Why the Market Moves Unevenly

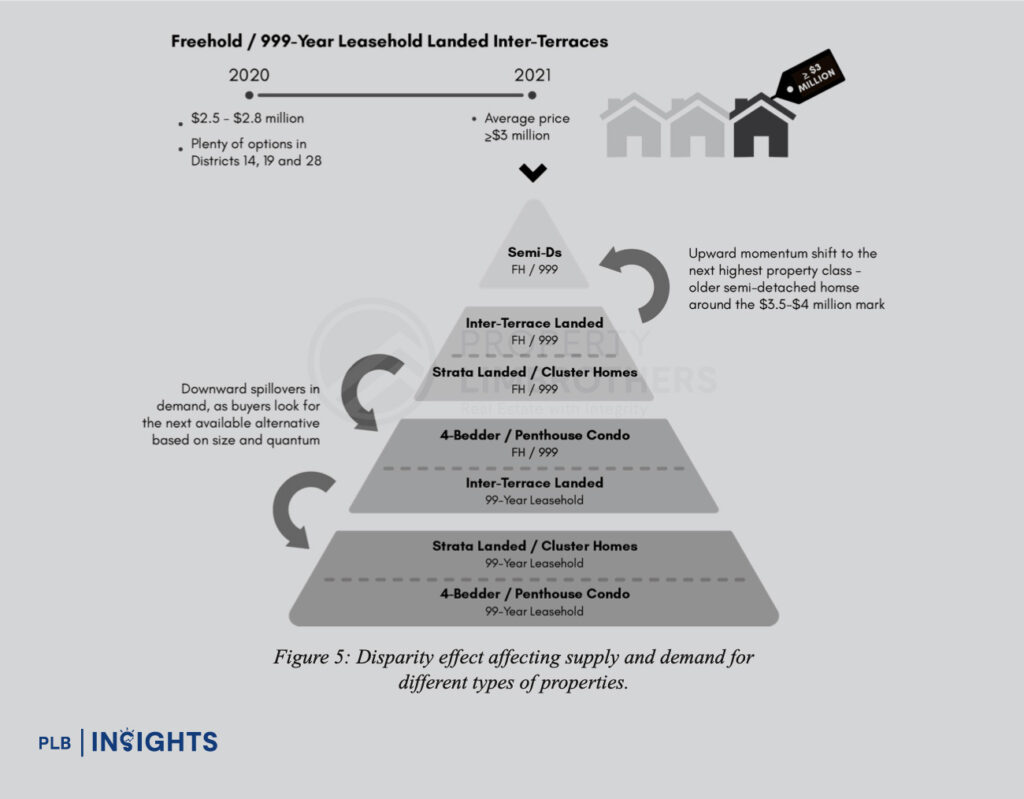

In Singapore’s property market, not all asset classes appreciate or transact at the same rate. The interplay between supply-demand dynamics, buyer sentiment, and government policy interventions leads to uneven market movements. At PropertyLimBrothers, we term this phenomenon the Disparity Effect®: the non-uniform shifts in pricing and demand across different property types, sizes, and locations. For sellers, a clear understanding of this effect is essential for optimising your sale and purchase.

“Every Type of Property Has Its Own Season of Movement Where It Moves Faster than Its Counter-Types Above and Below It” – Melvin Lim, Cofounder & CEO, PropertyLimBrothers

Understanding Market Dynamics and Pricing Tiers

The real estate market operates in distinct layers, with each asset type moving at its own pace. For example, the luxury segment (GCBs and high-end condos) often reacts differently to economic shifts than mass-market HDBs. Likewise, 4-bedders in the Outside Central Region (OCR) can experience a seller’s market while smaller Core Central Region (CCR) units stagnate.

Each tier has its own momentum. Sellers who understand which tier is rising or cooling gain knowledge of price and therefore have the advantage to position their home more effectively.

Let’s explore a common real-world scenario in 2024.

Case Study: Inter-Terrace vs Semi-D vs Cluster Homes

- Inter-terrace homes in District 15 have surged past $4M due to tight supply and renovation quality.

- Semi-detached homes, previously starting at $4.2M, now face competition from rising inter-terrace prices.

- Buyers priced out of inter-terrace homes shift their attention to cluster homes or larger condos.

This cascading effect illustrates how buyer migration fuels price movements across segments. Sellers must monitor adjacent asset classes—demand in one often pulls demand from another.

Real Life Case Study: From Inter-Terrace to Cluster Home Migration In 1Q 2024, a seller listed a 2.5-storey inter-terrace in Telok Kurau at $4.15M. Within weeks, multiple inquiries came in, mostly from buyers previously shopping for semi-detached homes who found inter-terraces more attractively priced after recent renovations.

One of these buyers had been considering a $4.4M older semi-D in Serangoon Gardens but chose the Telok Kurau inter-terrace due to its location and modern fit-out. After losing out on the unit due to a bidding war, the buyer pivoted and secured a cluster house in District 19 for $3.5M, which offered larger built-up space but on a strata title.

For the Telok Kurau seller, understanding this demand diversion meant they could raise their asking price mid-campaign. For cluster home sellers in District 19, it presented a short-term opportunity to capture demand overflow.

District-Based PSF Differences: Watch the Gaps

Even within the same asset class, price per square foot (PSF) varies widely across districts. For instance:

However, during periods of macroeconomic uncertainty or rising interest rates, these gaps often compress. Buyers downgrade expectations, causing mid-tier properties to outperform luxury ones in volume.

How to Plan Your Exit and Entry Strategically

The Disparity Effect® teaches one crucial lesson: Don’t just sell when your property is hot; also consider what you’re upgrading into.

Being aware of the demand and supply dynamic when buying is just as important as selling at peak.

Pro Tip: Use Disparity to your advantage and the best moves often happen during a gap

This way, sellers can lock in gains from their current asset and reposition into the next segment with better long-term upside.

Conclusion: Strategy Over Sentiment

The Disparity Effect® isn’t just a theory—it’s a recurring pattern in Singapore real estate. For home sellers, understanding this layered, dynamic market is key to timing your move, pricing smartly, and identifying value.

At PropertyLimBrothers, we help clients read these signals and act with clarity. Selling a home isn’t just about timing the peak—it’s about anticipating the shift. And those who recognise the ripple before it spreads, win the race to the next opportunity.

Stay Updated and Let’s Get In Touch

Do not hesitate to reach out to us!

Disclaimer: Information provided on this website is general in nature and does not constitute financial advice

PropertyLimBrothers will endeavour to update the website as needed. However, information may change without notice and we do not guarantee the accuracy of information on the website, including information provided by third parties, at any particular time. While every effort has been made that the information provided is accurate, individuals must not rely on this information to make a financial or investment decision. Before making any, we recommend you consult a financial planner or your bank to take into account your particular financial situation and individual needs. PropertyLimBrothers does not give any warranty as to the accuracy, reliability or completeness of information which is contained in this website. Except insofar as any liability under statute cannot be executed, PropertyLimBrothers, its employees do not accept any liability for any error or omission on this website or for any resulting loss or damage suffered by the recipient or any other person.