Singapore’s residential property market has entered 2025 with continued momentum, registering record-breaking transactions across both public and private sectors. However, beneath this robust performance lie growing concerns over affordability and emerging macroeconomic headwinds that could temper future growth. Structural safeguards and forward-planning remain key strengths, but rising income inequality and economic uncertainty may ultimately test the limits of demand resilience.

Public Housing: Surge in Million-Dollar Resale Flats

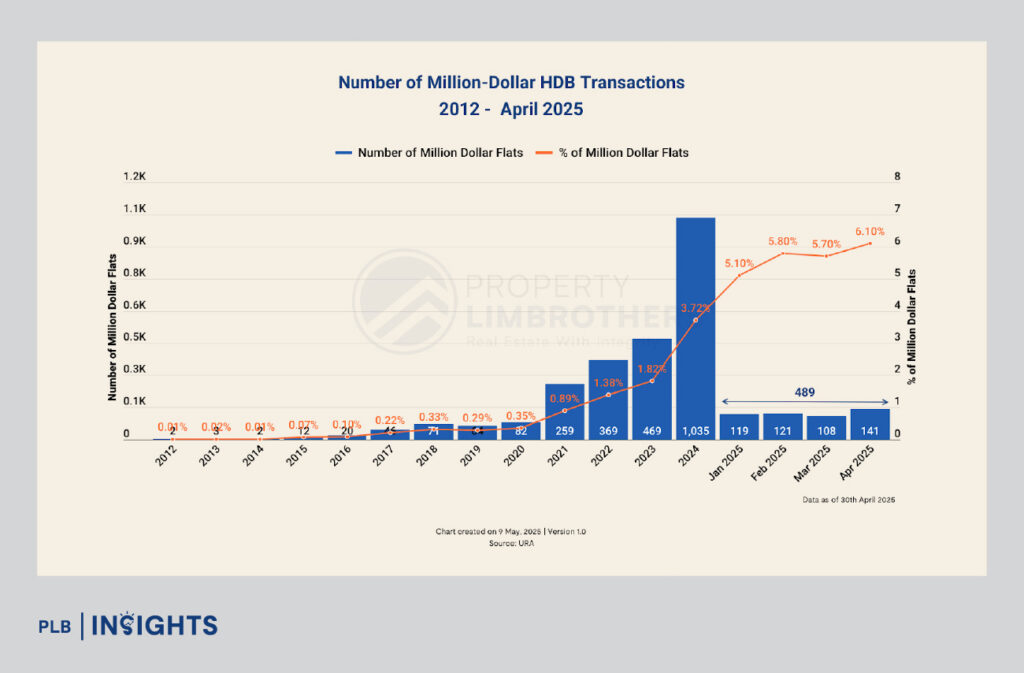

In April 2025, the HDB resale market witnessed an unprecedented surge, with 141 flats transacting at S$1 million or more — the highest monthly tally in the past year. These high-value transactions constituted 6.1% of the 2,309 resale deals for the month, surpassing March’s figure of 108 units. The majority of these sales occurred in mature estates such as Queenstown, Toa Payoh, Bukit Merah and Kallang/Whampoa, where five-room flats with long remaining leases and proximity to MRT lines commanded significant premiums. Among the most notable was a five-room unit in Lorong 1A Toa Payoh that transacted for S$1.49 million — a record for that estate.

This trend underscores the growing perception of well-located public housing as a viable substitute to private condominiums, particularly as the affordability gap narrows. For many, these units offer better locational attributes, tenure security, and long-term value than mass-market private developments in more remote areas.

Private Housing: Landed Homes Breach S$2,000 psf

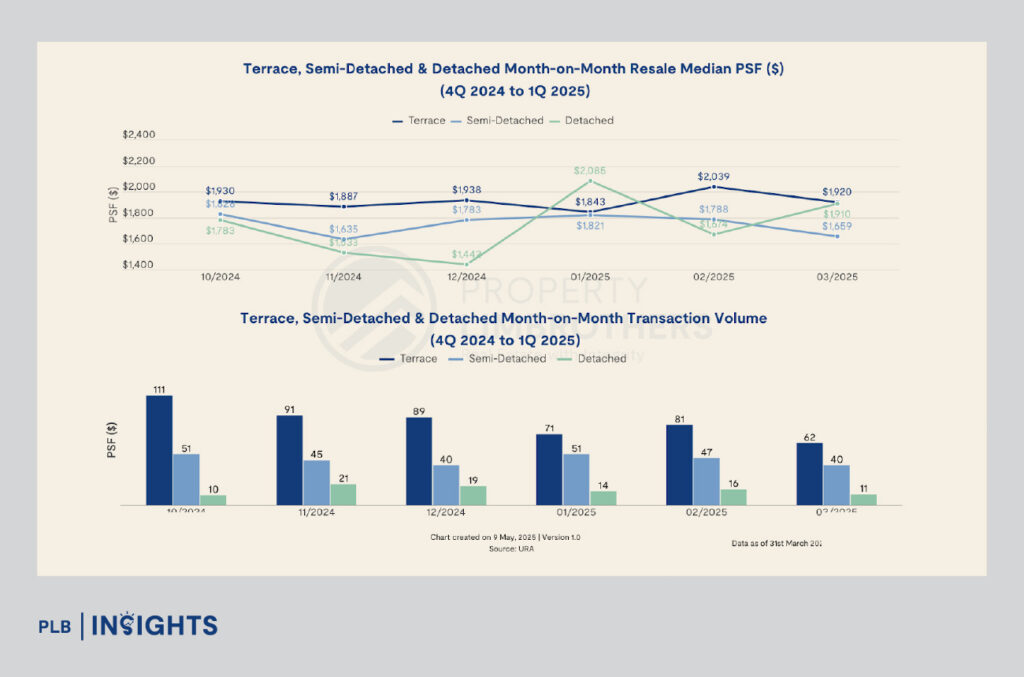

From 4Q 2024 to 1Q 2025, Singapore’s landed resale market displayed an interesting divergence between price and volume. Despite a consistent decline in transaction volumes across terrace, semi-detached, and detached segments, median PSF values inched up overall, suggesting resilient pricing power or limited supply.

Notably, terrace houses led the rally—crossing the $2,000 PSF mark for the first time in February 2025 at $2,039, reflecting robust buyer appetite for this category despite declining volumes (from 111 in October to 62 in March). Detached homes saw the most price volatility, rebounding from a low of $1,442 in December to a peak of $2,085 in January, while semi-detached homes trended downward in price.

A transaction that stood out during the quarter was a freehold detached home along Holland Grove Walk that sold for S$24.7 million, reflecting the robust demand from high-net-worth individuals and multi-generational households prioritising capital preservation amid geopolitical and inflationary uncertainty.

The data implies that even amidst cooling activity, price momentum—especially in the terrace segment—remains intact, underscoring a shift in buyer preferences towards lower-quantum landed properties, reflecting both affordability considerations and the enduring desirability of landed living in land-scarce Singapore.

Affordability Ratios: Approaching Historical Ceilings

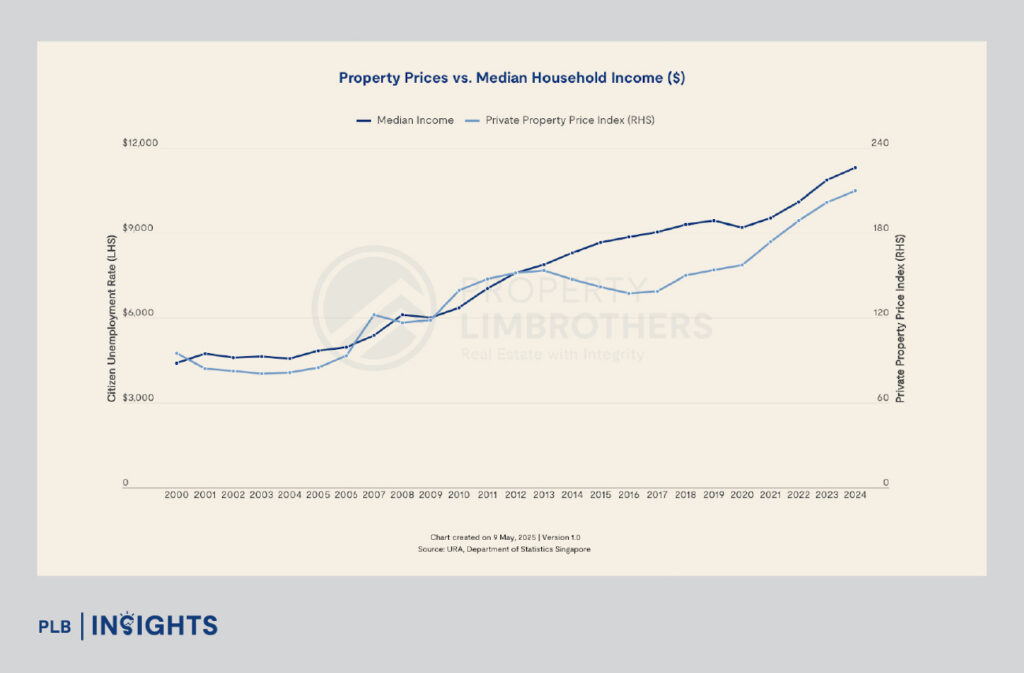

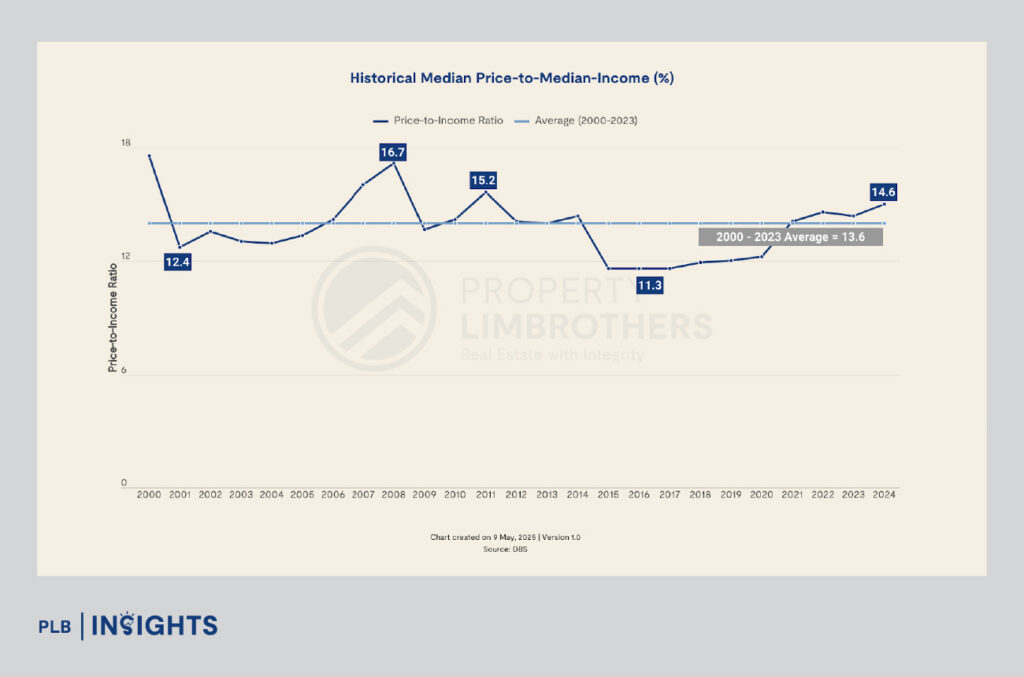

Between 2020 and 2024, private home prices rose by approximately 33% to 40%, reflecting annualised growth of 8% to 11%. Over the same period, median household incomes rose by around 23%, creating a divergence, as analysed by DBS bank, that has pushed the average price-to-income ratio from 13.6x (2000–2023 average) to 14.6x in 2024. This marks the upper end of Singapore’s long-term affordability spectrum.

At current levels, private housing is becoming increasingly inaccessible to median-income households without significant capital buffers or parental support. Unless wage growth accelerates, any further price increase could trigger demand fatigue and encourage more buyers to “trade down” to smaller units or remain in public housing.

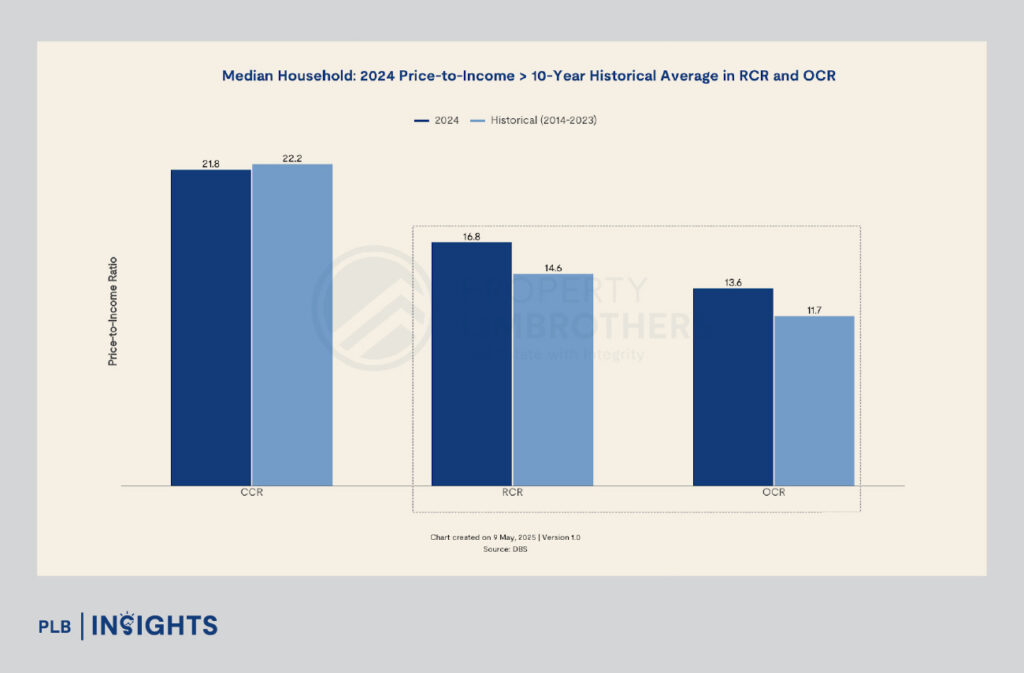

Regional Affordability: OCR and RCR Under Pressure

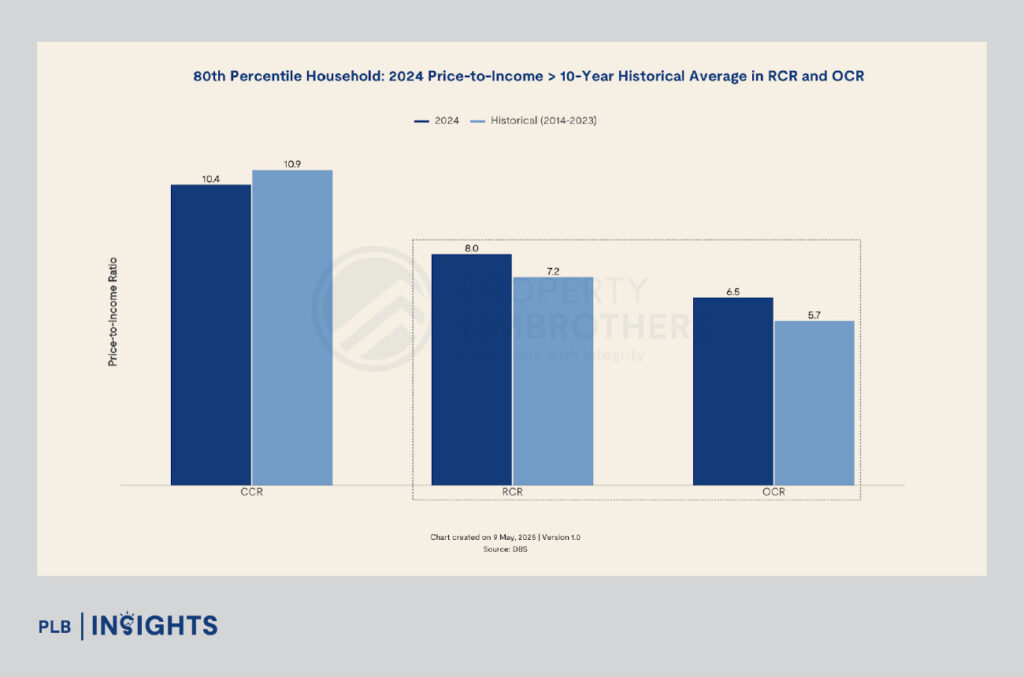

The affordability challenge is most pronounced in the Outside Central Region (OCR) and Rest of Central Region (RCR) — segments that traditionally cater to upgraders and middle-income families. From 2014 to 2024, the median price-to-income ratio increased from 11.4x to 13.6x in the OCR and from 13.8x to 16.8x in the RCR. By contrast, the Core Central Region (CCR) saw a modest improvement from 23.2x to 21.8x, largely due to subdued foreign demand following the April 2023 introduction of a 60% Additional Buyer’s Stamp Duty (ABSD) for non-residents.

Even households in the 80th income percentile are facing affordability strain. New sale ratios in the RCR and OCR have reached 9.9x and 8.1x respectively, compared to 7.5x and 5.8x for resale. This premium on new launches reflects developers’ higher land costs, branding, and amenity-driven pricing — but also points to a growing divergence between price and household income realities.

Market Momentum: Signs of Moderation in 1Q2025

Despite robust underlying demand, recent URA data indicates a deceleration in price growth. The private residential property index rose by just 0.6% in 1Q2025, down from 2.3% in the previous quarter. In the RCR and OCR, quarterly gains slowed to 1.0% and 0.3% respectively. This occurred despite several high-profile launches, suggesting a softening in buyer sentiment and a potential ceiling forming in mass-market price tolerance.

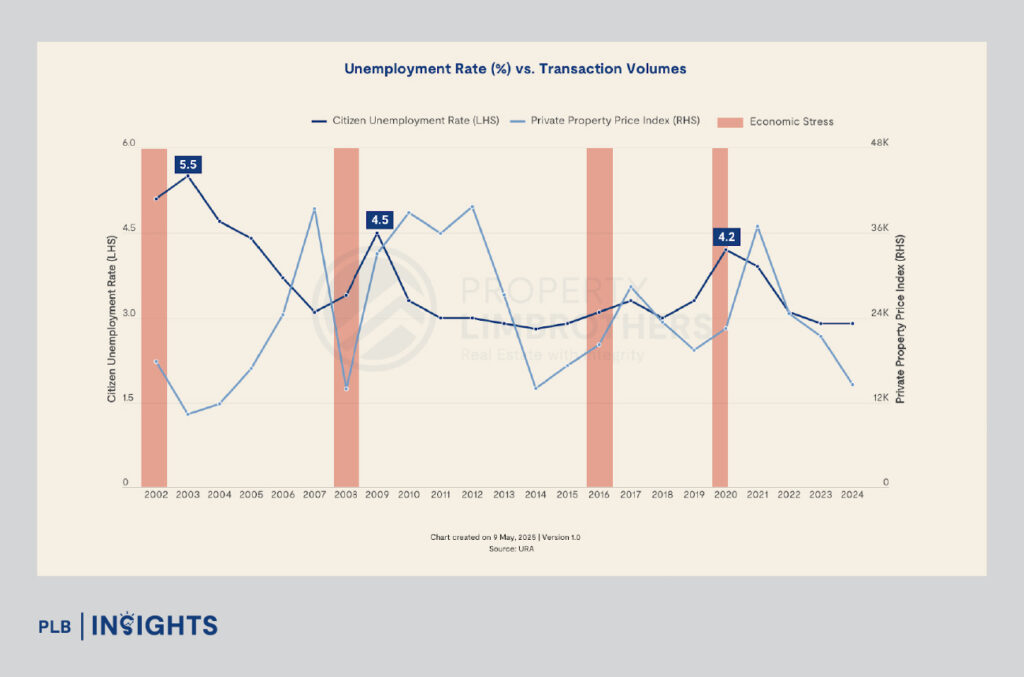

Macroeconomic Headwinds: Slowing Growth and Rising Risks

While Singapore’s economic fundamentals remain sound, there are mounting signs of stress. The Ministry of Trade and Industry has revised the 2025 GDP growth forecast to a range of 0.0%–2.0%, citing heightened trade protectionism, global supply chain reordering, and geopolitical tensions involving key partners such as China and the US. Rising tariffs and fragmentation in global trade flows are already weighing on export momentum.

At the domestic level, the resident unemployment rate inched up to 2.9% in 1Q2025, while real median household income growth remained weak at just 1.4% in 2024. Should job losses widen or wage stagnation persist, household purchasing power may decline — further eroding housing affordability and dampening sentiment in the upgrader market.

These risks suggest that without meaningful improvement in income fundamentals, further property price gains — particularly in the OCR and RCR — will be difficult to justify and sustain.

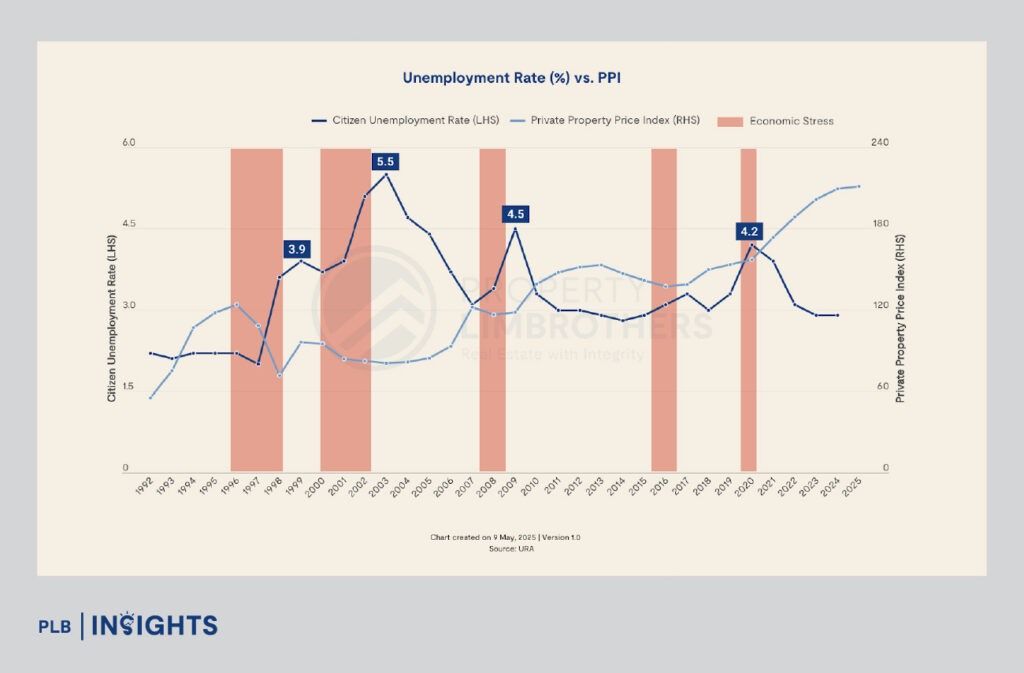

Housing Bubble Concerns: Are We at Risk?

While price-to-income ratios have stretched, the structural risks of a housing bubble appear contained. Unlike bubbles driven by speculation and excessive leverage, Singapore’s housing market is underpinned by tight regulatory controls. The Total Debt Servicing Ratio (TDSR), Loan-to-Value (LTV) caps, and ABSD mechanisms collectively limit systemic risk.

Moreover, speculative activity remains low, with most buyers being owner-occupiers or long-term investors. Progressive payment schemes and a high household savings rate further buffer the market against abrupt price corrections. While some overhang risk exists — particularly in high-end or fringe developments — widespread distress selling is unlikely unless triggered by a sharp and prolonged economic contraction.

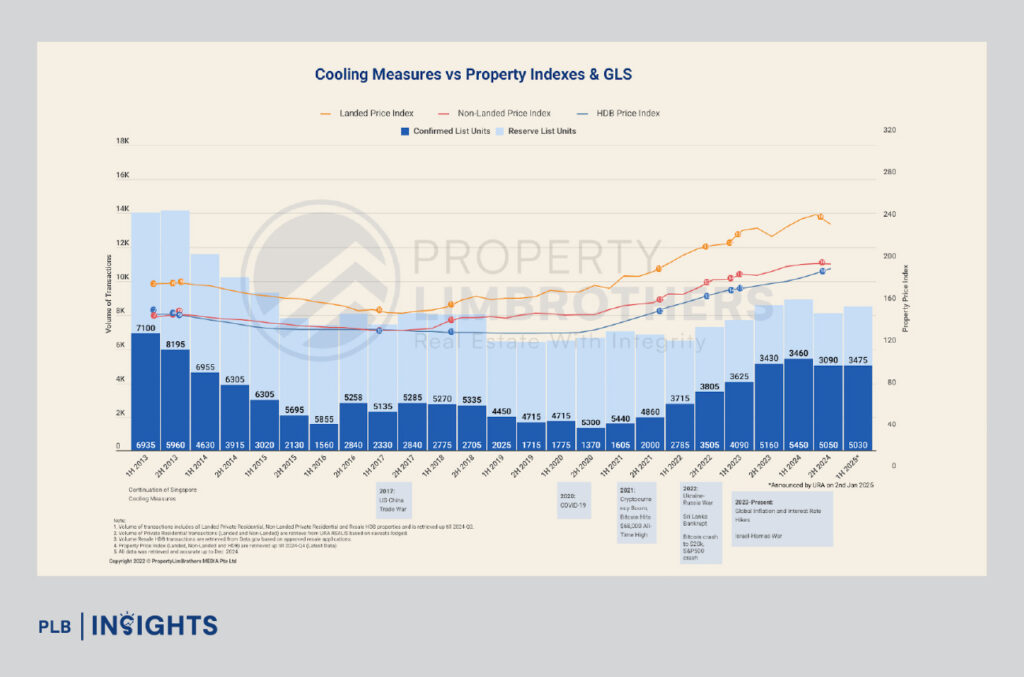

GLS Programme: Calibrating Supply to Anchor Prices

The Government Land Sales (GLS) programme remains a cornerstone of Singapore’s housing market stability. For 1H2025, the Confirmed List features 10 residential sites with a projected yield of 5,030 private homes, including 980 Executive Condominiums. This is 60% higher than the annual average from 2021 to 2023 and reflects the government’s pre-emptive strategy to boost mass-market supply.

By releasing land progressively and transparently, the GLS system discourages aggressive land bidding and speculative holding. It also offers visibility to developers and buyers, allowing the market to adjust expectations in line with supply pipeline indicators. Over time, this mechanism has been critical in anchoring market expectations and smoothing out cyclical price volatility.

Cooling Measures: Enhancing Market Responsiveness

Since 2010, Singapore has implemented a comprehensive suite of cooling measures to instil discipline and align market behaviour with real economy fundamentals. Key tools such as ABSD, TDSR, MSR, and SSD have limited over-leveraging and discouraged short-term speculation.

Crucially, these measures have made the market more responsive to economic shifts. Developers are quicker to adjust launch prices, and buyers are more cautious in their purchase decisions. Price declines — when they occur — are more measured and occur earlier in the cycle, reducing the risk of a large correction.

Today, Singapore’s property prices are less sticky in downturns, reflecting a mature, policy-tempered market structure. This flexibility is a strength — it limits systemic risk while allowing for healthier long-term appreciation tied to fundamentals like wage growth and household formation.

Conclusion: A Market at a Crossroads

Singapore’s housing market remains resilient, but its trajectory is increasingly constrained by affordability limits and macroeconomic uncertainty. Demand remains strong in well-located or niche segments, but mass-market buyers face a growing mismatch between earnings and property prices.

Policy discipline, proactive supply planning, and macroprudential regulation have built a strong foundation. However, unless real income growth resumes and economic headwinds recede, the next phase of the cycle will likely be marked by moderation rather than momentum.

For prospective buyers and investors, the message is clear: market strength remains, but prudence is now essential.

Stay Updated and Let’s Get In Touch

Our goal is to provide you with the latest real estate analyses. Do not hesitate to reach out to us!

Disclaimer: Information provided on this website is general in nature and does not constitute financial advice

PropertyLimBrothers will endeavour to update the website as needed. However, information may change without notice and we do not guarantee the accuracy of information on the website, including information provided by third parties, at any particular time. While every effort has been made that the information provided is accurate, individuals must not rely on this information to make a financial or investment decision. Before making any, we recommend you consult a financial planner or your bank to take into account your particular financial situation and individual needs. PropertyLimBrothers does not give any warranty as to the accuracy, reliability or completeness of information which is contained in this website. Except insofar as any liability under statute cannot be executed, PropertyLimBrothers, its employees do not accept any liability for any error or omission on this website or for any resulting loss or damage suffered by the recipient or any other person.