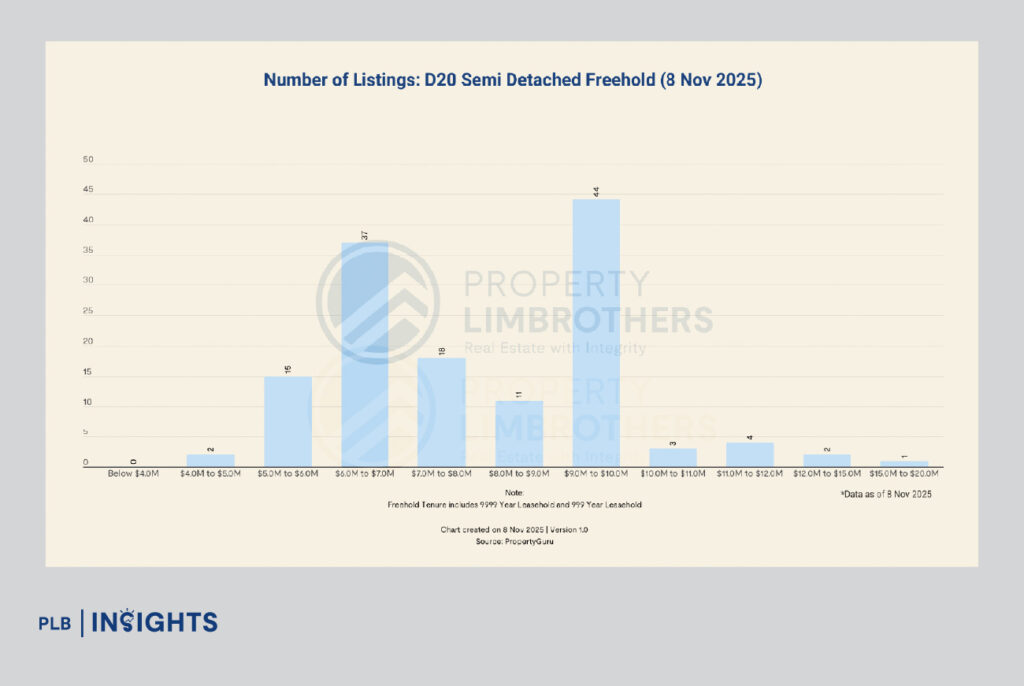

Based on the research report:

Collectively, over 70% of the entire Semi-Detached supply sits between $6M and $10M, forming the district’s backbone for family-oriented buyers seeking more substantial space without entering detached-house territory.

At the entry level, there are only 15 listings (11%) between $5M and $6M — and just two listings between $4M and $5M. No semi-datached homes in D20 fall below $4M. This reinforces how strongly the district’s landed values have appreciated over time.

At the top end, there are premium units ranging from $10M to $20M, including modern rebuilds or architect-led homes, which appeal to families prioritising design, quality, and a turnkey move-in experience.

The presence of older homes alongside newer, fully rebuilt ones also contributes to the segment’s variety. Many older homes are Category 1 or Category 2 under the PLB Landed Framework, appealing to buyers looking for A&A or full redevelopment potential. Conversely, Category 3 and 4 rebuilt units attract buyers seeking modern layouts, high ceilings, and contemporary facades — often commanding significant price premiums.

Absorption Patterns: A Slower but Expected Pace

Where Inter-Terraces in D20 display the fastest market turnover (~2 months) and Corner Terraces follow with a healthy ~3-month absorption ratio, Semi-Detached homes operate at a slower but predictable rhythm. According to the report, D20 semis have an estimated ~10–12-month absorption ratio, the longest among the landed categories.

This is not an indication of weak interest. Instead, it reflects the structural nature of the semi-detached segment:

In fact, the research report highlights that listings between $4M and $6M nearly tripled year-on-year due to increased resale activity among older semi-detached properties. This led to a temporary increase in inventory in the mid-tier band, extending the absorption timeline but not diminishing overall demand.

The slower turnover is typical of a semi-detached market that serves end-users rather than short-cycle investors. Buyers of semis are often evaluating for lifestyle, family growth, proximity to schools, internal configuration, and long-term comfort — decisions that naturally take more time.

The Three Key Buyer Groups for Semi-Detached Homes in D20

Upgraders Targeting $5M–$7M

This group typically includes families upgrading from larger condominium units, executive condominiums, or inter-terrace homes. They seek more generous living spaces and future-proof layouts, without crossing into higher quantum bands. For them, older semi-detached homes with A&A potential in areas like Sin Ming, Jalan Pemimpin, and Shunfu Estate often present appealing opportunities.

Multi-Generational Families Seeking $7M–$10M Homes

These buyers prioritise functional layouts, proximity to top schools, and convenient access to MRT stations such as Upper Thomson, Marymount, and Bishan. Modernised units in this range are particularly attractive given their blend of space, updated layouts, and walkability.

Aspirational Buyers Targeting $10M–$20M Rebuilt Homes

These households usually come from high-end condominiums or have previously stayed in landed homes. They value turnkey condition, design quality, and privacy. Rebuilt semi-detached homes in Windsor Park and Upper Thomson attract this group due to their modern layouts, contemporary facades, and proximity to greenery like MacRitchie Reservoir.

Price Growth: A Decade of Steady, Sustainable Appreciation

The D20 Research Report shows that Semi-Detached homes recorded a 56% increase in PSF from 2015 to 2025, rising from $1,098 to $1,720 (+5.0% CAGR).

This growth pattern aligns with the segment’s owner-occupier appeal:

While the appreciation rate is more moderate than terrace homes (+70% over the same period), the consistency of price growth reflects the semi-detached segment’s stability and alignment with end-user demand.

Key Micro-Trends Shaping Demand in 2025

Demand Concentration Around MRT Nodes

Semi-Detached clusters near Upper Thomson, Bishan, and Marymount continue to record stronger interest due to the ease of access and walkability. Families prioritising school access and reduced commute times gravitate toward these micro-locations.

Preference for Move-in-Ready Category 3–4 Homes

Modernised layouts, wider frontage, double-volume spaces, and newer facades significantly increase appeal among buyers, who increasingly prefer homes requiring minimal renovation.

Shrinking Entry-Level Availability

The report underscores that listings below $5M are now extremely rare. This shift reflects D20’s long-term value trajectory and strong owner holding power, contributing to a new, higher baseline for entry into the semi-detached segment.

Conclusion: Semi-Detached Homes Will Continue to Anchor D20’s Long-Term Appeal

Semi-Detached homes hold a unique and enduring place in District 20’s landed landscape. Their combination of centrality, space, privacy, and family-friendly layouts aligns with what many modern households prioritise today. Even as inventory expands in certain price ranges, the underlying demand for these homes remains fundamentally resilient, shaped by owner-occupiers who value long-term staying power and strong lifestyle attributes over short-term market fluctuations.

Over the past decade, Semi-Detached homes in D20 have demonstrated steady, sustainable price growth and a consistently deep buyer pool. As the district continues to mature — with stable connectivity, school networks, lifestyle amenities, and greenery — semi-detached homes are likely to remain a defining segment of D20’s property market. They represent the natural progression for families who want more than what terraces can offer, yet still appreciate the accessibility and vibrancy that the district provides. In the years ahead, these homes will continue to play a central role in shaping D20’s identity as a highly liveable and enduringly desirable landed enclave.

If you’re planning your next move in D20’s landed market, our team can guide you with data-backed clarity and confidence. Click here to connect with our sales consultants.

Thank you for reading, and stay tuned! For more detailed insights regarding the landed property market, join our Landed VIP Club and stay updated with the latest market trends and expert advice.