Singapore’s million-dollar HDB resale market remained resilient in the final quarter of 2025, even as the number of such deals eased from the previous quarter and from a year earlier.

An analysis of HDB resale transactions shows that from October to December 2025 showed 248 flats changed hands for S$1 million or more. The average price among these million-dollar deals was about S$1.16 million, while the median stood at S$1.12 million. Prices ranged from exactly S$1 million at the lower end to around S$1.63 million at the top.

Although this marks a moderation in volumes compared to earlier peaks, the data suggests that demand for high-quality, well-located HDB flats remains firm, particularly for larger units in mature estates.

Quarter-on-quarter: fewer deals, but slightly higher typical prices

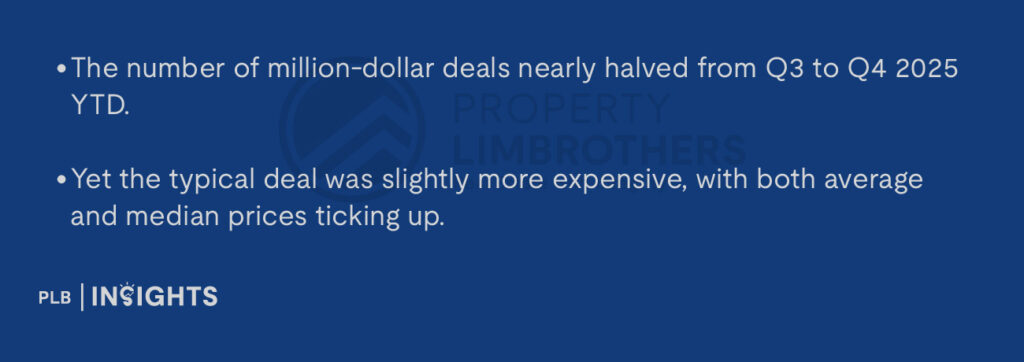

On a quarter-on-quarter basis, the million-dollar segment saw a noticeable pullback in the number of transactions, even as median prices inched higher.

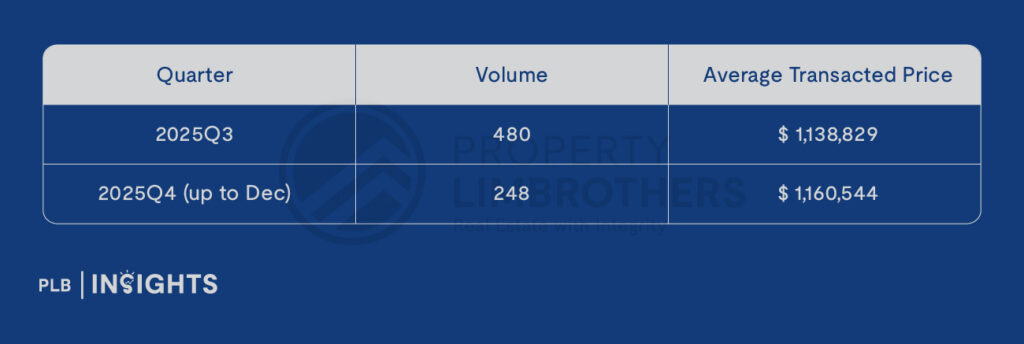

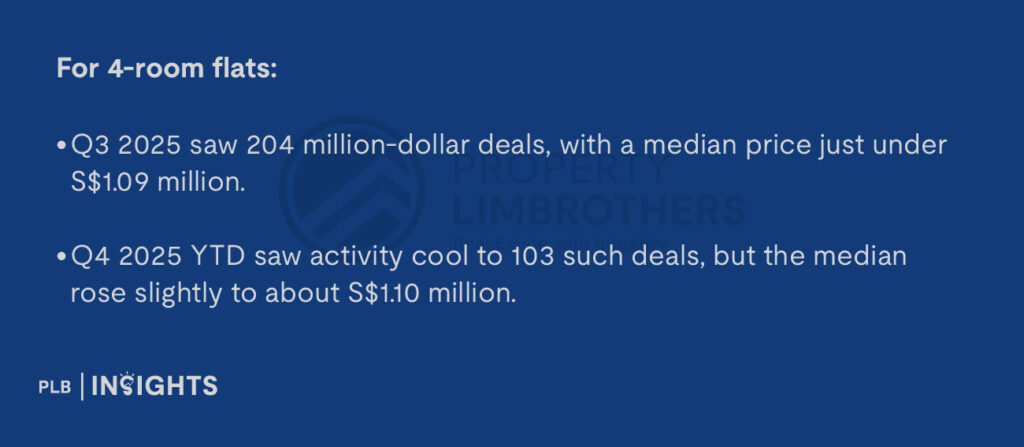

In Q3 2025, there were 480 million-dollar HDB deals, with an average price of about S$1.14 million and a median of roughly S$1.10 million.

In Q4 2025 (up till 5 Dec 2025), million-dollar deals fell to 248, but the average price rose modestly to about S$1.16 million, and the median climbed to S$1.12 million.

In other words, compared with the previous quarter:

From these, several patterns stand out.

The data indicates that while fewer million-dollar deals were closed in the fourth quarter—possibly reflecting more cautious sentiment or seasonal effects—buyers who did proceed were still willing to pay slightly higher prices for desirable units.

A S$1.63m Bishan DBSS flat sets the tone for the quarter

Against this backdrop of moderating volumes but firmer prices, the standout transaction of Q4 2025 came from Bishan.

The record deal for the quarter was a 5-room DBSS flat in Bishan, located at Block 275A Bishan Street 24. The unit, on a very high floor between the 34th and 36th storeys, with a floor area of 120 square metres and a lease commencing in 2011, fetched about S$1.63 million in November 2025.

With unit prices north of S$1,200 per square foot, the flat ranks among the priciest HDB resale deals in recent memory.

The transaction encapsulates what drives the million-dollar segment today: a mix of long remaining lease, high floor, modern design, and strong connectivity.

Even as some buyers hold back due to higher interest rates or policy uncertainty, the very best units in well-loved estates still see strong competition. For those buyers, the question is less about whether it crosses S$1 million, and more about how special the unit is.

Stay Updated and Let’s Get In Touch

Should you have any questions, do not hesitate to reach out to us!