Singapore’s housing market in 2025 is no longer just about homes appreciating in value. It has become a wealth accumulation. Public flats, once conceived purely as affordable social housing, are now partially functioning as equity engines—vehicles that generate sufficient capital gains and fuel mobility up the housing ladder.

In just the first eight months of the year, 1,059 HDB flats crossed the million-dollar mark, accounting for 6% of the resale market. For many families, this has meant walking away with $700,000 to $900,000 in profits, cash that often becomes the down payment for a private condominium.

This is the most significant structural shift in Singapore’s housing system since independence.

The Million-Dollar Flat Phenomenon

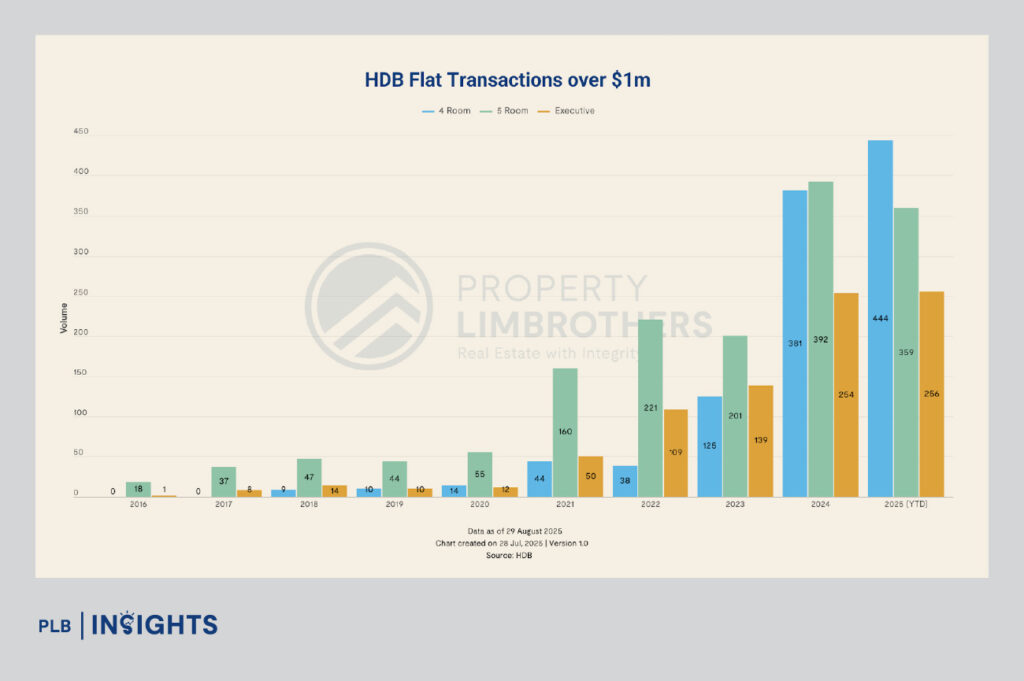

Not too long ago, million-dollar flats were viewed as freak anomalies, splashed across headlines precisely because they were so rare. But in 2025, they are no longer exceptions—they are a defined segment of the market. In the second quarter alone, there were 415 million-dollar transactions, a 19% jump from the previous quarter. Mature estates dominate this landscape. Toa Payoh alone accounted for 201 such sales, Bukit Merah 151, and Queenstown 110.

These flats span across different types, with four-room flats making up the largest share—444 units averaging $1.11 million. Five-room flats followed closely, with 359 units averaging $1.19 million, and executive flats added another 256 sales averaging $1.11 million.

The record holder so far is a five-room loft unit in Queenstown, which fetched $1.658 million, setting a new high-water mark for public housing.

For families, these transactions represent more than just impressive sale prices. They are wealth creation events. Many who purchased their flats in 2015 or 2016 for around $450,000 to $600,000 are now selling them for double or triple the price. After paying off mortgages and CPF obligations, the typical family is unlocking hundreds of thousands in cash—a windfall that can transform their financial trajectory.

The New Value Hierarchy Among Flat Types

While million-dollar deals capture attention, the broader resale market continues to function with its own internal value hierarchy. Three-room flats remain the most affordable entry point, with over 4,300 transactions averaging $471,000. Their price per square foot is around $643, keeping them accessible for younger buyers, although a single outlier sale at $1.398 million shows how location can create extraordinary premiums.

Four-room flats, however, are the market’s workhorse. Representing 43% of all transactions, they occupy the sweet spot between space and affordability. Their median price is $628,000, with the highest price per square foot at $660, reflecting strong demand pressure. Additionally, they also dominate the million-dollar category making up the largest share of record sales, largely due to the higher supply of 4 room flats in the market.

Five-room flats appeal to families who need space. With an average of 118 square metres, they provide comfort without the cramped feel of smaller layouts. Their median price sits at $735,000, translating to better value per square metre than four-room flats. They are also the stage for some of the most spectacular appreciation stories, including the Queenstown loft at $1.658 million.

Finally, executive flats occupy the premium end of the HDB spectrum. With an average floor area of 145 square metres, they deliver the best price efficiency at just $590 per square metre. But their sheer size also means higher absolute prices, often above $900,000, and more than 250 of them have crossed the million-dollar line this year. While they form only 6% of the resale market, their exclusivity keeps them desirable.

The Upgrader Wave and Its Dominance

The most compelling narrative, however, is what happens after these resale windfalls are realised. Families do not stop at selling—they upgrade. The upgrader has become the defining force in Singapore’s private housing market.

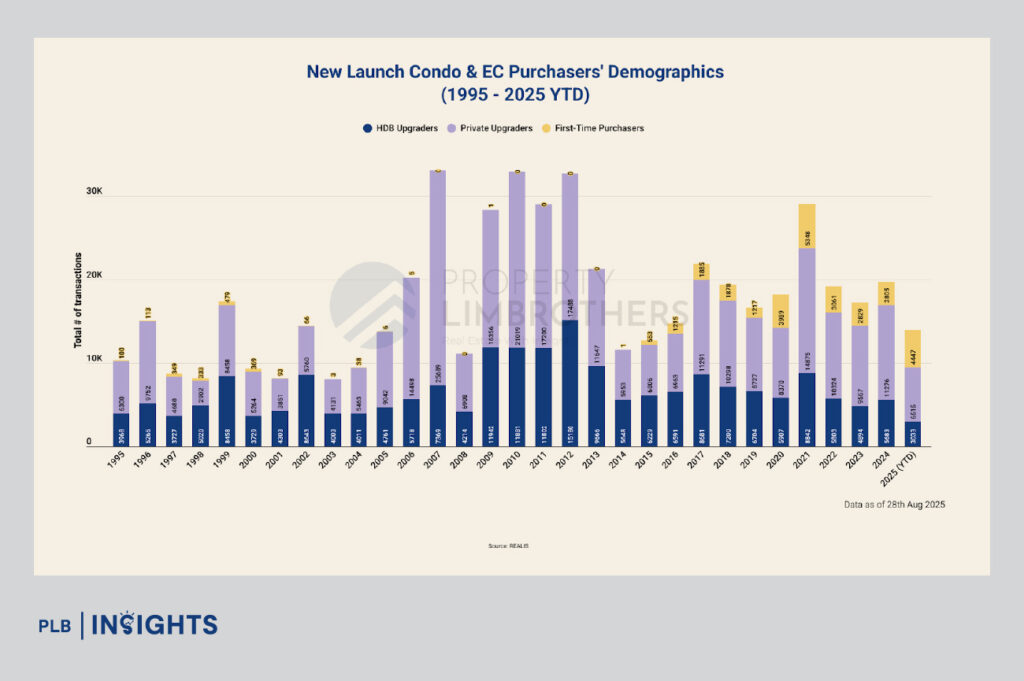

Data from REALIS spanning 1995 to 2025 makes the pattern clear. HDB upgraders have consistently been the largest group of new launch condo buyers, often outnumbering private upgraders and first-time purchasers combined. During the 2010 to 2013 boom, they bought more than 15,000 units a year. The trend resurfaced in 2021, when 14,575 HDB households moved into new launches in the post-pandemic boom.

In 2025, the trend seems to taper off. By August, 3,033 HDB upgraders had already purchased new launches or executive condominiums, making up 22% of the private market. By comparison, private upgraders accounted for 6,515 sales, while first-time and other buyers made just 4,447.

However, the sale of million-dollar flats have allowed for equity gains which translate to demand for upgrading – a phenomenon that is structurally different as compared to a decade ago when million-dollar flats were rare. As such, Singapore’s private condo market today is increasingly being sustained by wealth generated from HDB resale.

The Private Property Connection

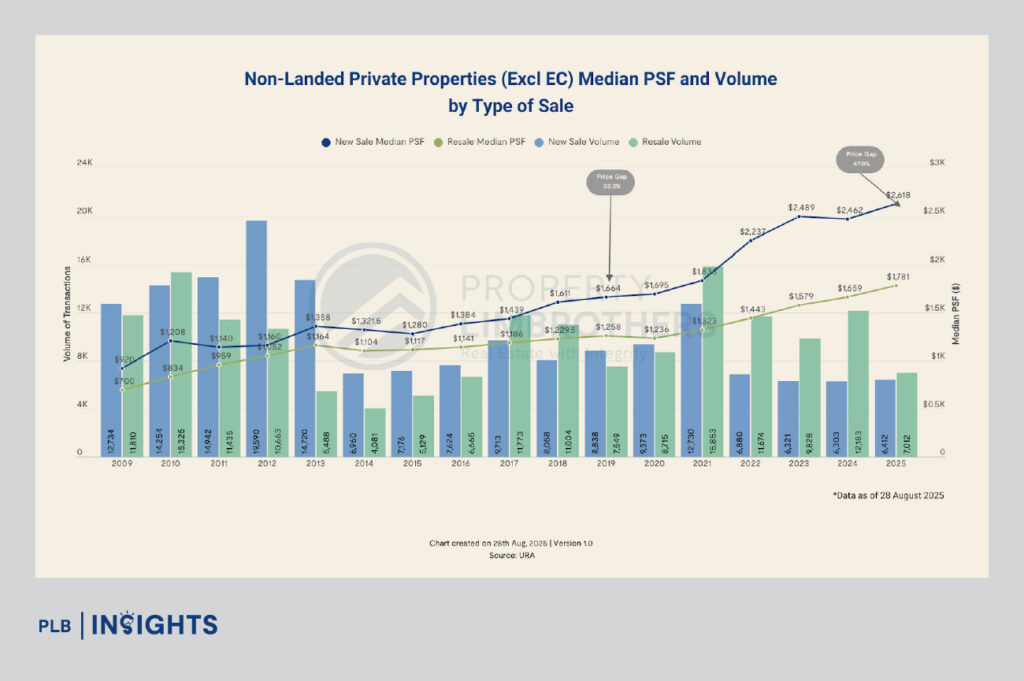

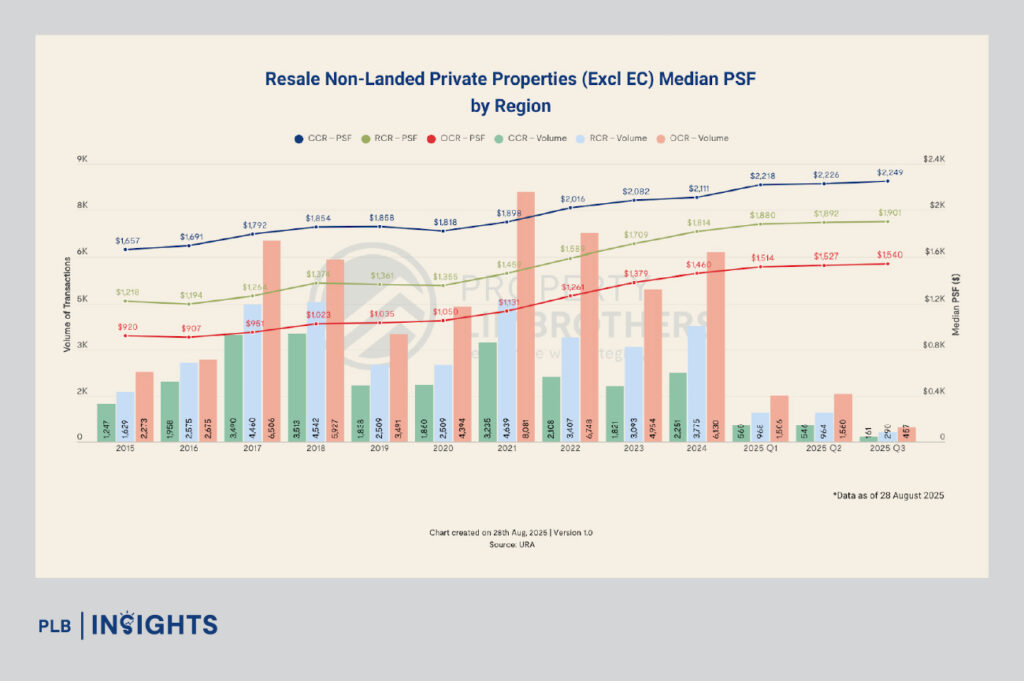

The URA data also reveals a widening chasm between new sale and resale condos. Back in 2017, the price premium for new launches over resale condos was just 21%, with new sales averaging $1,439 per square foot compared to $1,186 for resale. Today, that gap has exploded to 47%, with new sales commanding $2,618 per square foot while resale sits at $1,781.

For cash-rich HDB sellers, this dynamic creates both challenge and opportunity. Some are willing to pay the developer premium for a brand-new unit with full tenure and modern facilities. But others, increasingly savvy, are targeting the resale condo market, where their windfall stretches further.

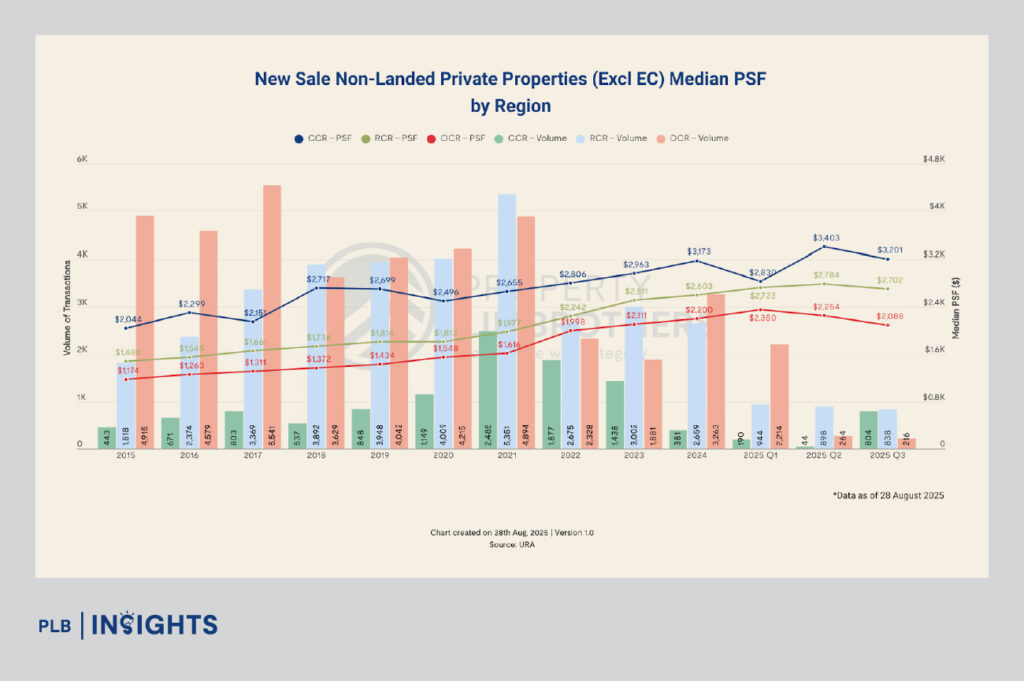

Regionally, the Outside Central Region (OCR) has emerged as the upgrader magnet. New launches here average $2,088 per square foot, while resale sits at $1,540, a compelling 67% of new launch pricing. This explains why OCR projects consistently lead in volume. The Rest of Central Region (RCR) offers a balanced choice, with new sales at $2,702 and resale at $1,901, while the Core Central Region (CCR) remains aspirational, averaging $3,201 for new launches and $2,249 for resale—high barriers that naturally thin transaction volumes.

The Wealth Transfer in Action

The mechanics of wealth transfer become clear when we zoom into real families.

Take a household in Toa Payoh who bought a four-room flat in 2015 for about $450,000. Ten years later, they sell it for $1.15 million. After repaying their mortgage and CPF, they unlock nearly $700,000 in equity (cash + CPF). That lump sum opens doors: they can comfortably purchase a resale OCR condo for about $1.2 million, stretch into a new launch OCR project for around $1.6 million, or choose a city-fringe resale two-bedder at $1.1 million. One flat sale, three entirely different futures.

Now consider Clementi Crest, where a five-room unit at 445B Clementi Avenue 3 recently changed hands for a record $1.459 million. The seller, who likely purchased the flat during its 2016 BTO launch for under $620,000, could have realised close to $850,000 in profit after just five years of occupation. With that kind of windfall, the owners aren’t merely buying another home—they are repositioning their family’s entire financial trajectory. A resale OCR condo would be well within reach, with substantial capital left to spare. Even a brand-new OCR launch at $1.8M–$2.0M becomes comfortably attainable without overstretching.

These examples illustrate how HDB is no longer just an affordable entry point into homeownership. For many, it has become the first rung of a powerful wealth ladder, providing the equity needed to climb into private housing. The ripple effect is clear: every million-dollar resale not only creates a seller with newfound liquidity but also injects steady, equity-backed demand into Singapore’s condo market, which eventually supports demand in the private residential market – setting the pace for price growth in that segment too.

Looking Ahead: 2025 and Beyond

The outlook is clear. Overall HDB resale prices will likely continue to grow modestly, around 4–5.5% in 2025, but the million-dollar flat segment will keep expanding, potentially hitting 1,200 transactions by year-end. The upgrader wave shows no sign of abating, particularly with thousands of 2019–2020 BTO projects set to hit their Minimum Occupation Period in the next two years.

Private new launches in the OCR will remain the sweet spot for most upgraders, though savvy families will increasingly look at resale condos for better value.

Meanwhile, government policy will continue to walk a fine line between enabling wealth creation and keeping housing affordable for younger generations.

Conclusion: The Redefined Singapore Dream

The Singapore Dream has always been tied to home ownership. But in 2025, that dream has taken on a new form. The HDB flat is no longer just a home—it is also a financial instrument, a stepping stone, a generator of intergenerational wealth.

As public flats evolve into private wealth engines, the housing ladder has been reconstructed. From young couples buying their first three-room unit, to families in mature estates cashing out million-dollar deals, to upgraders funnelling equity into private condos, the ecosystem is alive with mobility.

Stay Updated and Let’s Get In Touch

Our Goal is to Provide you with Transparent and Meaningful Insights! Should you have any questions, do not hesitate to reach out to us!