District 20 has long been regarded as one of Singapore’s most stable and desirable city-fringe landed districts. Its mature estates, deep owner-occupier roots, and enduring appeal to families create a level of resilience that few other areas can replicate. While the district offers the full spectrum of landed types, Inter-Terrace and Corner-Terrace homes form the backbone of its market liquidity and long-term value.

Drawing from the latest PLB Research findings based on URA REALIS data and listing inventories up to November 2025, this week’s deep dive focuses on the dynamics, performance, buyer demand, and investment outlook of these two key segments. Together, they shape the “entry to mid-tier spine” of D20’s landed landscape — and understanding how they behave is essential for any buyer or seller planning their next move.

Why Inter- and Corner-Terrace Homes Matter in D20

Terrace houses — both Inter-Terrace and Corner-Terrace — form the most active, fluid, and accessible segment of the district’s freehold landed market. With D20’s landed supply staying largely unchanged over 15 years (less than 6% growth islandwide) and only ~5% of Singapore’s total residential stock classified as landed, these categories provide the broadest buyer base and the widest spectrum of price ranges.

For many families, Inter-Terraces represent D20’s ideal first step into the landed segment: centrally located, liveable, and realistically priced by today’s standards. Corner Terraces, meanwhile, offer a rare balance — more space and privacy, without reaching the premium quantum of Semi-Detached homes.

Inter-Terrace Homes in D20: The Market’s Liquidity Engine

Inventory Profile: Largest Supply, Strongest Demand

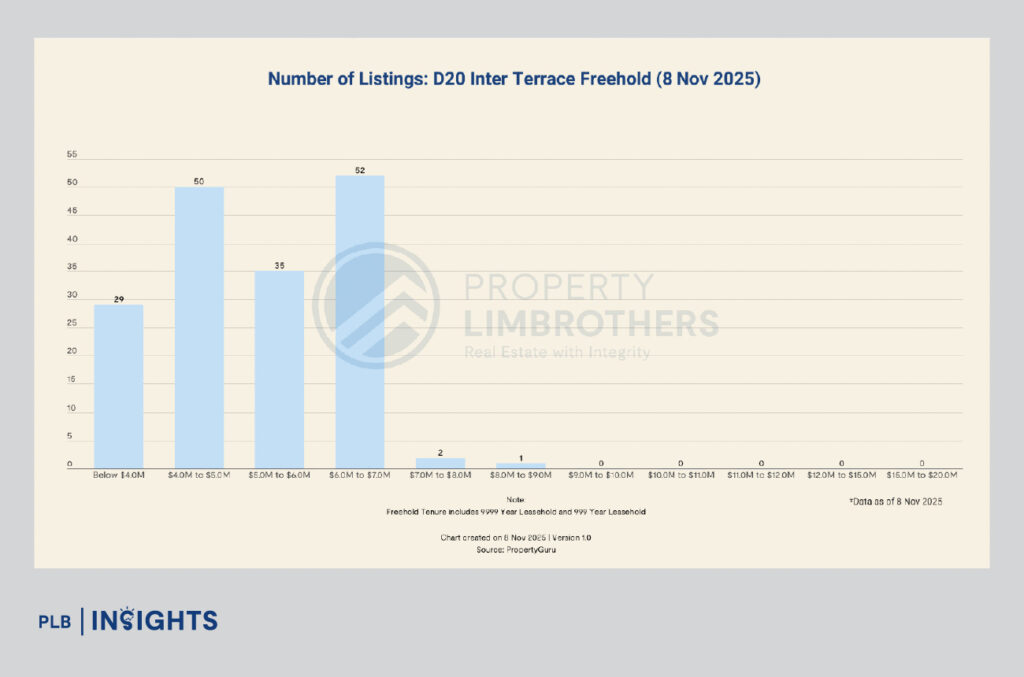

With 169 active listings as at November 2025, Inter-Terraces form the most prevalent segment in D20’s freehold landed market.

This size of inventory does not signal oversupply — instead, it reflects a highly active resale ecosystem driven by upgrader demand, owner-occupier mobility, and a price quantum that remains competitive for central landed housing.

Most listings fall between $4.0M and $7.0M, the sweet spot for families transitioning from large condos or premium HDBs.

Together, these tiers account for 81% of all Inter-Terrace supply, underscoring the segment’s strong alignment with real-world budgets and buyer expectations.

Absorption Ratio: Fastest Turnover Among All Landed Types

Inter-Terraces record an estimated ~2-month absorption ratio, reflecting the strongest liquidity in D20’s entire landed market.

This speedy turnover is supported by:

Even in a higher-interest-rate environment, the Inter-Terrace segment maintains predictable, consistent movement, making it the most reliable indicator of D20’s overall market health.

Price Trends: The Best Performer Over 10 Years

Terrace houses (inter-terrace and corner-terrace) recorded the highest PSF appreciation among all landed types:

Key drivers:

For buyers seeking both stability and capital growth, Inter-Terraces stand out as the most dynamic performer in D20.

Corner-Terrace Homes in D20: Scarce, Spacious, and Increasingly Competitive

Inventory Profile: Limited Supply with Mid-Tier Concentration

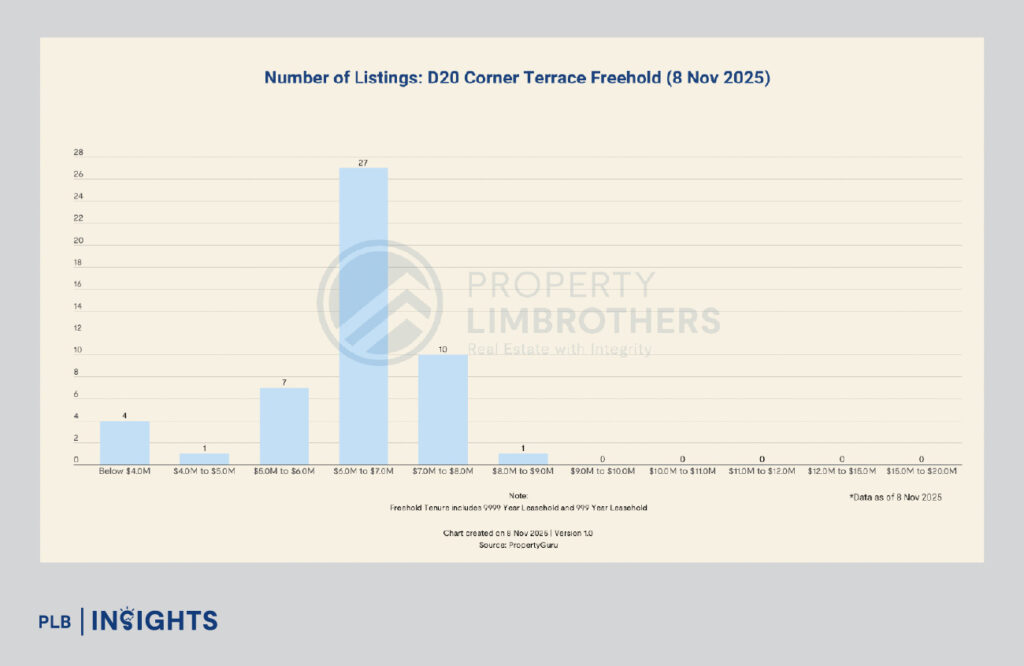

Corner Terraces represent a much smaller, tightly-held segment, with 50 active listings in November 2025.

This scarcity naturally underpins stronger long-term price stability, particularly in premium enclaves such as Shunfu, Windsor Park, and Thomson Ridge.

The price distribution is highly concentrated in mid-upper tiers:

Together, these two ranges account for 74% of the entire Corner-Terrace inventory, reflecting the segment’s position as a comfortable mid-tier upgrade for families seeking space, privacy, and frontage without the jump into Semi-Detached levels.

Year-on-Year Inventory Doubling — But Demand Holds Steady

Between September 2024 and November 2025, Corner-Terrace listings more than doubled, largely due to owners taking the opportunity to capitalise on appreciation.

Importantly, this rise does not reflect weakening demand. Instead, it shows:

Even with expanded supply, Corner Terraces remain comparatively scarce — meaning this growth represents a temporary window rather than structural oversupply.

Absorption Ratio: A Balanced, Healthy Market

Corner Terraces show an estimated ~3-month absorption ratio, placing them in a healthy middle ground between Inter-Terraces (fast) and Semi-Detached homes (slow).

This figure tells us three things:

For many long-term homeowners, Corner Terraces represent one of D20’s most versatile and future-proof landed choices.

Comparing Both Segments: Understanding Their Roles in D20’s Landed Ecosystem

Inter-Terraces: Accessibility & Liquidity

Inter-Terraces anchor the entry-tier segment:

They are, in many ways, the “trustable workhorse” of D20’s market — providing stability, predictable resale velocity, and broad buyer interest.

Corner Terraces: Space, Privacy & Stability

Corner Terraces fill the mid-tier gap:

They serve buyers who want to remain central while enjoying enhanced comfort and flexibility for renovations or extensions.

Key Micro-Trends Shaping Buyer Decisions in 2025

MRT-Proximate Terraces Command Strong Premiums

Homes near Upper Thomson, Marymount, or Bishan MRT nodes record the strongest velocity and price resistance.

This includes enclaves such as:

These micro-pockets continue to attract intense interest due to walkability, schools, and connectivity.

Category 3 & 4 Rebuilt Homes Move Fast

Move-in-ready homes with modern layouts routinely outperform older Category 1–2 units.

Key features buyers prioritise:

Entry-Level Scarcity is Increasing

Listings below $4M have shrunk across both Inter- and Corner-Terrace segments.

This reflects:

For buyers, this suggests that today’s $4M–$5M Inter-Terrace homes may form the next “entry-tier floor” for the district.

Long-Term Investment Outlook: Why These Two Segments Will Remain the District’s Most Resilient

Consistent Growth, Minimal Volatility

Across a decade of data, Inter- and Corner-Terrace homes have shown:

Extremely Limited New Supply

With Singapore’s landed supply increasing by less than 6% over 15 years, D20’s mature enclaves face structural supply constraints that no policy or new development can meaningfully change.

Centrality + Freehold Means Evergreen Appeal

District 20 remains one of the most liveable and convenient city-fringe districts, supported by:

This combination continues to anchor long-term buyer confidence.

Conclusion: D20’s Terrace Homes Will Continue to Define Its Market Strength

Inter-Terrace and Corner-Terrace homes form the core of D20’s landed identity. Inter-Terraces remain the district’s liquidity engine — fast-moving, high-demand, and consistently appreciated over time. Corner Terraces provide the upgraded comfort tier, balancing exclusivity, space, privacy, and centrality.

Both segments benefit from the district’s strong owner-occupier base, stable fundamentals, and extremely limited new supply. As a result, these terraces will continue to anchor D20’s market confidence and long-term price resilience well into the next cycle.

If you’re exploring your next move in D20’s landed market, our team can help you make a confident, well-timed decision — click here to connect with our sales consultants.

Thank you for reading, and stay tuned! For more detailed insights regarding the landed property market, join our Landed VIP Club and stay updated with the latest market trends and expert advice.