District 15 and District 16—both rooted in Singapore’s East—have long held sway in the minds of landed property buyers. Yet, beneath their surface similarities lie nuanced distinctions that speak to differing buyer motivations, market behaviour, and long-term value dynamics. Whether you’re upgrading to your first freehold home or exploring your next move in the landed segment, understanding how each district performs across various property types—Terrace, Corner Terrace, Semi-Detached, and Detached—can help you make a more informed decision.

Let’s break down the data.

Inter-Terrace: Entry Points with Diverging Market Rhythms

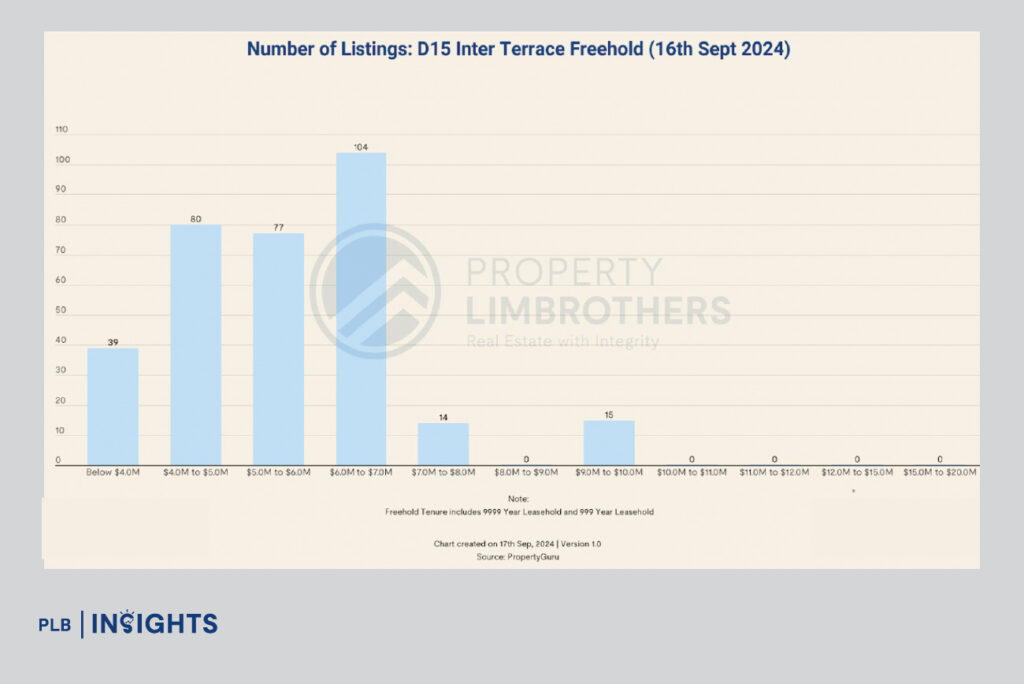

Inter-Terrace homes represent the most accessible rung of landed living. In D15, this segment saw the fastest turnover, with an Absorption Ratio (AR) of 48.1 months and a 10-year price growth CAGR of 5.3%. Most listings clustered between $6M and $7M, showing demand resilience even at higher quantum levels.

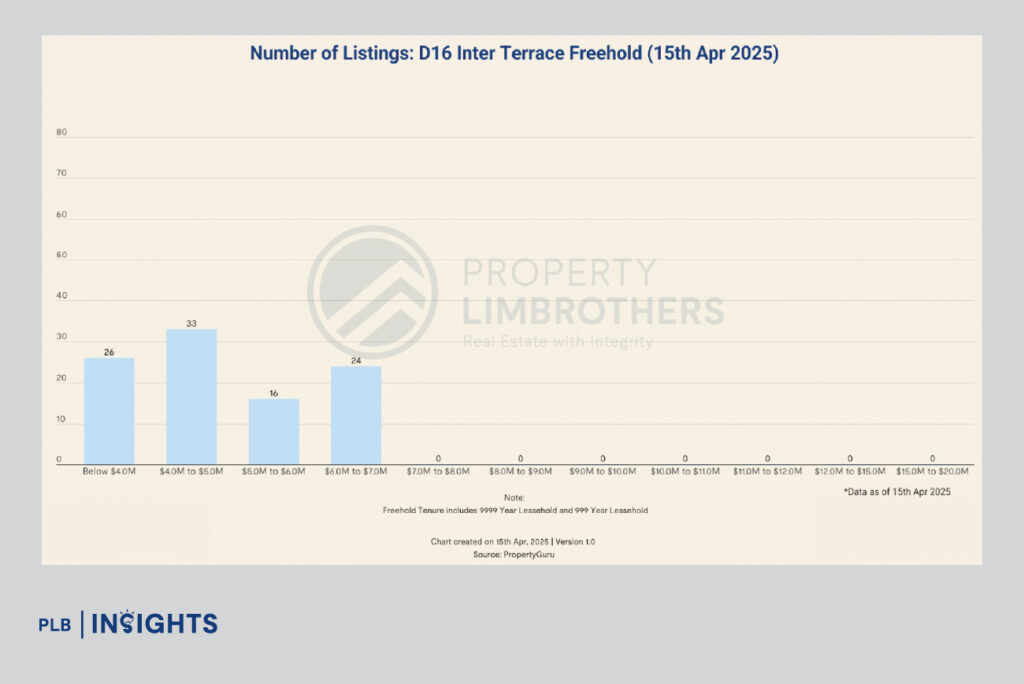

In contrast, D16’s Inter-Terrace market offers a tighter and more affordable spread. With most listings below $5M and none above $7M, D16 clearly caters to price-sensitive buyers or those seeking to enter the freehold landed market with lower risk. Most importantly, its AR of just 4.3 months reflects a highly liquid and fast-moving segment—one that balances accessibility with upward potential. The 3.7% CAGR here, while slightly lower than D15, comes with more affordability-driven upside and less speculative volatility.

Takeaway: D15 offers stronger capital gains historically, but D16’s Inter-Terrace segment stands out for liquidity and entry-level accessibility—an ideal starting point for young families or cautious upgraders.

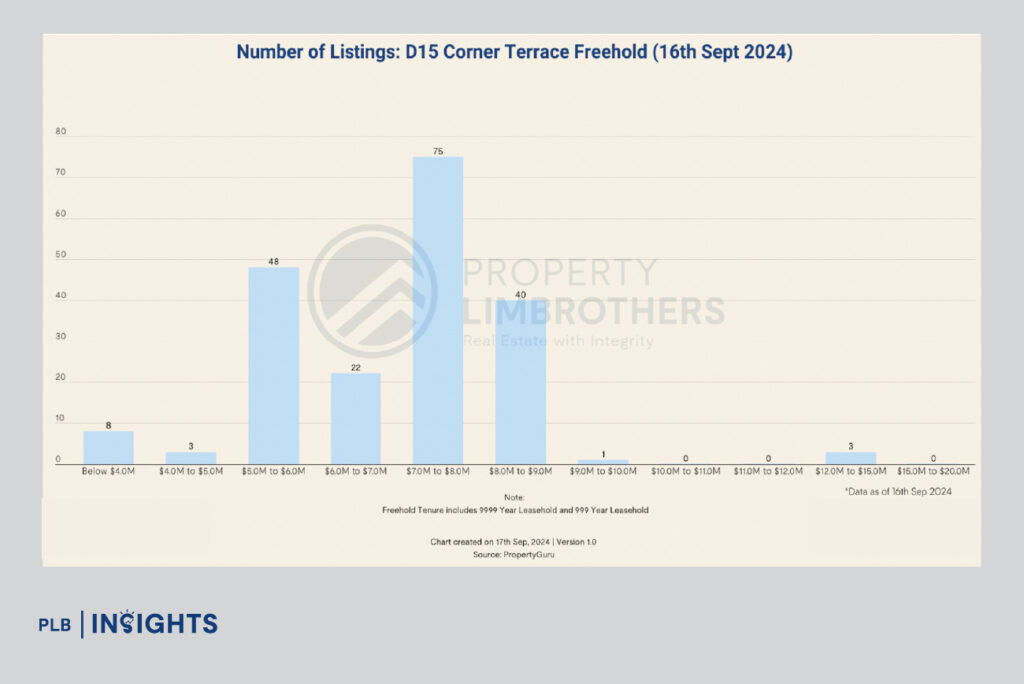

Corner Terrace: Rare Inventory with Stable Demand

Corner Terrace homes remain a rare breed in both districts due to inherent supply constraints. D15 recorded 200 listings as of 16 September 2024, with a wide price spread peaking around $9M. Although inventory in this segment has slightly dipped—suggesting some tightening—D15 Corner Terraces still trend toward larger price brackets.

D16, however, presents a stronger case in terms of pricing discipline. With only 73 active listings as of 15 April 2025, the segment skews towards the $5M–$6M and $6M–$7M range, preserving its position as a mid-tier upgrade choice. These homes offer buyers additional frontage and land without entering the Detached bracket. The liquidity remains healthy, with prices expected to hold firm due to limited supply.

Takeaway: D15 has more volume and a broader range, but D16’s leaner Corner Terrace segment may hold better long-term price resilience due to scarcity and more consistent mid-tier demand.

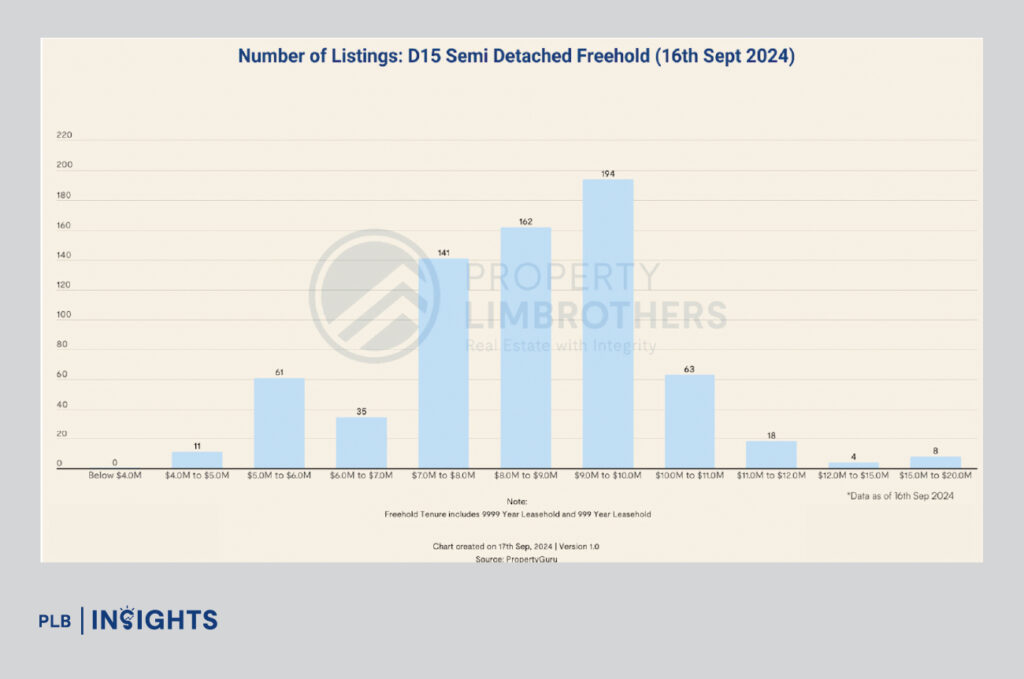

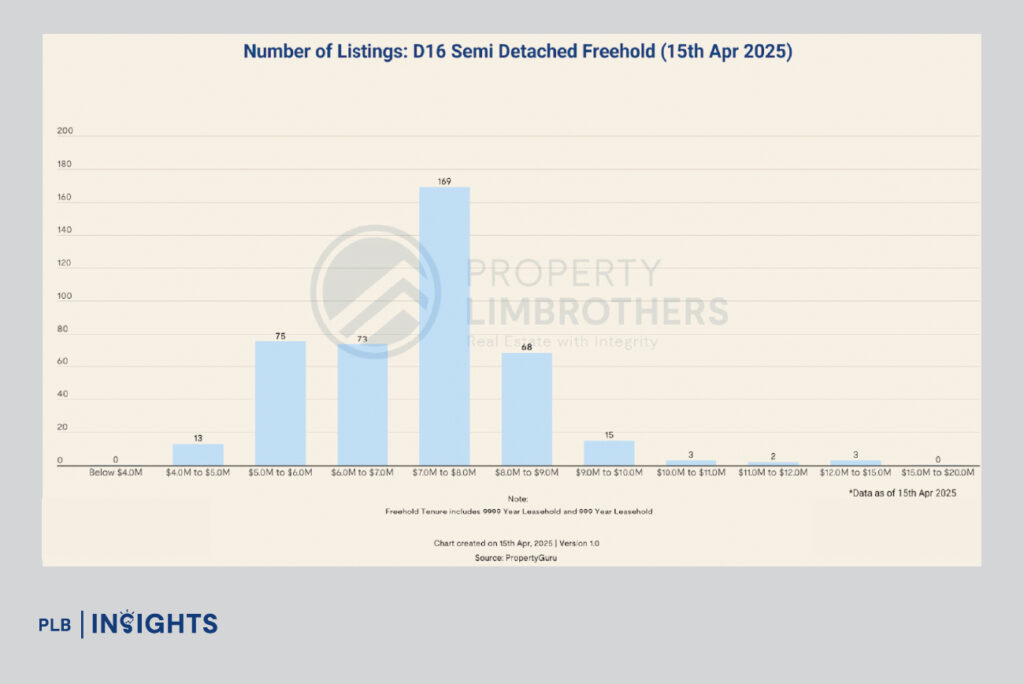

Semi-Detached: The Mid-Tier Powerhouse with a Split Personality

Semi-Detached homes often reflect the widest spectrum of buyer preferences—from original homes awaiting A&A to rebuilt multi-storey residences. In D15, this category had the highest listing volume (697 listings) as of 16 September 2024 and a modest CAGR of 3.4%. The AR stood at a long 99.7 months, indicating a slow-moving market. While there’s demand in the $9M–$10M range, an oversupply across other tiers is weighing on turnover.

In D16, the Semi-Detached market tells a more balanced story. Although listings were also high at 421 as of 15 April 2025, the price distribution is better spread across $5M to $9M. The AR of 12.8 months signals a healthier absorption rate than D15’s, pointing to steadier demand—especially for modern homes in the $7M–$8M sweet spot. The CAGR of 3.6% slightly outpaces D15 and reflects a growing appetite for mid-sized homes close to East Coast lifestyle offerings and schools.

Takeaway: D15 has depth, but D16 wins on pricing efficiency and turnover. Its Semi-Detached segment offers both scalability and value retention in a more digestible mid-market range.

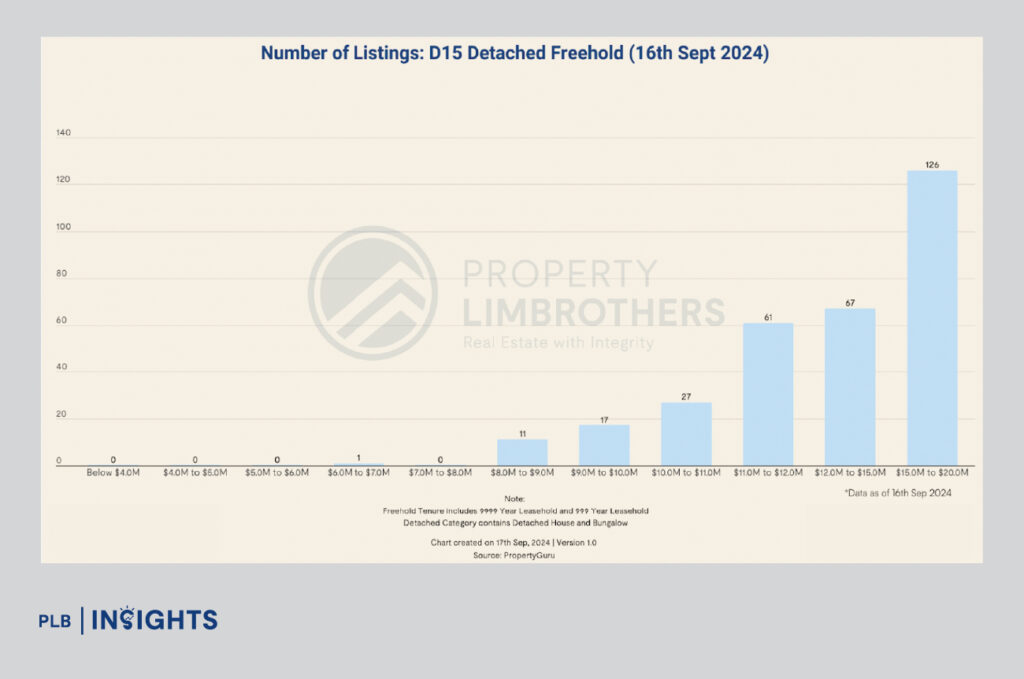

Detached: Exclusivity vs. Velocity

Detached homes represent the crown jewel of any landed district. In D15, this segment is notably premium, with 41% of listings priced between $15M and $20M. While this tier saw the highest price growth at 5.5% CAGR, it also recorded the slowest movement—AR of 173.5 months and only two transactions between August and September. This is a niche segment for ultra-high-net-worth individuals with the holding power to weather slow liquidity.

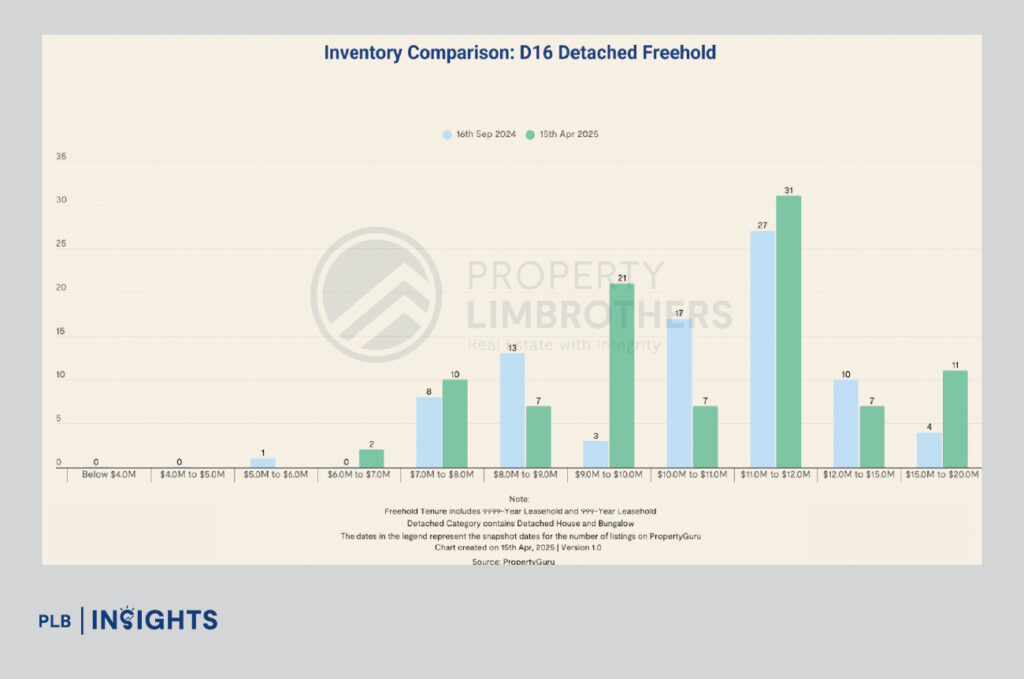

D16’s Detached landscape offers a broader spread, with 90 listings from September 2024 to April 2025, and most sales taking place below $12M. The segment is characterised by a mix of older homes ripe for redevelopment and newer luxury units rivalling CCR counterparts. Its 2.1% CAGR may appear modest, but this is likely due to quantum sensitivity and the longer gestation cycle of detached investments. More critically, the AR of 12.9 months, though high, is significantly better than D15’s—indicating stronger buyer appetite at slightly lower price points.

Takeaway: D15 offers peak prestige but slower turnover. D16 provides a compelling alternative for buyers seeking spacious living and luxury without entering the ultra-premium bracket.

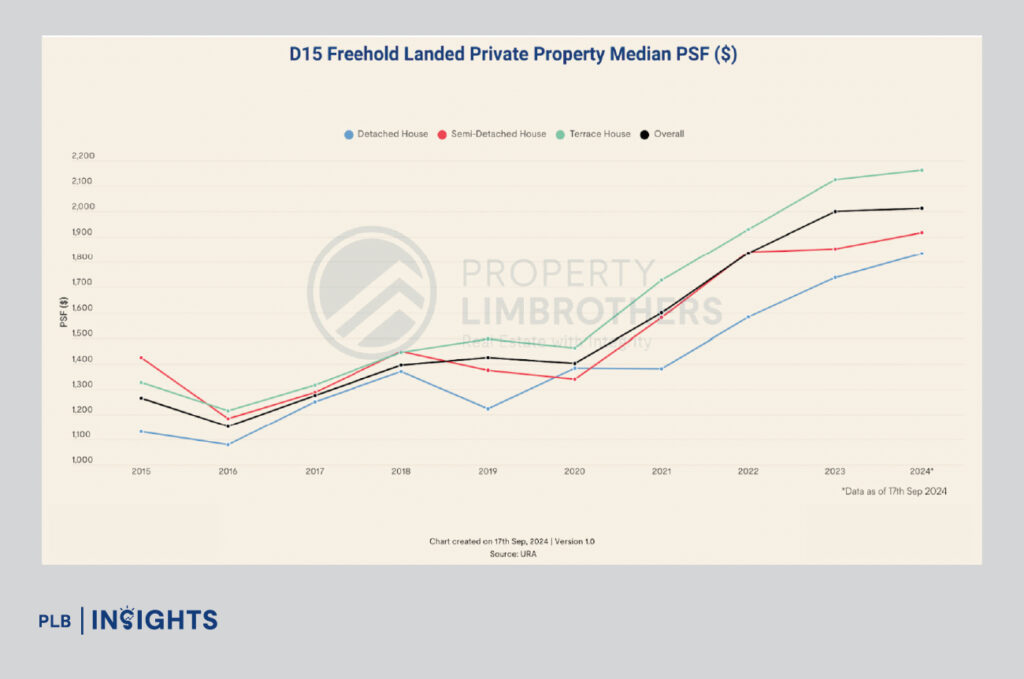

Price Growth Over a Decade: Stability with Scalable Gains

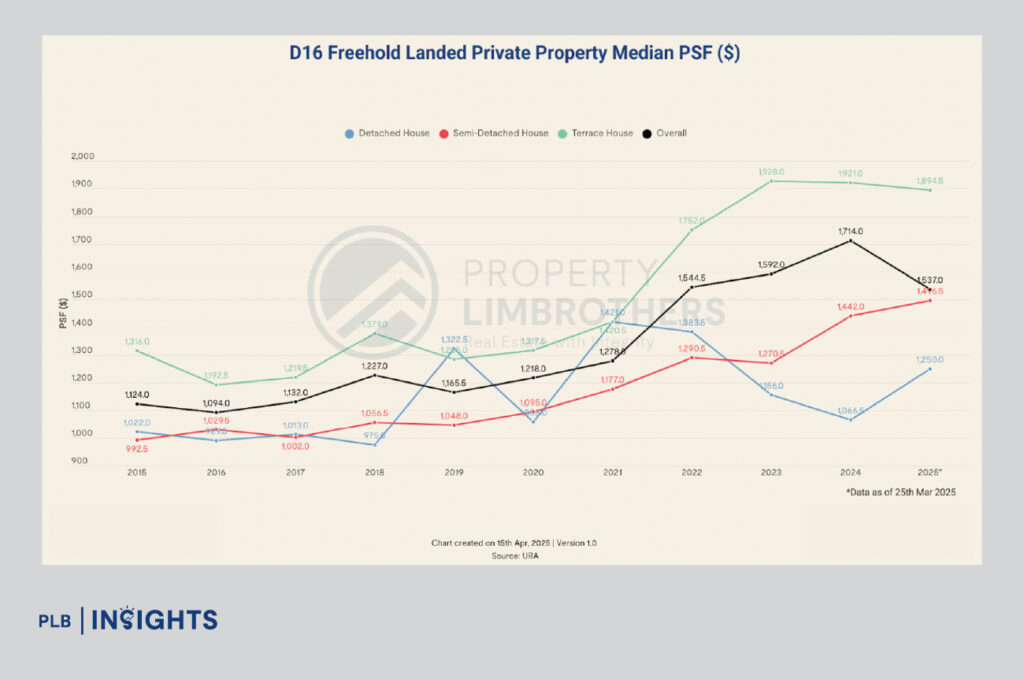

From 2015 to 2025 YTD, D15 achieved an overall CAGR of 5.3% across landed segments—driven largely by Detached and Inter-Terrace price performance. D16, on the other hand, posted a respectable 3.3% CAGR overall, with Terrace (3.7%) and Semi-Detached (3.6%) leading the charge.

While D15 may have outpaced D16 in raw growth, it’s worth noting that D16 remains relatively undervalued in the OCR context. With major developments like the Thomson-East Coast Line (TEL) and transformation plans around the Bayshore precinct, D16’s upside potential may still be in its early chapters.

Final Thoughts: Why D16 Deserves a Closer Look

District 15 may bask in the glamour of Katong cafes and sea-view bungalows, but District 16 is where today’s prudent landed buyers are quietly placing their investments. Its blend of affordability, strong mid-tier demand, and resilient transaction velocity offers a unique equilibrium not easily replicated in other mature districts.

Buyers looking for long-term value, practical lifestyle access, and scalability in their landed journey will find D16 an underrated but increasingly strategic choice. Especially with freehold Terrace and Semi-Detached homes commanding healthy demand and move-in-ready options, this district continues to shine in its own understated way.

In short: If you’re searching for balance—between capital preservation, entry price, and future potential—D16 may just be the East’s best-kept secret.

Want to stay ahead of the curve on D16’s landed market? Join our Landed VIP Club to receive exclusive insights, research breakdowns, and invites to upcoming clinics where we unpack the trends behind Singapore’s most resilient property class.

Navigating Singapore’s landed property market doesn’t have to be daunting. Our experienced consultants are here to provide personalised guidance and expert insights, ensuring a smooth journey to finding your ideal home. Whether you’re seeking a legacy investment or a dream property for your family, we’re ready to help you make the right choice. Contact us today to turn your aspirations of owning a landed home into a seamless and rewarding reality.