When conversations turn to Singapore’s East-side landed properties, District 15 usually dominates the spotlight. Its Katong shophouses, sea-view bungalows, and bustling cafe enclaves have long given it prestige and desirability. But just as younger siblings often surprise with their quiet strengths, Districts 14 and 16—D14 covering Kembangan, Eunos, Geylang, and Paya Lebar, and D16 spanning Bedok, Upper East Coast, and Tanah Merah—are showing why they deserve equal attention.

Both districts share certain similarities: strong freehold bases, family-oriented enclaves, and connectivity to lifestyle anchors. Yet their nuances—price points, transaction volumes, and absorption rates—offer different appeals to discerning buyers. Taken together, D14 and D16 stand as more viable entry options into freehold landed living compared with their elder sibling D15.

Let’s dive into how these two districts measure up.

Market Fundamentals: The Case for Liquidity and Accessibility

The landed market thrives on three essentials: scarcity, demand, and liquidity. Both D14 and D16 illustrate these fundamentals in ways that set them apart from D15.

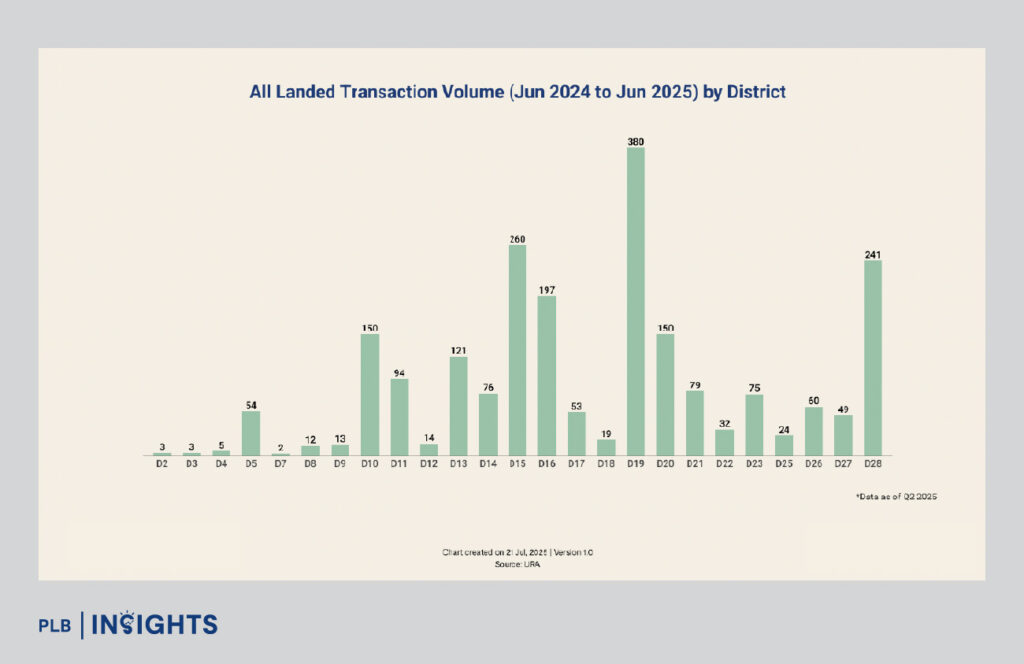

Between June 2024 and June 2025, D14 recorded 76 landed transactions across all categories. While modest compared to D15’s volumes, this figure highlights steady demand for a city-fringe market often overshadowed by its neighbours. Nearly all of D14’s landed stock is freehold, giving it an intrinsic scarcity value.

D16, by contrast, is one of the more active markets islandwide. Over the same time period, the district logged 197 pure landed transactions—a robust number signalling strong buyer interest. Liquidity here supports transparent price discovery, and that translates into confidence for both buyers and sellers.

The difference is subtle but important. D14 has a measured pace, consistent with its more tightly held enclaves, while D16 demonstrates breadth and depth, particularly in its terrace and semi-detached segments. Together, they present alternatives to D15’s prestige-driven market, but with more approachable entry points.

Price Trends: Growth with Distinct Rhythms

When examining long-term price trajectories, it’s important to anchor findings in the data ranges provided.

D14

From 2015 to 2025 YTD, D14’s landed homes achieved a 4% compound annual growth rate (CAGR). Semi-detached homes outperformed with 4.8% CAGR, detached homes followed at 4.3%, while terraces grew at 3.2%. This resilience is remarkable, especially as broader OCR landed averages came in at around 5%.

D16

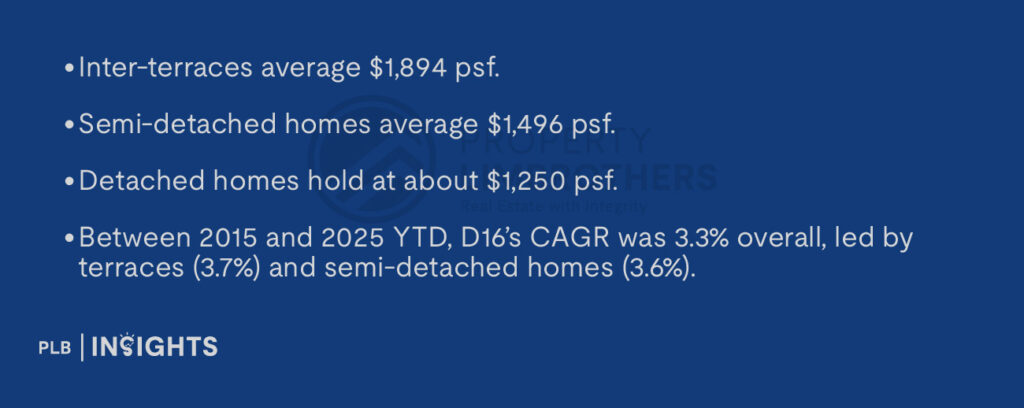

Over the past decade, D16 has maintained a measured upward trajectory. Median PSF peaked in 2024 and moderated slightly in 2025, mirroring islandwide cooling, but the overall growth narrative holds. By category:

Taken together, the numbers show D14 delivering slightly stronger mid-tier growth (particularly semi-detached), while D16 excels in maintaining liquidity and entry accessibility.

Inter-Terrace Homes: The Most Accessible Entry Point

For many families, the journey into landed living begins with inter-terraces.

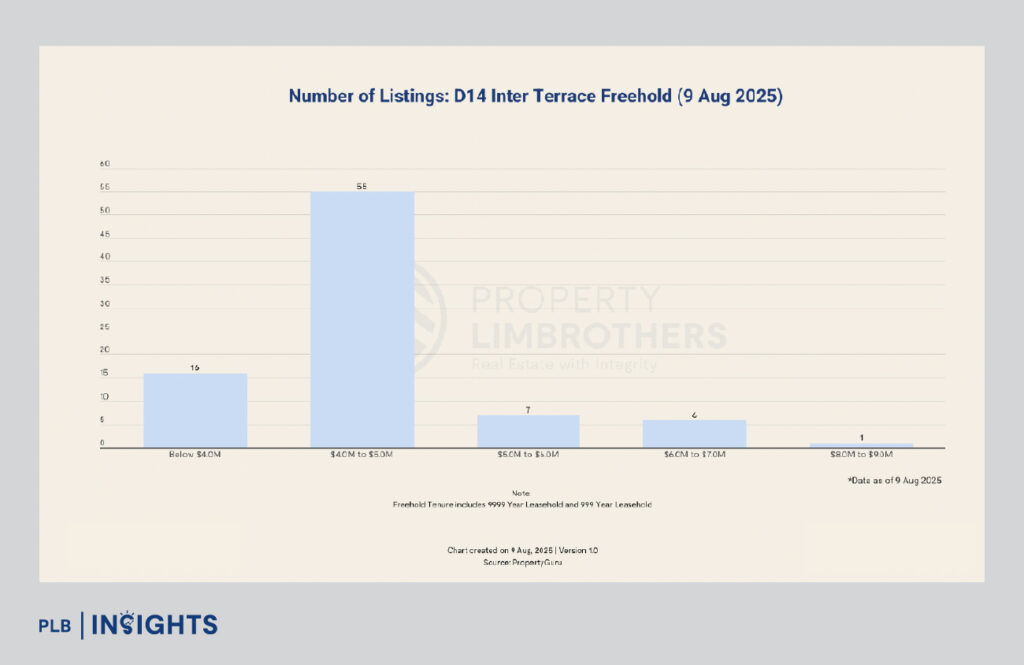

D14 Inter-Terraces

As of August 2025, there were 85 listings, with most priced between $4M and $5M. Over 70% of listings fall into this band, with only a handful above $6M. This narrow clustering reflects strong owner holding power—redeveloped homes rarely come up, and when they do, they are absorbed quickly. Liquidity is healthy, with terraces (inter + corner) recording a 4-month absorption ratio.

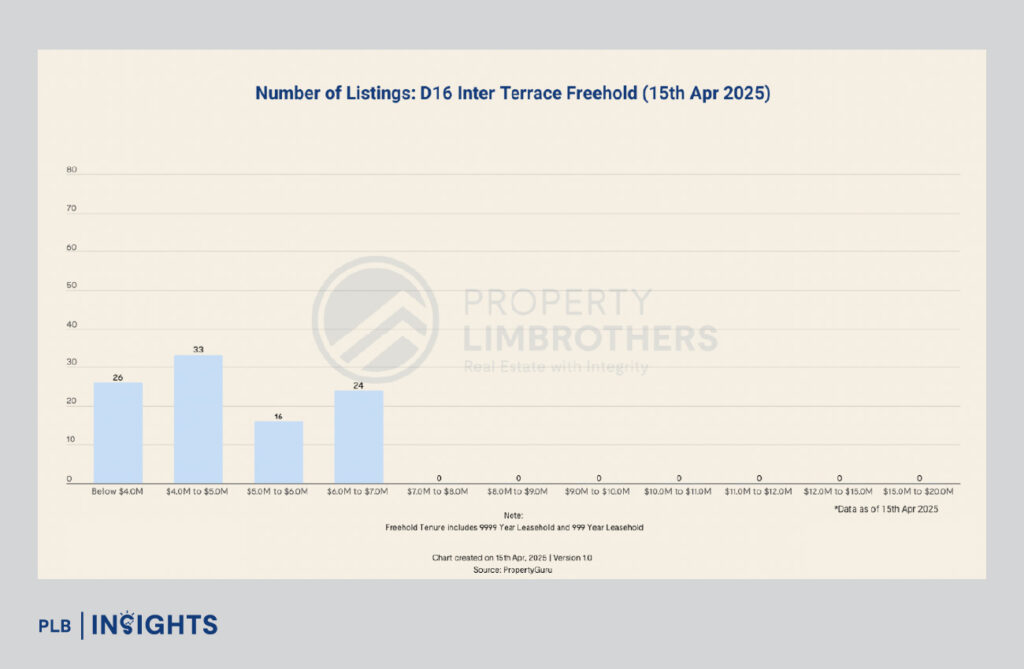

D16 Inter-Terraces

As of April 2025, most listings were between $4M and $5M, followed by $6M–$7M, and none above $7M. A notable 26 listings remained below $4M, making this one of the rare districts still offering sub-$4M freehold landed options. Liquidity is strong, with 70 inter-terrace transactions logged from January 2024 to January 2025. The absorption ratio of 4.3 months underscores how fast-moving this segment is.

Comparison:

D14 terraces showcase scarcity-driven strength—fewer listings, higher holding power. D16, however, provides a broader base of affordability and quicker turnover. Buyers eyeing liquidity and entry-level accessibility may gravitate toward D16, while those seeking long-term scarcity value may find D14 compelling.

Corner Terraces: Mid-Tier Options with Strong Utility

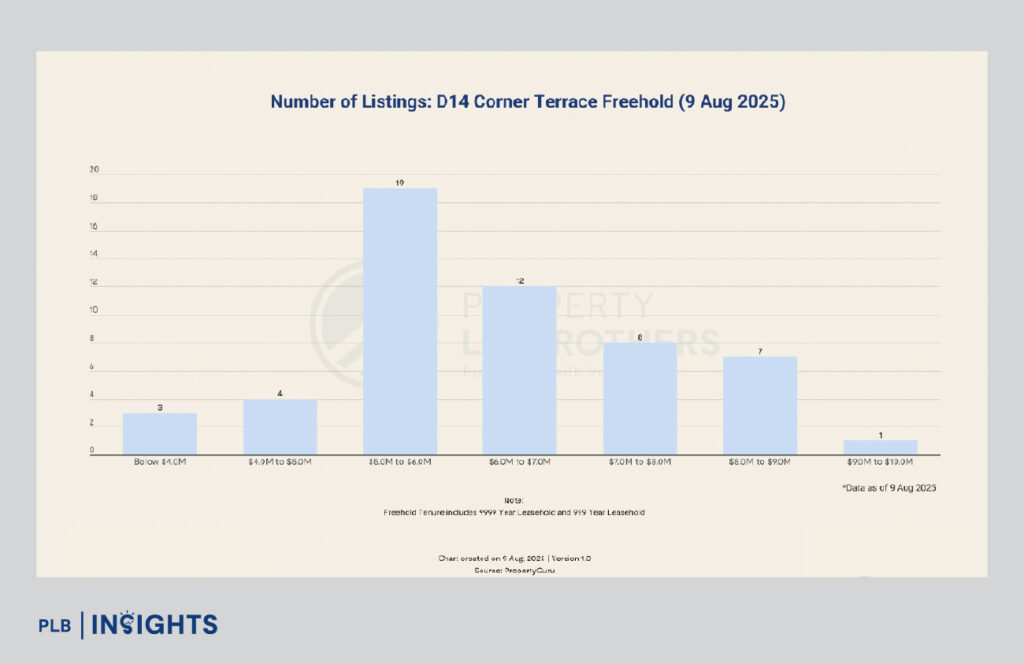

D14

With 54 listings as of August 2025, most cluster around $5M–$6M, positioning them as a natural step-up from inter-terraces. Larger plots with better frontage and outdoor space appeal to families wanting more without overshooting budgets.

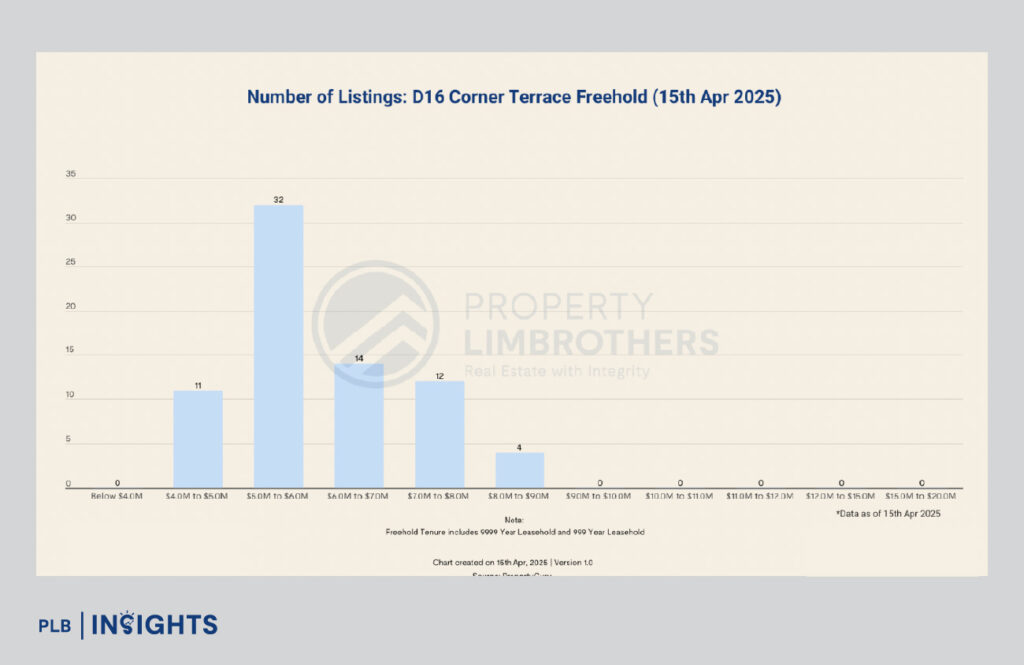

D16

Corner terraces numbered 73 listings as of April 2025, concentrated in the $5M–$6M range, with pockets up to $8M-$9M. They strike a balance between space and price, appealing to families prioritising outdoor utility.

Comparison:

Both districts maintain stable demand in this niche, but D16’s larger pool and higher quantum ceiling reflect a slightly broader range. D14, meanwhile, preserves its city-fringe affordability edge.

Semi-Detached Homes: Mid-Tier Anchors

Semi-detached homes are often considered the backbone of the landed segment.

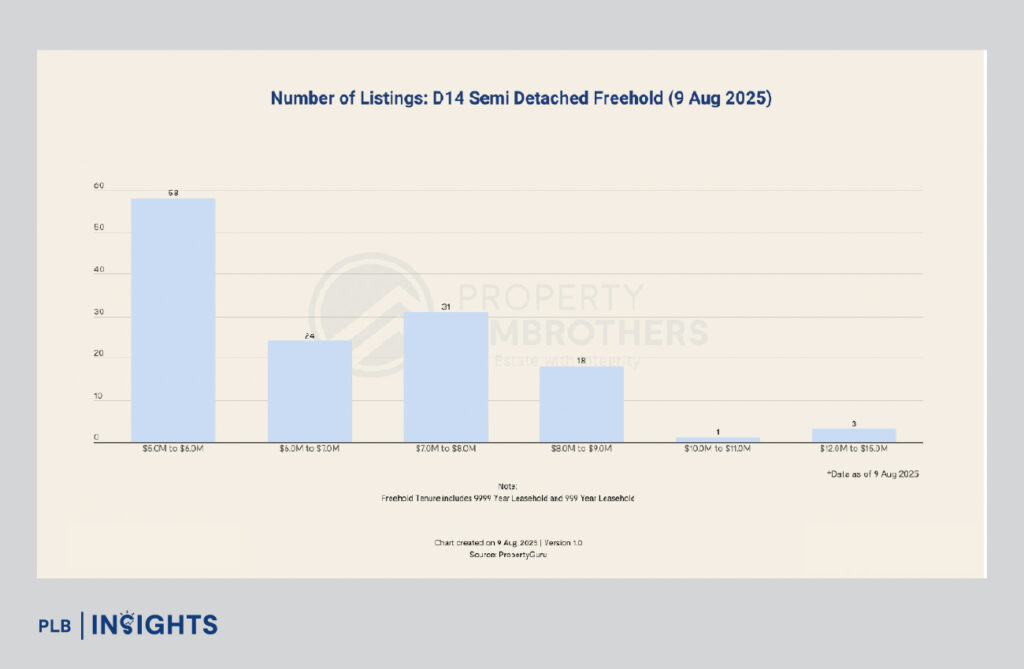

D14 Semi-Detached

As of August 2025, D14 had 135 listings (the largest category), with nearly half priced at $5M–$6M. Another 55% were spread across $6M–$9M. However, absorption slowed, with 11.2 months of supply, showing buyers have more leverage here. Still, semi-detached homes in D14 posted the strongest CAGR at 4.8% from 2015 to 2025 YTD, underscoring long-term resilience.

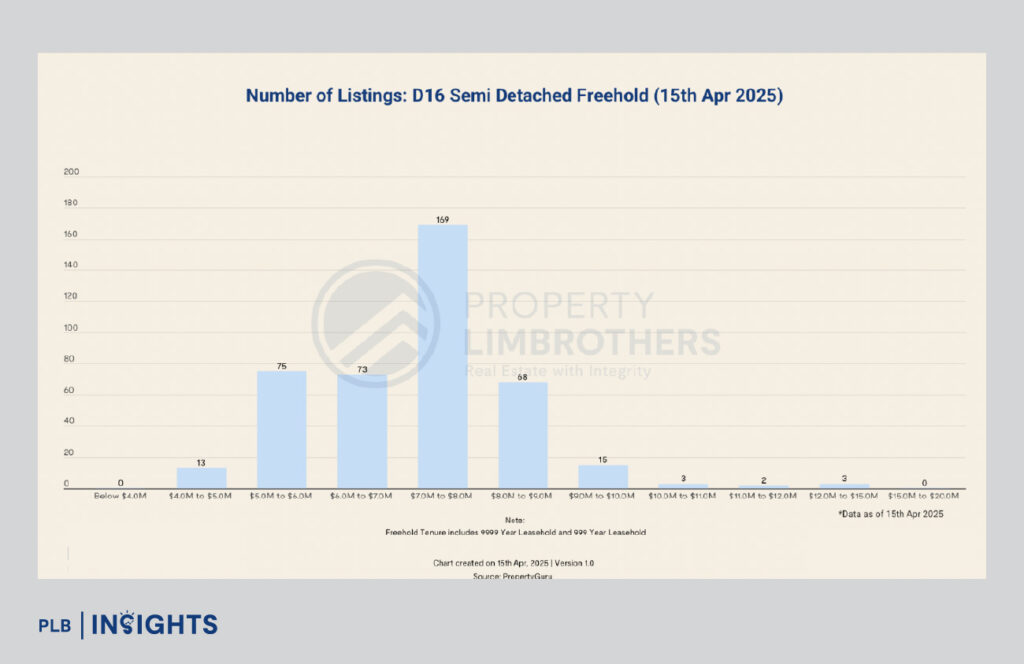

D16 Semi-Detached

With 421 listings as of April 2025, this is D16’s dominant landed type. Most sit in the $7M–$8M band, though options stretch from $4M to beyond $10M. The absorption ratio is far healthier than D14’s, at 12.8 months, with 44 transactions in the past year. CAGR of 3.6% (2015–2025 YTD) reflects steady growth.

Comparison:

D14 shines in long-term capital growth, while D16 delivers depth and liquidity, especially for families seeking larger layouts within mid-market quantum.

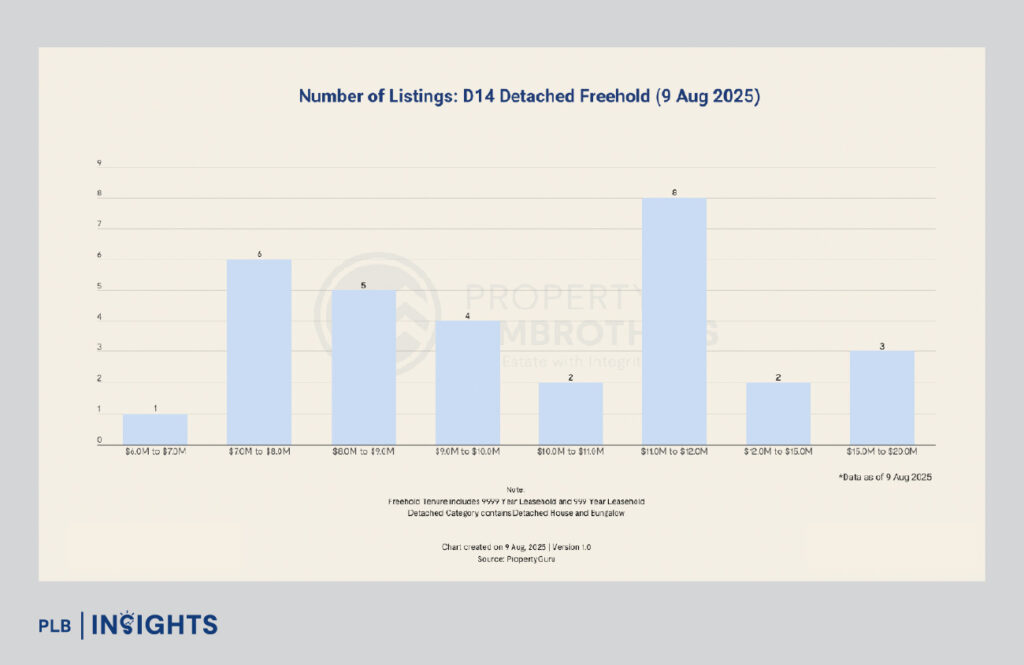

Detached Homes: Exclusivity and Holding Power

D14 Detached

With only 31 listings as of August 2025, detached homes are the rarest category. Most cluster in the $7M–$12M band, with absorption at 5.8 months—faster than semi-detached, a sign of scarcity-driven demand. CAGR stands at 4.3% over 2015–2025 YTD.

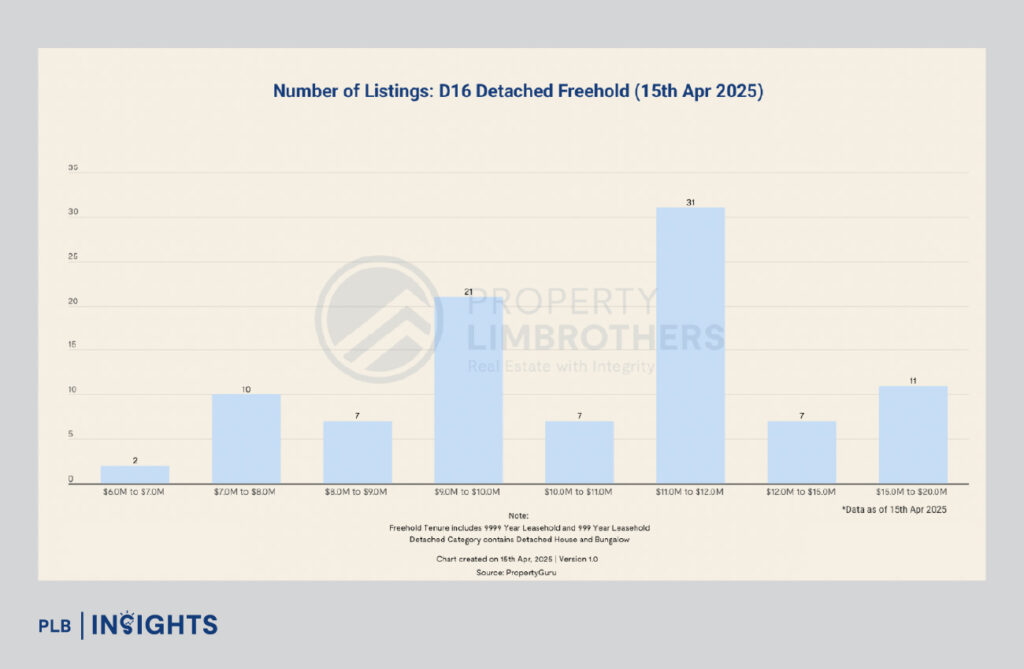

D16 Detached

Detached homes numbered 96 listings as of April 2025, priced mainly between $9M–$12M, with some reaching $15M or more. Transaction volumes are naturally slower—just 7 sales from January 2024 to January 2025—but the 12.9 months absorption ratio is still healthier than D15’s ultra-premium segment. CAGR is modest at 2.1%, reflecting quantum sensitivity.

Comparison:

D14 offers rarity at more approachable price points, while D16 provides scale and redevelopment potential for buyers with longer-term horizons.

Lifestyle and Liveability: More Than Just Numbers

Data tells part of the story, but lifestyle completes it.

The Younger Siblings Analogy: Where D14 and D16 Stand

If D15 is the elder sibling—glamorous, prestigious, and commanding premiums—then D14 and D16 are the younger siblings quietly carving out their own niches.

Both districts provide viable entry routes into landed living without the ultra-premium price brackets that dominate D15.

Final Thoughts

D14 and D16 may lack the prestige branding of D15, but they deliver something arguably more valuable for discerning buyers—a balance of accessibility, resilience, and long-term viability. D14’s city-fringe enclaves stand out for their scarcity and capital growth potential, offering enduring value for those who prioritise long-term appreciation. D16, on the other hand, provides confidence through its diverse stock, steady transaction momentum, and appeal as an accessible entry point into freehold landed living.

In a market where supply is permanently capped at under 5% of Singapore’s total housing stock, both districts represent strategic opportunities for families and investors alike. Whether it is D14’s heritage-driven scarcity or D16’s dynamic liquidity, the younger siblings of D15 are proving they are no longer in the shadows, but firmly standing on their own.

If you are exploring landed opportunities in the East, our sales consultants are ready to guide you with personalised advice and in-depth market insights. Click here to connect with us and take the next step toward finding your ideal home.Thank you for reading, and stay tuned! For more detailed insights regarding the landed property market, join our Landed VIP Club and stay updated with the latest market trends and expert advice.